From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Report: January 2026 – Sharp Declines Amidst International Tensions

Recent satellite data reveals a worrying decline in steel production activity across China’s major steel plants, directly correlating with escalating tensions highlighted in industry discussions. The article “Trumps Zollpolitik lässt deutsche Exporte in die USA einbrechen“ indicates that China remains a key beneficiary in the face of faltering trade relationships, exacerbating supply chain uncertainties. However, plant activity levels have exhibited significant volatility, reflecting broader industry fears.

Measured Activity Overview

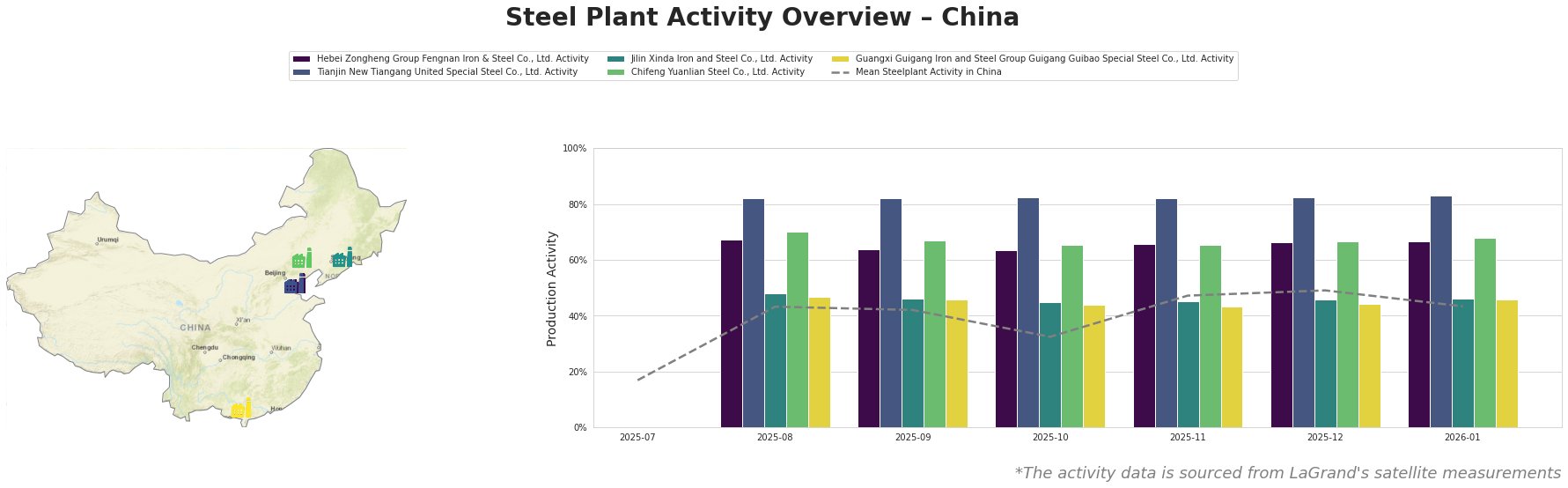

Plant activity reflects a fluctuating landscape, with overall mean activity dropping from 49% in December 2025 to 43% in January 2026. Specifically, Hebei Zongheng has lately shown strong resilience, peaking at 67% activity, while Jilin Xinda trails with a drop to 46%, showing no clear connection to any recent news developments.

Tianjin New Tiangang maintained a stable 83%, while Chifeng Yuanlian’s fall to 68% raises concerns about future production capabilities without a clear explanatory anchor from current events.

Evaluated Market Implications

The adverse market sentiment for steel producers is fortified by evidence of trade pressures and decreased confidence in the international marketplace, as denoted in the news article “Europa zögert: Steht ein Handelskrieg mit den USA bevor?” and “Europas Macht ist im Zollkonflikt begrenzt.” This suggests that potential disruption of trade and market access may affect supply lines primarily linked with Hebei and Tianjin regions.

For procurement professionals:

– Increase stock levels from Hebei Zongheng, given its relatively better output at 67%, signaling strong reliability amidst instability.

– Monitor fluctuations in Jilin, as its decline could lead to potential supply shortages if not addressed promptly.

– Reevaluate contracts that heavily depend on Chifeng Yuanlian, which showed a significant contraction and could indicate a risk for the coming months.

In conclusion, while certain plants display resilience, the overall market outlook remains very negative, urging proactive, data-driven adjustments for procurement strategies.