From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSwitzerland’s Steel Market Faces Challenges Amid Economic Strain and Climate Initiatives

The steel market in Switzerland is currently facing a negative sentiment as recent activity data indicates a downturn, coinciding with ongoing political debates regarding climate funding like those detailed in the articles “Klimafonds-Initiative: Bundesrat wehrt sich gegen zusätzliche Milliarden für den Klimaschutz“ and “Klimafonds: Zukunftsinvestition oder Angriff auf Schuldenbremse?”. The proposed climate funding increases and the federal government’s position against it may contribute to uncertainties affecting steel plant operations.

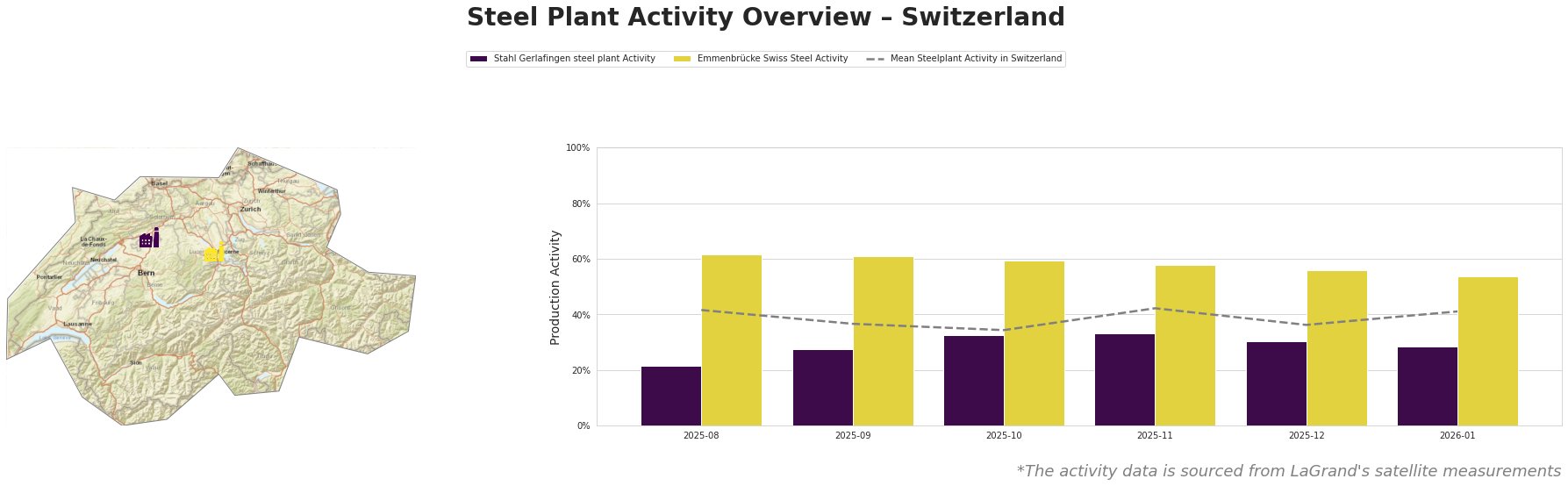

The satellite-observed activity of the Stahl Gerlafingen steel plant has been notably low, hitting a low of 22% in August 2025, with only a slight recovery to 28% in January 2026. In contrast, Emmenbrücke Swiss Steel showed relatively higher activity levels, peaking at 62% in August but trailing off to 54% by January. The overall average activity across all observed plants indicates a downward trend, with January’s mean at 41%, highlighting a lack of resilience in market conditions.

Stahl Gerlafingen operates with an electric arc furnace (EAF) and predominantly produces semi-finished and finished rolled products, employing a workforce of 560. The decline in activity from 32% in October to 28% in January indicates potential operational challenges, possibly linked to the broader economic climate surrounding climate initiative debates. Despite production capacity remaining underutilized, no direct connections to the named news articles can be established.

Emmenbrücke Swiss Steel, also utilizing EAF technology, produced similar products but displayed a more stable performance compared to Gerlafingen, reflecting potentially healthier operations despite the overall market pressures. However, the plant still faces uncertainties relating to the discussions around funding for green initiatives as captured in the news articles.

Given these conditions, steel buyers should be vigilant regarding potential supply disruptions, particularly from the underperforming Stahl Gerlafingen plant. Buyers may consider securing contracts with Emmenbrücke Swiss Steel due to its relatively better performance and to mitigate risks associated with the fluctuations highlighted in the political landscape regarding climate funding.

It is advisable to closely monitor upcoming votes on climate initiatives as they could introduce further changes in funding structures that may affect the operational viability of plants and consequently the supply chain within Switzerland’s steel industry.