From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSweden’s Steel Market Sees Positive Momentum Amid Multi-Year Supply Agreements and Innovative Sustainability Initiatives

Recent developments in Sweden’s steel sector indicate promising growth driven by new strategic partnerships and innovative production methodologies. The Stegra and Thyssenkrupp agree multi-year steel supply and the thyssenkrupp Materials Services Signs Major Multi-Year Deal for Non-Prime Steel from Stegra’s Hydrogen-Based Plant in Sweden highlight significant shifts in supply dynamics. These developments are mirrored by satellite data indicating rising activity levels at relevant plants, particularly those engaged in greener steel production.

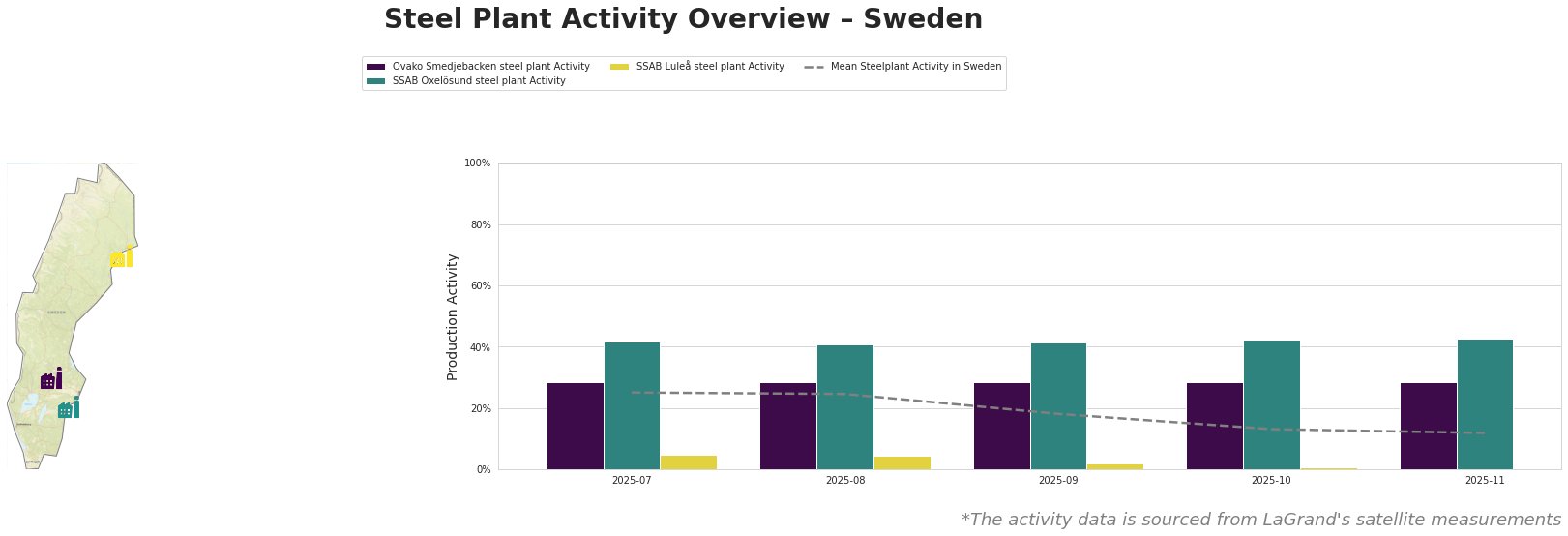

Recent satellite-observed data shows varied activity levels across key steel plants in Sweden. The Ovako Smedjebacken plant exhibited a stable activity level (29% in July and 28% in August), reflecting consistent operational performance amidst evolving market conditions. In contrast, both SSAB Oxelösund and SSAB Luleå’s activities showed notable fluctuations; SSAB Luleå’s activity peaked at 5% in July before dropping to 2% in September. These shifts may correlate with Thyssenkrupp’s focus on enhancing its offerings with non-prime steel, although a direct relationship with the observed activity levels is not established for SSAB plants.

The Ovako Smedjebacken steel plant, which operates primarily as an electric arc furnace producer, maintained consistent output, largely attributed to its focus on high-demand steel segments like spring and wear-resistant steels for automotive and energy sectors. Recent agreements emphasize the increasing need for specialized steel, with no direct connection to a production spike, yet solidifying Ovako’s strategic position in the market.

The SSAB Oxelösund steel plant, engaged in integrated production via blast furnaces, is currently the highest performing plant, with an activity level around 42% in July. Although the activity level dropped slightly in subsequent months, this facility has aligned with Thyssenkrupp’s strategy to source sustainable steel alternatives, strengthening its market position.

In stark contrast, the SSAB Luleå steel plant has experienced significant instability, with its activity plummeting to 2% by September. The drop corresponds with the market’s shifts toward non-prime steel items driven by the agreements with Stegra, where increased supply pressures could balance market demand but present challenges for traditional producers like SSAB Luleå.

In light of these developments, steel buyers should monitor the integration of new supplies from Stegra’s hydrogen-based plant, anticipated to commence deliveries in 2027, and consider diversifying procurement strategies to include non-prime steel solutions. Maintaining flexibility in purchasing decisions will be key to navigating future supply disruptions, particularly for buyers reliant on higher volumes of specialty steels. It is advisable to establish relationships with suppliers engaged in sustainable production to align with the evolving industry standards and demand for green steel initiatives.