From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineQatar Steel Market Q1 2026: Positive Sentiment Driven by Import Duty Increases

Qatar is experiencing a very positive sentiment in its steel market as evidenced by recent updates. The news articles titled “Qatar: Increase in Customs Duties on Rebar and Wire Rod“ and “Qatar raises import duties on rebar and wire for 2026“ are indicative of heightened activity levels at local steel plants, specifically aligning with enhanced protectionist measures aimed at domestic producers. The recent increases in customs duties, now set at 10%, bolster the competitive position of local manufacturing against external pressures from imports.

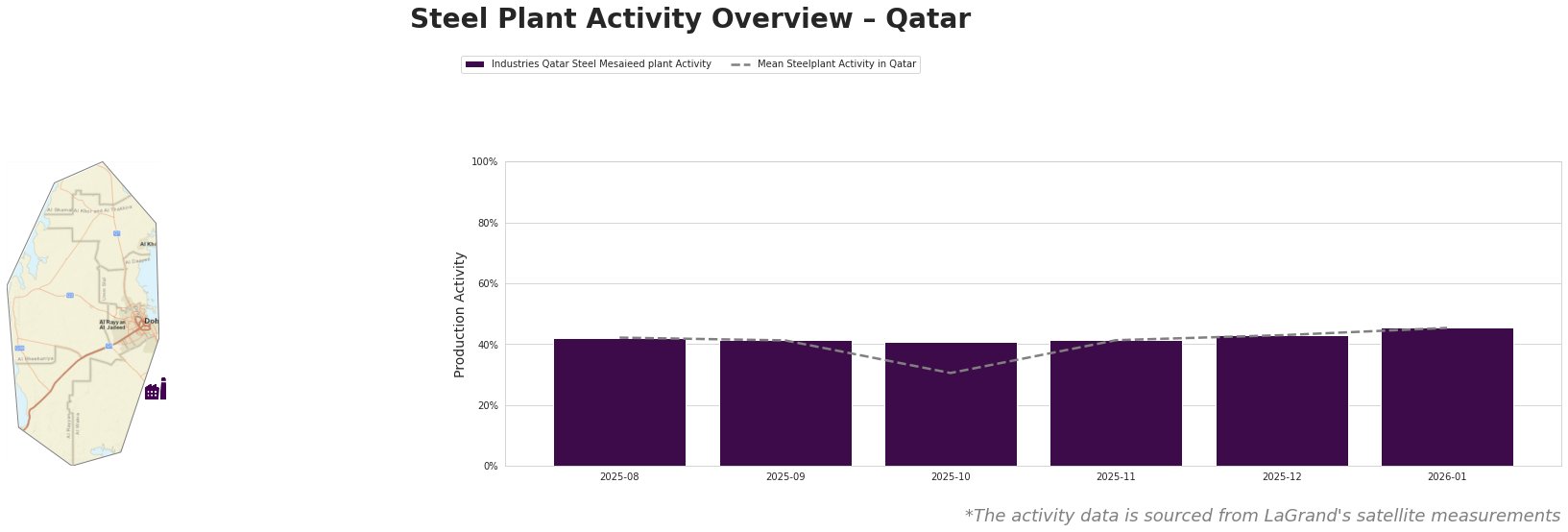

The Industries Qatar Steel Mesaieed plant, which operates with a crude steel capacity of 2,575,000 tons via Direct Reduced Iron (DRI) and Electric Arc Furnace (EAF) processes, has shown a robust upward trend in activity, reaching 45% in January 2026. This marks a significant recovery from a low of 31% in October 2025 and indicates a recovering robust demand for finished steel products like rebar and coils, likely influenced by local customs duties aimed at sustaining market equilibrium, as asserted in the aforementioned news articles.

Evaluating market implications, the combination of increased customs duties and heightened activity at the Mesaieed facility suggests a strong potential for supply stability. Steel buyers are advised to capitalize on the current production ramp-up, potentially negotiating longer-term contracts with Industries Qatar to secure advantageous pricing before broader market fluctuations occur. As Qatari steel firms ramp up output to meet projected high domestic demand, resale opportunities might arise for products like rebar to markets where competitive conditions permit. No explicit connections found for specific supply disruptions at studied plants beyond the improved activity trend, highlighting a currently stable supply outlook in the sector.