From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: January 2026 Activity Trends and Insights

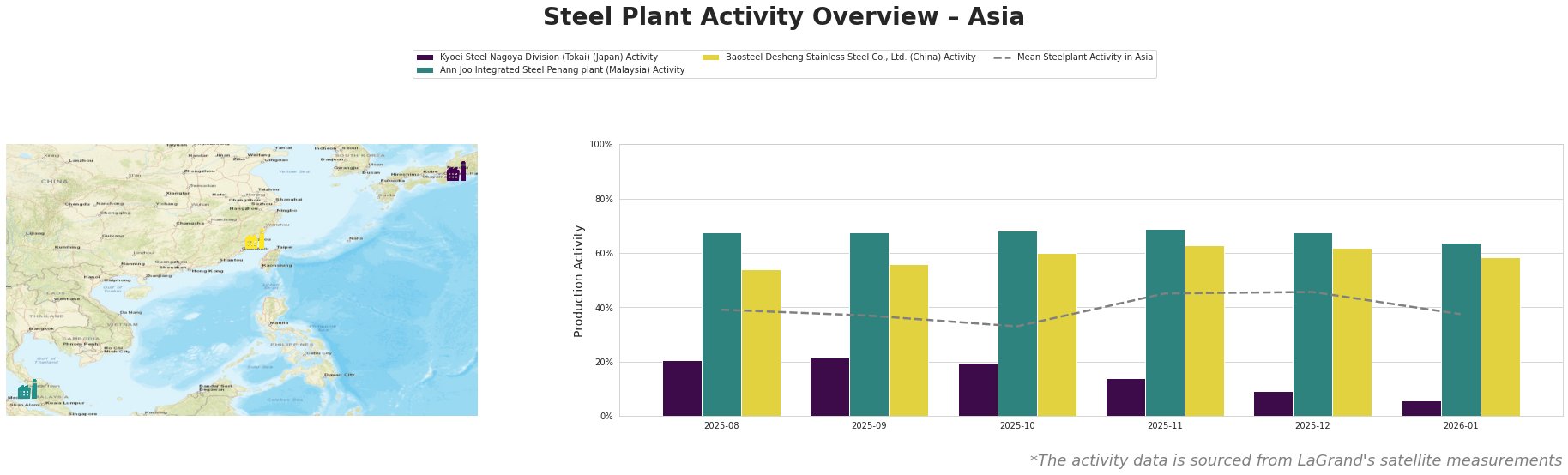

The steel market in Asia is currently characterized by a Neutral sentiment. Recent developments indicate varying levels of plant activity across the region, tied to global energy dynamics and specific regional news. Satellite-observed changes reflect significant activity declines at several facilities.

The article “US tackles protection of Venezuelan oil funds“ highlights geopolitical factors affecting energy markets, which indirectly influence steel sectors reliant on energy prices. However, no direct correlation to plant activity changes in Asia can be substantiated from the news provided.

Kyoei Steel Nagoya Division (Tokai)

Kyoei Steel, based in Chūbu, Japan, primarily produces finished rolled products including deformed bars and rebars, operating at a capacity of 1,264 tonnes primarily through electric arc furnace (EAF) technology. The facility observed a decline in activity from 9.0% in December 2025 to just 6.0% in January 2026. This significant drop is not directly linked to any specific news event but may reflect broader market challenges influenced by external energy supply concerns.

Ann Joo Integrated Steel Penang Plant

Ann Joo, located in Penang, Malaysia, functions as an integrated plant with a capacity of 500 tonnes focusing on products like pig iron and billets. The plant operated at a solid rate of 64.0% in January 2026, down from a steady 68.0% but still above the mean activity level. Despite a stable production rate, no connections to significant global or regional events from the current news set can be established, suggesting local operational consistency amidst international fluctuations.

Baosteel Desheng Stainless Steel Co., Ltd.

This Fujian-based facility has a capacity of 3,410 tonnes and specializes in stainless steel products through integrated processes. The plant’s activities remained resilient with a reduction to 58.0% by January from 62.0% in December. The decline connects subtly to concerns about US sanctions and potential crude oil market impacts discussed in articles like “US tackles protection of Venezuelan oil funds”, indicating that market sentiment around energy prices could be affecting higher production costs.

Evaluated Market Implications

The decline in activity at Kyoei Steel raises potential concerns for Japanese steel procurement strategies, especially given the geopolitical instability linked to energy resources. Steel buyers should consider securing contracts that account for variable production capabilities as influential energy market dynamics, particularly connected to Venezuelan oil supplies, become more prominent. Conversely, activity stability at Ann Joo might support procurement from Malaysian producers in the short term, albeit without strong ties to current global disruptions. Steel buyers should navigate these local and regional insights to mitigate risks associated with supply variability in 2026.