From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Steel Market Soars: Vigorous Production Expansion Drives Positive Sentiment Amid Coking Coal Demand Growth

India’s steel industry is experiencing a robust upward trend, driven by favorable policy changes and significant expansions in production capacity. According to the article, “India finalizing national steel scrap policy to align with industry shifts, global trends,” recent initiatives by the Ministry of Steel signify a strategic pivot towards increasing steel scrap utilization in production, aligning with both domestic needs and global standards. As reflected in the satellite-observed data, marked activity levels at major steel plants support this momentum.

Measured Activity Overview

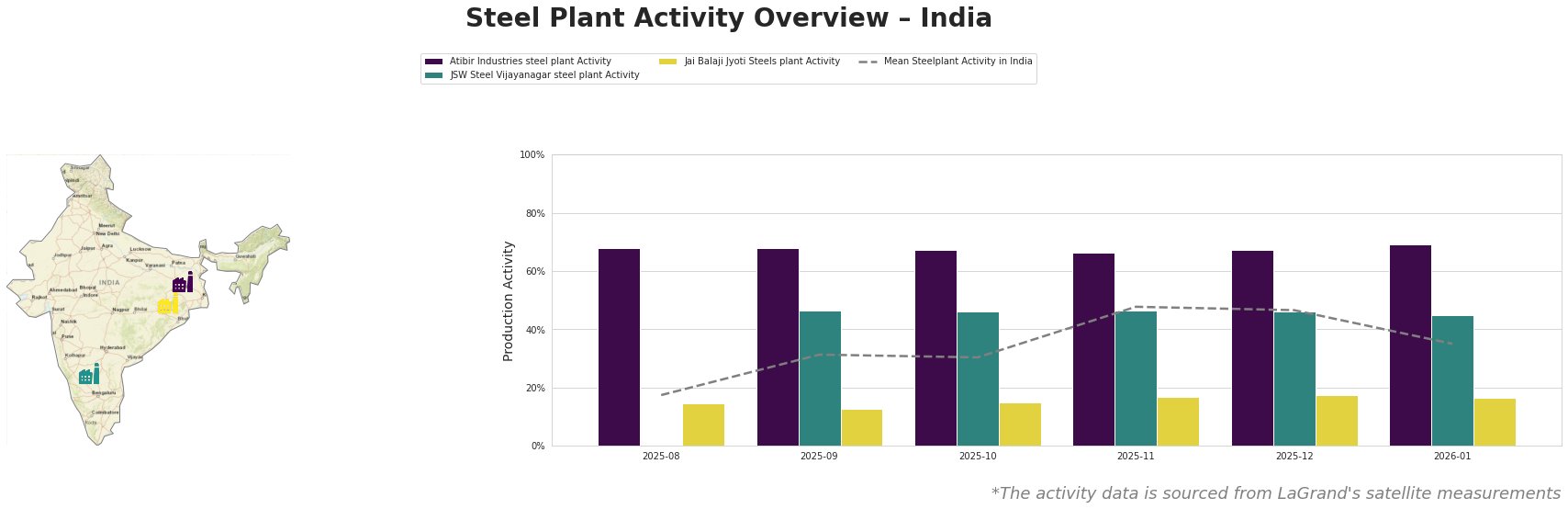

The overall mean activity across Indian steel plants showed a rising trend, peaking at 48% in late November 2025. Atibir Industries steel plant exhibited notable stability with activity consistently above 66%, suggesting resilience amid increasing production demands. JSW Steel Vijayanagar reported significant fluctuations, hitting a robust 47% in November but experiencing a slight decline in January. Jai Balaji Jyoti Steels, while lower at approximately 15%, maintained relative consistency, reflective of ongoing challenges in scaling output.

Plant Insights and Connections to Articles

The Atibir Industries steel plant (Jharkhand), with a capacity of 600K tons of crude steel, observed sustained activity levels around 68-69% from August 2025 to January 2026. This stability correlates with the aim stated in “India finalizing national steel scrap policy to align with industry shifts, global trends,” indicating the industry’s shift towards boosting scrap in production processes. The alignment of scrap policy with operational enhancements at plants indicates an infrastructure ready to support future increases in production capacities.

JSW Steel Vijayanagar (Karnataka) holds a staggering capacity of 12 million tons and its activity peaked at 47% before dipping again. This fluctuation aligns with insights from “India’s steel expansion to drive coking coal demand,” which notes a dual impact of rising output goals and protective tariffs, crucial to maintaining operational viability. The recent import increases in coking coal interface directly with activities observed at this facility.

Meanwhile, Jai Balaji Jyoti Steels (Odisha), with a significant 120K tons capacity, reflects ongoing struggles with activity levels averaging around 15-17%. While no direct correlation to the cited articles was found, the plant’s status may be influenced by broader market dynamics resulting from expanding import dependencies highlighted in multiple articles.

Evaluated Market Implications

In light of the increasing demand for steel and related inputs, steel buyers should prepare for potential supply constraints, particularly in coking coal, which is directly referenced in “India increased its imports of coking coal by 10% y/y in 2025.” Given that India’s reliance on imports is set to rise, particularly from Australia and the U.S., procurement strategies should prioritize securing coking coal supplies proactively.

Steel buyers are advised to engage in forward contracts for coking coal, especially considering the anticipated surge in production capacity under the new national steel scrap policy. Additionally, diversification of supplier sources can mitigate risks associated with disruptions in the global coking coal market.