From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Analysis: Exciting Developments Amid EU CBAM Implementation

The Asian steel market is registering a very positive sentiment, buoyed by recent news on the Carbon Border Adjustment Mechanism (CBAM) imports into the EU, as detailed in the articles “Iron, steel dominate first CBAM imports“ and “The quiet beginning of the CBAM era for the EU steel industry.” The integration of the CBAM has led to minor increases in steel prices and significant international trading activities, influencing activity levels in Asian steel plants.

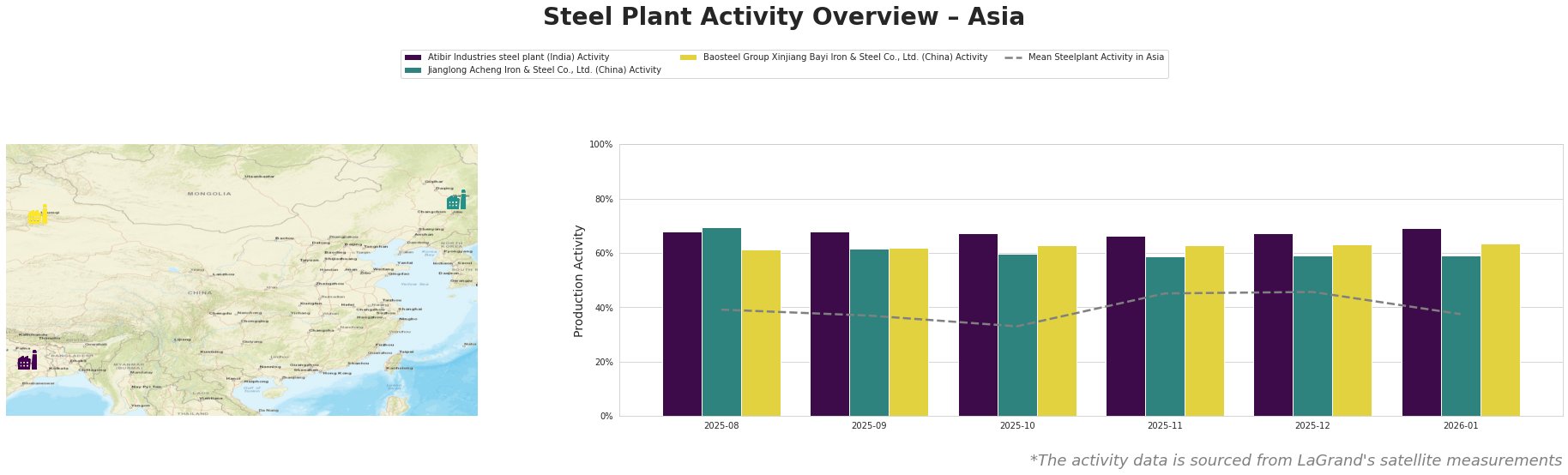

Atibir Industries Steel Plant, located in Jharkhand, has shown consistent activity, peaking at 69% in January 2026, with a notable stable range around the 67-68% mark over previous months. This aligns positively with increased demand driven by the CBAM introduction as mentioned in “Iron, steel dominate first CBAM imports,” though no direct correlation was observed with activity changes.

In Heilongjiang, Jianglong Acheng Iron & Steel has activity fluctuating between 60-70% over recent months, following the announcement in “The quiet beginning of the CBAM era for the EU steel industry,” where the market reacted by adjusting production levels. Although not directly linked, the activity levels indicate manufacturers are optimizing output in response to price adjustments.

Conversely, Baosteel Group’s activity has shown steadiness around 63-64% but is slightly behind the increasing mean activity across other plants. The minor 1% increase in January might reflect cautious adjustments in procurement in anticipation of the CBAM impacts as outlined in the related news articles.

Evaluating potential implications for procurement, buyers need to act decisively. With Brazil’s stringent emissions duties now reflected in the new trading framework under the CBAM, buyers should focus on sourcing materials from Indian and Turkish producers who may still benefit from lower CBAM tax rates, particularly given Turkey’s fixed cost of €115 versus India’s €295 per tonne. Maintaining strong supplier relationships and exploring flexible procurement strategies will be crucial in navigating these early market shifts.