From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Steel Market Trends in Europe: Declining Production and Future Supply Challenges

Sweden’s steel industry faces significant challenges as illustrated by the article “Swedish output declines, SSAB to replace key bridge“. Notably, total crude steel production dropped by 3.2% in November 2025, marking a year-to-date decline of 1.4% amid ongoing operational disruptions and strategic infrastructure developments. Connection between these decreased activity levels and recent news about SSAB’s infrastructure plans is evident, underscoring the potential for further supply interruptions.

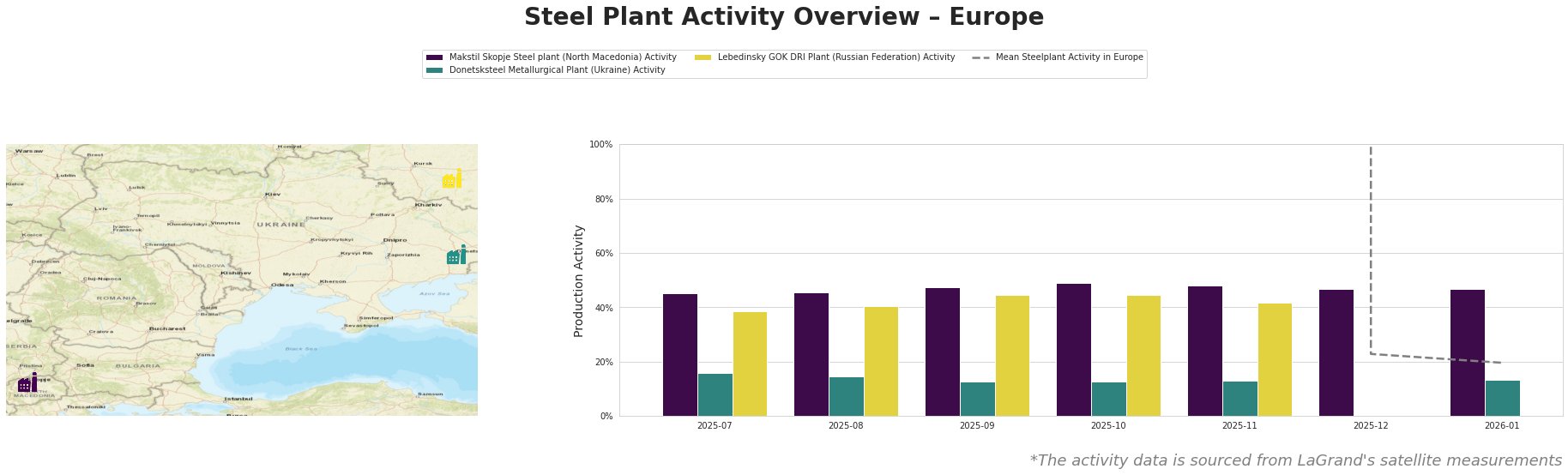

The recent data indicates a severe decline in overall steel activity, with significant drops observed in the mean activity of European plants from July 2025 (407,779,662.0) to January 2026 (20.0). The Donetsksteel plant experienced sustained low levels, peaking at 16.0 in July 2025 but regressing to 13.0 by January 2026. This stability amidst low activity suggests a plateauing effect likely driven by regional instability rather than operational recovery.

Similarly, the activity levels of the Makstil Skopje Steel plant remained consistently low, with little variation from 45 to 49 over several months. The plant operates with an electric arc furnace, producing semi-finished steel (slab), and its modest fluctuations indicate potential operational instability, likely unconnected to any recent news developments. Conversely, the Lebedinsky GOK DRI Plant mirrored lower mean activity levels reflecting wider industry challenges.

From the “Sweden builds dam gate using fossil-free steel“ article, it is clear that while strides to innovate with fossil-free steel are being made, the overall backdrop of declining production presents stark market implications. The bridging construction project by SSAB might disrupt logistics, thus impacting supply further in the coming years, particularly in the Swedish market.

Procurement actions are crucial at this juncture. Buyers should consider:

– Diversifying sources, particularly for semi-finished products, as both Swedish and Eastern European plants are exhibiting instability.

– Monitoring infrastructure developments closely to assess potential delays in supply chains, especially concerning SSAB’s bridge project.

– Preparing for potential sourcing from alternative suppliers who show more stability amidst the declining local production in Sweden and broader Europe.

Immediate reassessment of supply strategies will be vital for steel purchasers looking to mitigate risks and sustain operations in this deteriorating market climate.