From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAfrica’s Steel Production Poised for Growth Amidst EU Policy Changes

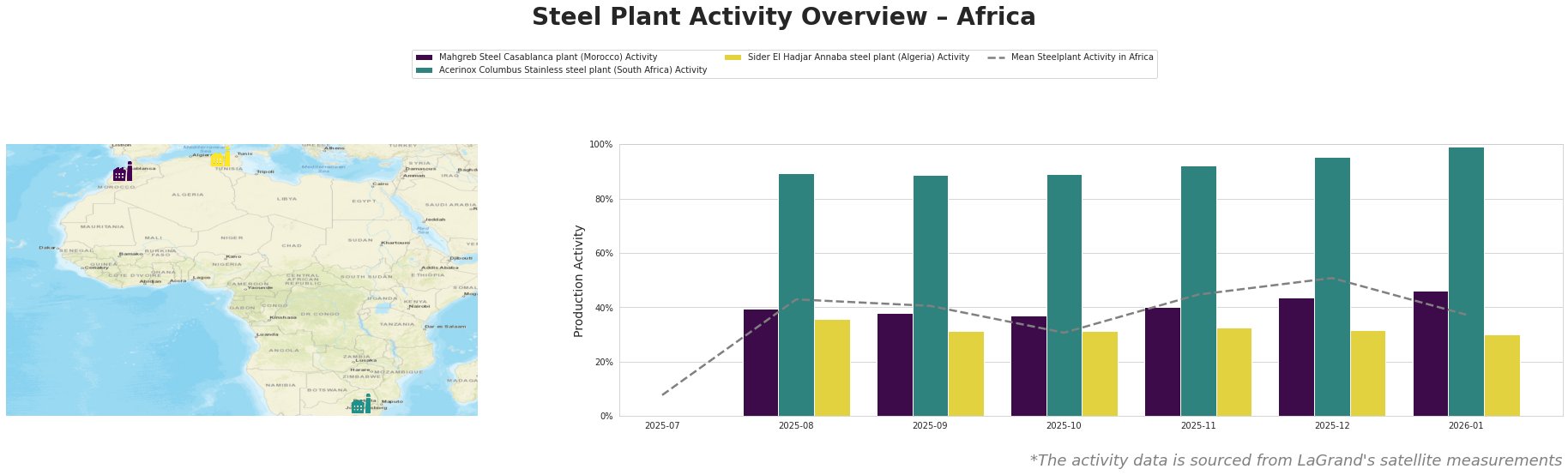

The steel market in Africa is experiencing a positive shift, driven by calls for the European Union to alter steel import restrictions. Recent news from “The EU should abolish steel quotas for countries with environmentally sustainable production – Fuat Tosali“ and “Turkish steel giant urges EU to cancel quotas on green steel“ highlights the urgency for the EU to support low-emission steel producers like Turkey and Algeria. These developments correlate with increases in satellite-observed activity levels at several African steel plants.

The Mahgreb Steel Casablanca plant observed an increase in activity from 40% in August to 46% in January, aligning with the industry’s strategic shift toward sustainable production. This may reflect rising demand for low-emission steel, as advocated by Tosyali Facing EU quota pressures, which hampered alternative suppliers, including Algeria and Morocco, the plant’s performance shows Russia was overcoming strict regulations while adapting to market needs.

The Acerinox Columbus Stainless Steel Plant operated at high levels, achieving 99% activity in January, indicating robust performance sustained throughout the reporting period. This trend reflects confidence in regional production and may correlate with enhanced procurement opportunities related to incentivized green steel initiatives emphasized in “Tosyalı urges EU to remove Türkiye, Algeria’s quotas.”

However, the Sider El Hadjar Annaba steel plant has faced declining activity, dropping from 36% to 30% between December and January, showing less engagement in production compared to its peers. There is no direct link established here to the named articles, which means this decline might require further investigative efforts by procurement professionals.

It is crucial for steel buyers to leverage these positive signals, particularly focusing on sourcing from the Mahgreb Steel and Acerinox facilities, which demonstrate higher sustainability and responsiveness to market demands against a backdrop of changing EU policies.

In conclusion, steel buyers should prioritize partnerships with low-emission producers highlighted in the recent news while also monitoring Sider El Hadjar Annaba for potential risks or procurement adjustments.