From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Market Thrives Amid Rising Exports and Improved Plant Activity

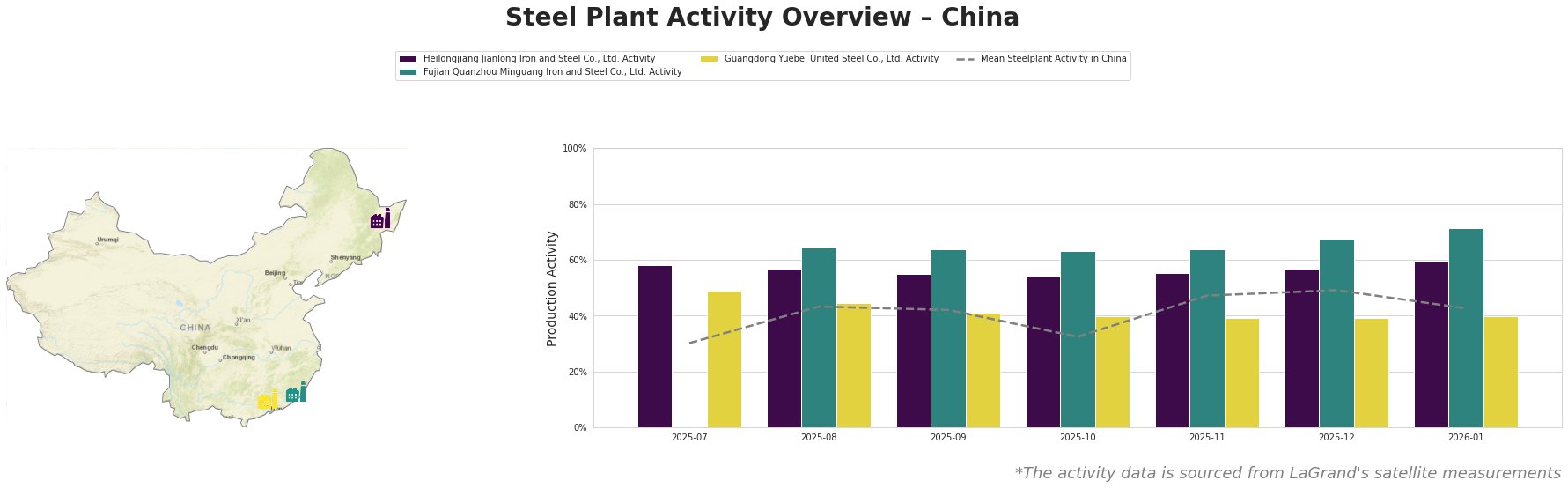

Recent reports indicate that China’s steel market is demonstrating resilience, driven by increased exports and a notable decrease in inventory levels. The article titled “China increased steel exports by 7.5% y/y in 2025“ highlights a substantial rise in exports, reaching a record 119.02 million tons. Concurrently, satellite data reveals a positive uptick in operational activity at key steel plants, particularly amidst a backdrop of decreasing steel production, as outlined in “Steel production in China fell to a seven-year low in 2025.”

As of January 10, 2025, total inventories of five main finished steel products in major cities decreased by 1.4%, reflecting robust demand that aligns with the export surge and slightly improved profitability across the sector.

Heilongjiang Jianlong Iron and Steel Co., Ltd. demonstrated stability with a production activity level of 60% in January, a clear rise from previous months and responsive to the announcement regarding exports. Meanwhile, Fujian Quanzhou Minguang Iron and Steel Co., Ltd. experienced a remarkable peak activity of 72%, correlating with the overarching export increase as discussed in “China increased steel exports by 7.5% y/y in 2025.” Conversely, Guangdong Yuebei United Steel Co., Ltd. displayed less resilience, maintaining a lower activity level but remaining steady at 40%.

Overall, the increase in export volumes and the simultaneous decline in inventories suggest a tightening market. Distribution disruptions could occur if the recently introduced export licensing regime leads to any bottlenecks, especially for plants like Guangdong Yuebei United Steel, which retains a lower activity threshold.

Procurement strategies should focus on securing contracts with Fujian Quanzhou Minguang, given its responsive production levels and suitability for high-demand products. Additionally, monitoring Heilongjiang Jianlong for further activity increases could provide leverage as the market adapts to new export regulations. Secure procurement agreements for inventory-sensitive products, particularly hot rolled and rebar types, can optimize supply chain resilience against potential regulatory volatility.