From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Sentiment in the European Steel Market: Opportunities and Challenges for Buyers Ahead

Recent developments within the European steel market suggest a mixed yet positive sentiment as demand conditions evolve. The article European rebar producers push for higher prices, but buyers resistant indicates producers are attempting price hikes due to rising costs; however, buyer resistance due to low seasonal demand in construction is evident. Meanwhile, Steady EU HRC prices supported by good order books at local mills, CBAM bullishness outlines robustness in hot-rolled coil (HRC) market sentiment, bolstered by strong order books and optimism around the Carbon Border Adjustment Mechanism (CBAM). Notably, no direct relationships were established between the buyer resistance and observed activity trends.

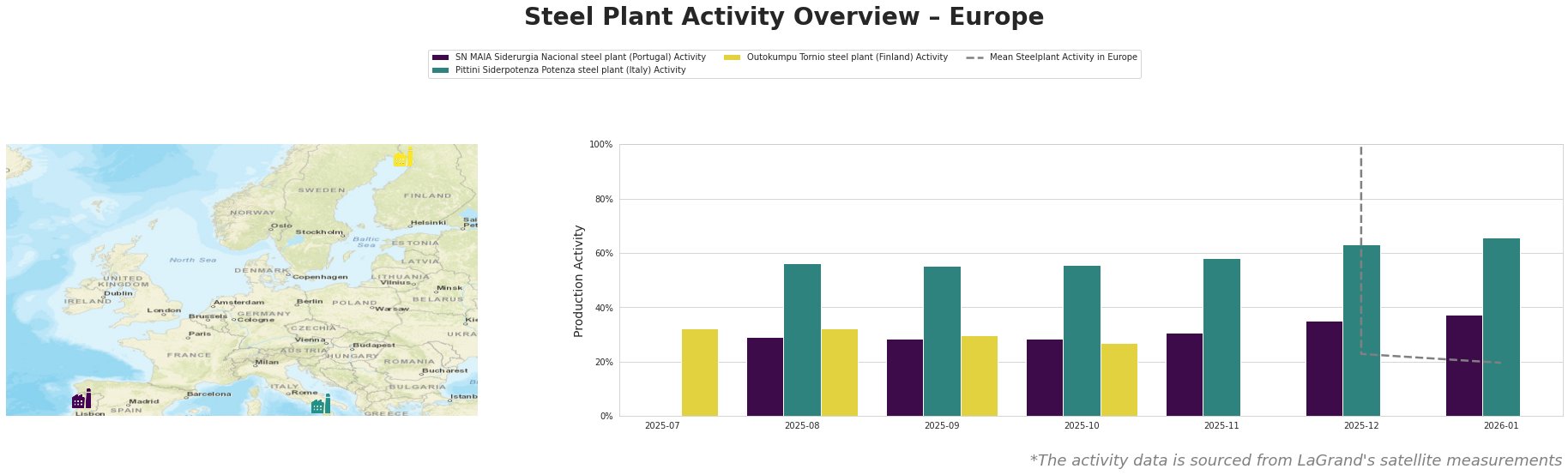

The activity levels of steel plants exhibit fluctuations:

- SN MAIA in Portugal: Demonstrated an increase from 29% in August to 37% in January 2026, aligning with the anticipated price increases from producers, potentially reflecting better demand forecasts despite some resistance from buyers.

- Pittini in Italy: Increased activity from 55% in September to 66% in January suggests responsiveness to market conditions and robust order management, resonating with findings in the Italian room stock grows as CBAM prices rise as manufacturers extend order deadlines and reassess pricing strategies.

- Outokumpu in Finland: Activity remains relatively stable, indicative of consistent production, though no clear ties to recent regional pricing strategies were identified.

These activity trends suggest that while some plants are gearing up in response to tight supply and potential price increases, buyer sentiment is influencing how quickly this capacity can be translated into actual order fulfillment.

Potential Supply Disruptions:

– The SN MAIA plant’s reliance on regional markets could be tested if the resistance from customers persists, especially as producers are adaptable but also facing competitive pressures.

– In the Pittini plant, a notable increase might also expose them to supply chain vulnerabilities if global conditions shift, particularly regarding the impact of CBAM.

Procurement Recommendations:

– Steel buyers should monitor offers closely, especially from Pittini, where rising activity and product demand are evident, and consider strategic forward bookings for HRC to capitalize on transitional market conditions.

– For SN MAIA, delaying procurement may lead to missed opportunities if prices do overcome negotiation barriers, particularly as seasonally influenced demand may recover following construction activity increases.

– Remain cautious with reliance on competitive procurement strategies given the news of resistance and adjust procurement plans to prioritize relationships with producers actively managing order books, particularly as seen with HRC pricing stability.

The outlined dynamics present a positive market sentiment amidst challenges, recommending strategic engagement with active suppliers based on observed activity and regional production capabilities.