From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSurge in Asian Steel Activity Amid EU Import Challenges and Regulatory Changes

Recent observations indicate a very positive sentiment in the Asian steel market, particularly amidst ongoing changes in the European Union’s import dynamics. Reports such as “Steel imports to the EU in early 2026 became a bottleneck: some quotas for the first quarter were exhausted within a few days” and “EU steel import quotas for some steel products have been reached full capacity“ reveal significant import challenges for products from Asia, influencing local market conditions. As EU quotas tighten, satellite data show heightened activity in Asian steel production facilities, although not all fluctuations can be directly connected to European demand shifts.

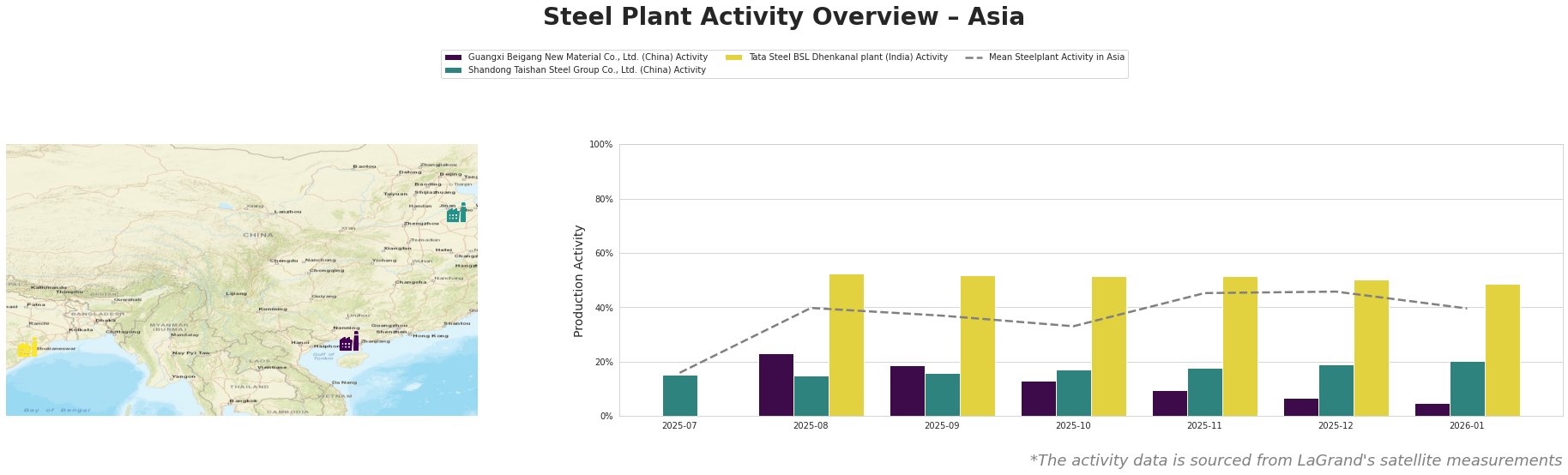

Guangxi Beigang New Material Co., Ltd. displayed a consistent decline in activity from 23.0% in August to just 5.0% by January 2026. This drop aligns with the mounting regulatory pressures mentioned in “CBAM ‘successfully’ in force since start of year: EU,” where stringent controls led to decreased EU orders. Shandong Taishan Steel Group Co., Ltd. has shown a more stable activity level, fluctuating from 15.0% to 20% within the same period, indicating a robust local demand which doesn’t directly correlate with the news reports. Conversely, Tata Steel BSL Dhenkanal maintained high activity levels (from 52% to 49%), emphasizing resilience amidst potential supply chain issues tied to EU quotas.

As EU markets tighten import capacities, it presents an opportunity for Asian suppliers to bolster production and fill the gap left by restricted imports. Steel buyers should strategically secure contracts focusing on producers with stable and higher recent activity levels, such as Tata Steel BSL, while considering potential disruptions in supply due to fluctuating EU demand and regulatory conditions.

Our analysis suggests that buyers should prioritize procurement from stable plants like Tata Steel and engage with firms equipped to adapt to changing demands, specifically in products impacted heavily by recent EU regulatory changes. Additionally, given the bottlenecks further described in “European steel HRC import prices grow amid trade regulations, fewer suppliers,” price negotiations may become more favorable as demand shifts away from traditional EU suppliers.