From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America Steel Market Report: Satellite Insights and Political Landscape Affect Activity Levels, January 2026

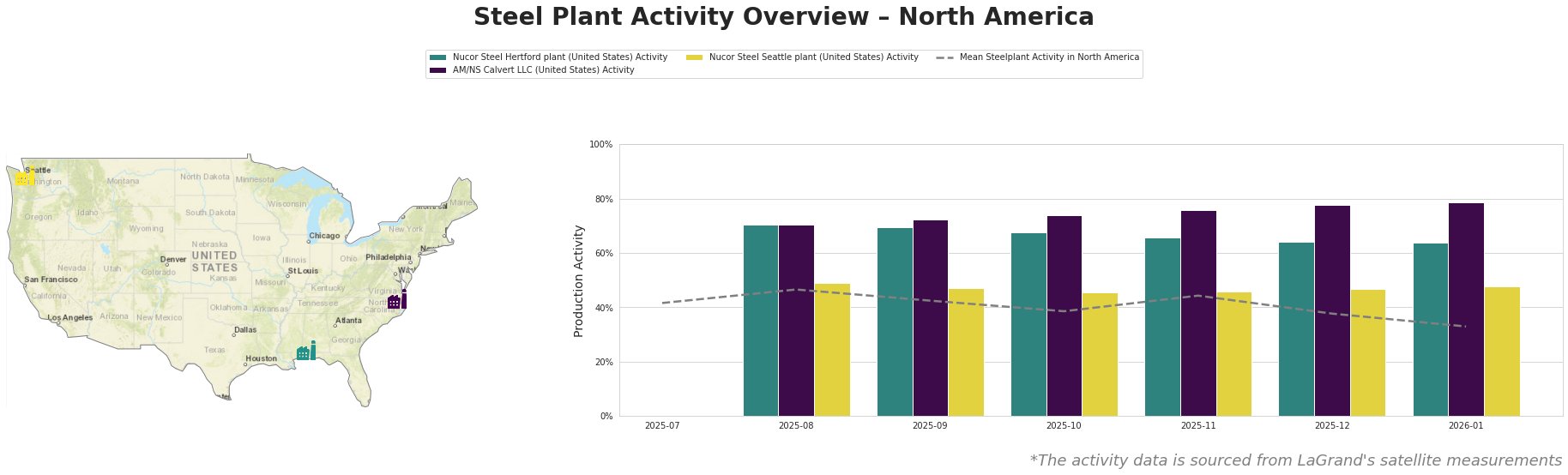

In North America, plant activity remains steady amid ongoing political developments affecting the steel industry. Recent news articles including Trump mulls tariffs in quest for Greenland and Greenland’s resources face extraction hurdles highlight the U.S. government’s strategic interests, which may indirectly influence market dynamics. However, direct correlations with current plant operations show only modest shifts.

The Nucor Steel Hertford plant in North Carolina recorded activity rates peaking at 71.0% in August 2025 but fell to 64.0% by January 2026. This steady decline aligns with the broader mean activity trends, suggesting that geopolitical tensions have created a slight market correction, but no direct link to the mentioned news can be established.

AM/NS Calvert LLC in Alabama has shown a gradual increase, from 71.0% to 79.0% between August and January. This growth could be linked to increased demand dynamics or positive responses to foreign policy developments, although no immediate correlation to the recent news articles has been definitively established.

The Nucor Steel Seattle plant’s activity levels remain relatively stable, fluctuating between 46.0% and 49.0% over the same period, showing resilience in the face of broader market uncertainties, but without a direct dependency on recent political developments.

Evaluated Market Implications:

Given the neutral market sentiment and recent observed shifts in plant activities, buyers should prepare for possible supply disruptions particularly linked to the Nucor Steel Hertford plant’s declining output. While geopolitical narratives may shape future demands and tariffs, firms should consider enhancing procurement strategies focused on securing timely contracts with AM/NS Calvert LLC amid its activity uptick.

Overall, steel buyers should monitor political developments closely, especially those surrounding trade tariffs as articulated in the article Trump mulls tariffs in quest for Greenland, which could affect logistics and supply channels in the coming months.