From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Update: Activity Trends and Implications Amid Political Turbulence

Recent assessments highlight a Neutral sentiment within Ukraine’s steel market, influenced by geopolitical dynamics. The article Neue Weltordnung: Es lohnt sich, für die NATO zu kämpfen indicates that the shifting global order under Trump’s presidency complicates relationships between NATO and Ukraine, resulting in enhanced vigilance regarding regional stability. However, no direct correlation to recent steel plant activity levels has been established. Meanwhile, Trump withdraws EU, UK tariff threat has temporarily eased market apprehension by retracting proposed tariffs on key trading partners, fostering a more stable trading environment.

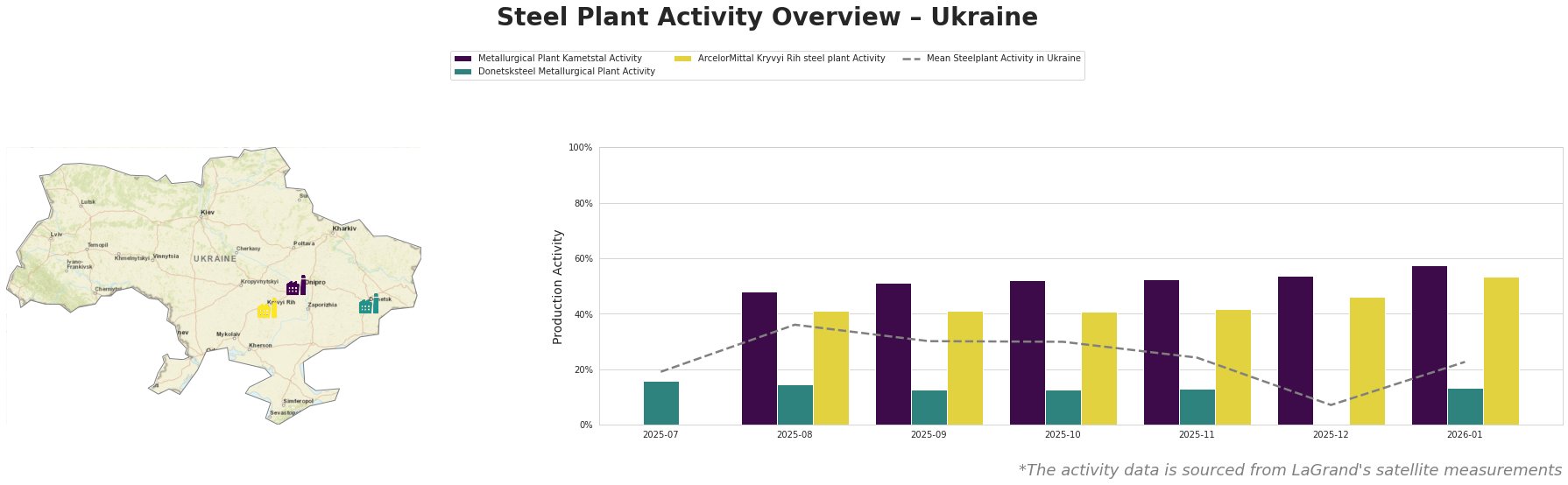

Metallurgical Plant Kametstal has shown a remarkable increase in activity, peaking at 58% in January 2026, up from 16% in July 2025. This gradual increase indicates a recovery phase possibly linked to market stabilization efforts noted in Trump withdraws EU, UK tariff threat, suggesting less trade friction could support production levels.

Donetsksteel Metallurgical Plant, with activity remaining consistently low and dropping to zero reporting in December 2025, has not demonstrated any recoverable activity, indicating severe operational challenges not directly connected to the politically influenced trade environment.

ArcelorMittal Kryvyi Rih reported a substantial rise to 54% by January 2026 from 46% in December, reflecting a potential resurgence in production aligned with improved market conditions but also the necessity for robust operations amid competitive pressures.

Evaluating these trends indicates possible supply disruptions from Donetsksteel, which may leave procurement professionals without reliable sources from this region. Conversely, the operational recovery at Kametstal and ArcelorMittal suggests a procurement focus should be placed on these plants, with a strategic approach in conversations to secure future supply given the fluctuating market sentiment and stability efforts influenced by geopolitical factors.

Steel buyers should prioritize sourcing from Kametstal and ArcelorMittal due to their upward activity trajectory. Monitoring any bilateral agreements discussed by Trump and NATO representatives could yield further actionable insights as political climates impact operational capacities.