From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Faces Severe Downturn Amid Geopolitical Tensions and Plant Activity Declines

The steel market in Asia is currently experiencing a very negative sentiment, primarily driven by geopolitical uncertainties and declining plant activity levels. Articles such as Trump calls off talks with Iran highlight the escalating tensions that have raised concerns over export logistics and the steel supply chain in the region. This has been corroborated by activity data indicating significant drops in production levels across key plants.

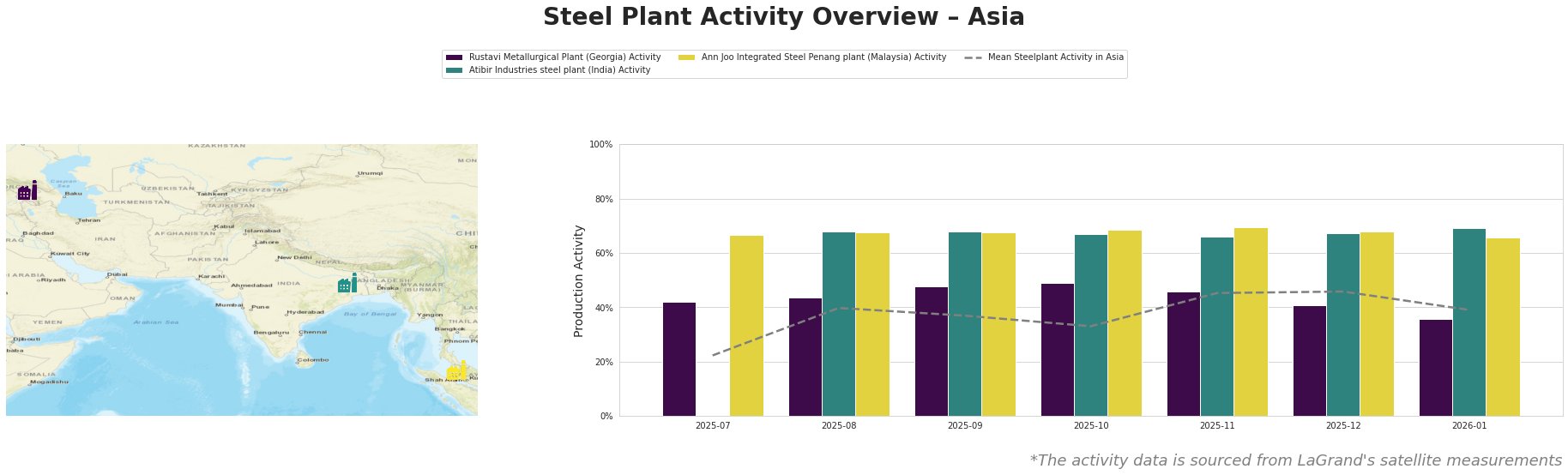

Rustavi Metallurgical Plant has seen its activity decline from 41% in December 2025 to 36% in January 2026. This drop aligns with adverse market sentiment exacerbated by geopolitical tensions referenced in Trump calls off talks with Iran, though no direct link to operational disruptions was identified. This plant, employing integrated production techniques, is crucial for infrastructure-related steel products, and diminished output might signal future supply issues.

Atibir Industries Steel Plant reported a slight uptick from 67% to 69% activity, contrasting with general downward trends, indicating resilience amid disruptions. Still, the interdependencies rooted in Iran-related sanctions could pose risks to market stability, as noted in Mideast bitumen flows to India may slow on US threats, though a direct connection with Atibir’s activity has not been established.

Ann Joo Integrated Steel Penang maintained steady production levels, fluctuating minimally around 66%-69%, which underscores a relatively stable supply caterer to the building and infrastructure sectors. However, this stability must be viewed against the backdrop of increased costs and potential sourcing challenges, as highlighted by Mideast bitumen flows to India may slow on US threats, which may extend to steel logistics and sourcing.

The combination of heightened geopolitical risks and observed plant activity declines underline the potential for regional supply disruptions, particularly for integrated operations that depend on stable input logistics. Steel buyers should consider hedging strategies and diversifying suppliers, particularly from less geopolitically influenced regions, to mitigate risks and ensure continuity of supply. The current market conditions suggest that proactive procurement planning will be essential in navigating this volatile landscape.