From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Market Faces Decline Amid Weaker Domestic Demand: Key Insights for Buyers

In China, steel production has hit a seven-year low largely due to a protracted real estate crisis, as noted in the article “Steel production in China fell to a seven-year low in 2025.” This aligns with significant declines in satellite-observed activity at major steel plants, underscoring the grim outlook for the industry. Simultaneously, the recent report “Stocks of main finished steel products in China down 1.4 percent in early Jan 2025” highlights a decrease in inventory levels, further reflecting decreased domestic demand for steel.

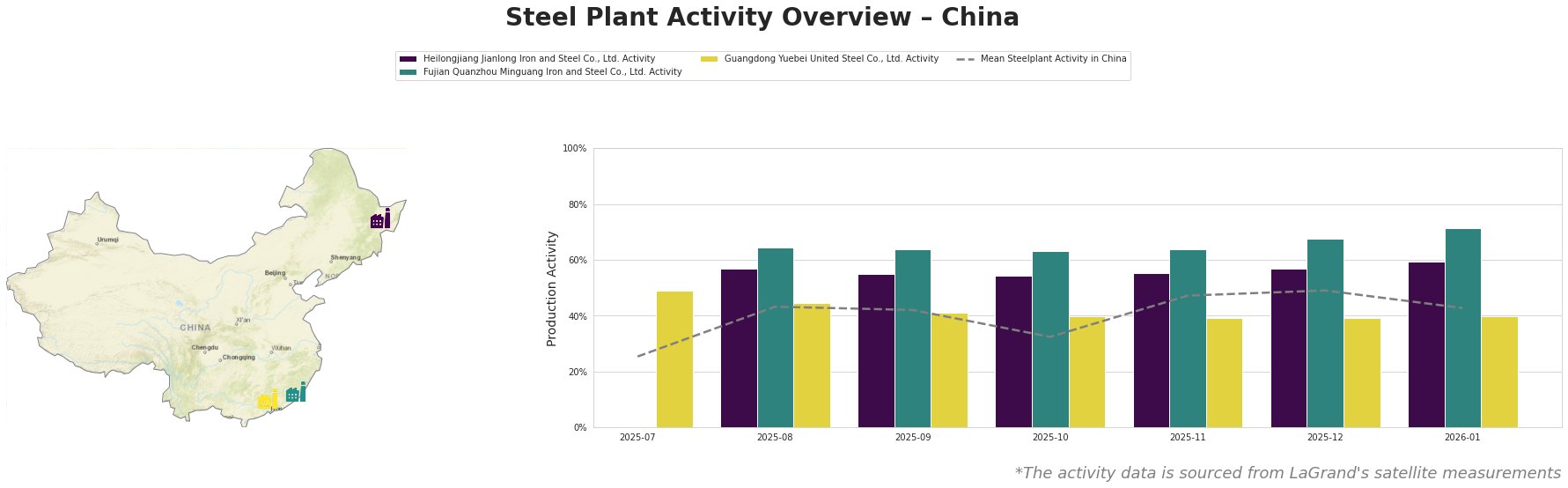

Heilongjiang Jianlong Iron and Steel Co., Ltd. has shown mixed activity levels, with a notable 5% increase to 60% in January; however, this arises from a low base and does not counteract the industry-wide downturn. This plant’s activities are significantly influenced by the weak domestic demand articulated in the aforementioned news articles. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. also demonstrated a dip to 72%, reflecting an increase in January but still exposes the plant’s vulnerability to the stressed market conditions. Conversely, Guangdong Yuebei United Steel Co., Ltd. has remained relatively stable, fluctuating around 40% in activity, suggesting that it is managing to adapt amidst the overall decline.

The overall production drop, particularly emphasized in “China’s crude steel output down 44 million mt in 2025, lowest monthly volume in Dec,”, signals potential supply disruptions ahead. With the implementation of an export licensing regime for specific steel products starting in 2026, as noted in “China increased steel exports by 7.5% y/y in 2025,”, buyers should prepare for further market constraints.

Steel buyers should consider locking in prices immediately, as the current declines indicate potential increases following regulatory changes. Additionally, diversifying suppliers and maintaining flexible contracts could provide necessary cushioning against imminent supply chain disruptions as domestic demand is likely to remain under pressure.