From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Report: China’s Production Slump and Rising Inventories Create Negative Sentiment

China’s steel market is facing significant challenges as indicated by a variety of recent developments. Notably, Steel production in China fell to a seven-year low in 2025 and Stocks of main finished steel products in China down 1.4 percent in early Jan 2025, reflecting stark shifts in supply and demand. The relationship between high inventory levels and ongoing production depression suggests further supplier struggles and potential procurement complications for steel buyers.

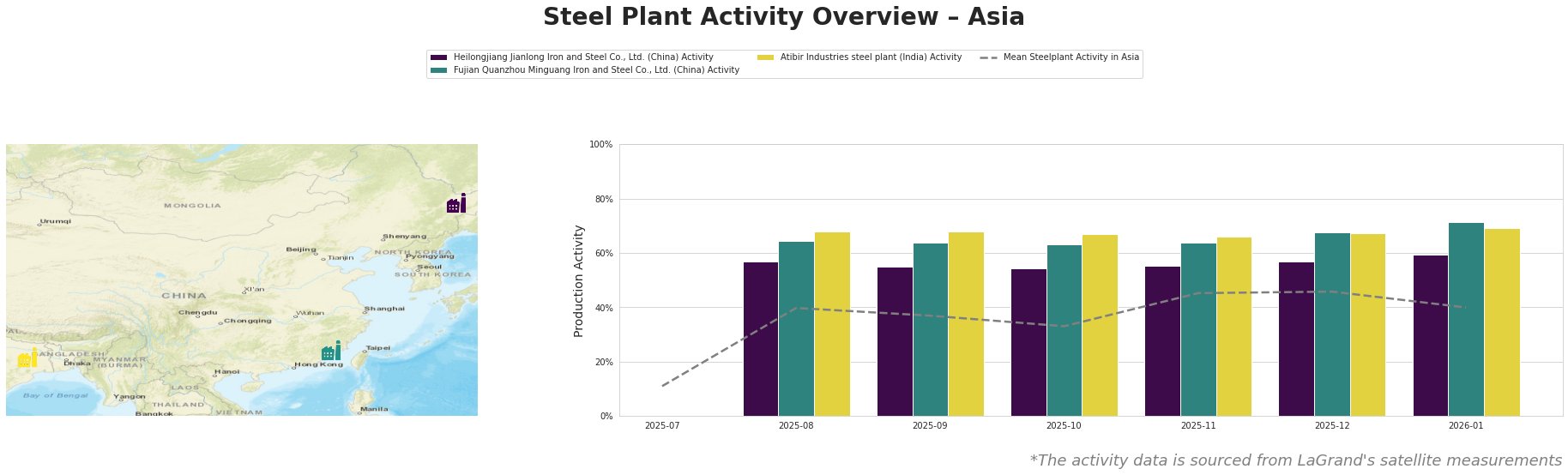

Measured Activity Overview

From July 2025 to January 2026, activity levels of steel plants exhibited a marked increase, peaking in December and January, driven by the seasonal spike in demand during winter. Heilongjiang Jianlong Iron and Steel Co., Ltd. showed an increase to 60% in January 2026, while Fujian Quanzhou Minguang Iron and Steel Co., Ltd. peaked at 72% during the same period. However, their levels were still subject to the broader context, including high inventory levels reflected in the report Stocks of main finished steel products in China down 1.4 percent in early Jan 2025, indicating a mismatch between production capability and demand.

Steel Plant Insights

Heilongjiang Jianlong Iron and Steel Co., Ltd. operates with a crude steel capacity of 2 million tons, primarily utilizing the Blast Furnace (BF) method. Activity increased from 57% in December 2025 to 60% in January 2026, though this temporary uptick is overshadowed by the overall declining production trends described in Steel production in China fell to a seven-year low in 2025. The improvement may be momentary as demand continues to wane, particularly due to low domestic consumption.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., also employing BF technology, showed resilience with a notable rise from 68% to 72% from December to January. Their operations produce a mix of finished rolled products. Even with such gains, these figures are set against a backdrop of increasing inventories noted in Stocks of main finished steel products in China down 1.4 percent in early Jan 2025, highlighting a stagnation in market momentum that steel buyers must navigate.

Atibir Industries sits at a lower activity range of 69%, showing stable performance yet limited growth compared to its peers. Their output of semi-finished and finished products may cushion against broader market volatility, but the trends signal a cautious approach needed for steel purchasing as emphasized in the market’s current negativity.

Evaluated Market Implications

Potential supply disruptions could arise from the confluence of high inventories and low production, particularly within the Heilongjiang and Fujian regions. Steel buyers should closely monitor developments, as the forecasts indicate no significant recovery in the Chinese steel sector and further declines in production in 2026. They are advised to consider strategic sourcing from plants like Atibir Industries that may benefit from lower operational risks.

In conclusion, continued vigilance and strategic alignment with production forecasts will be critical for procurement experts navigating this challenging landscape. Keeping abreast of inventory trends and actively engaging with more stable producers can mitigate risks associated with the current negative market sentiment.