From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Outlook: Very Positive with Significant Growth in Ukrainian Producer Activity

The European steel market is currently showing a Very Positive sentiment, largely driven by robust recent production increases among key Ukrainian steel producers. Notably, Zaporizhstal increased its rolled steel production by 15.1% y/y in 2025, and ArcelorMittal Kryvyi Rih produced 1.69 million tons of steel in 2025, demonstrating resilience in a challenging environment marked by the ongoing war. These developments align with satellite-observed activity levels which indicate improved operational performance in these plants.

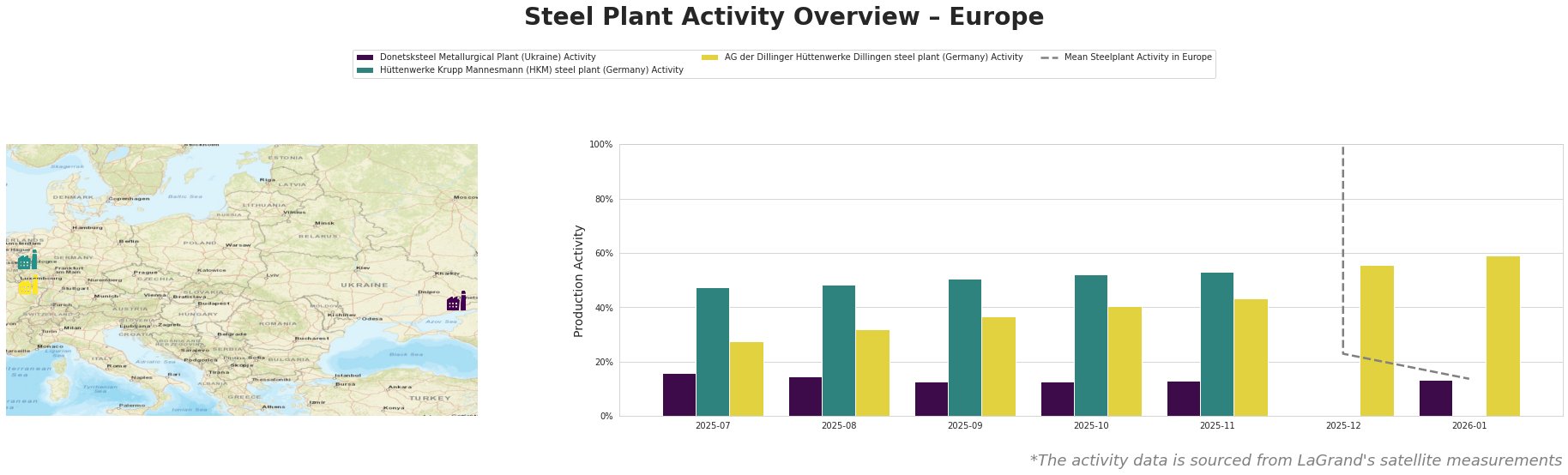

The activity levels of Donetsksteel have shown a notable decline, maintaining 13% operational capacity, which correlates with ongoing combat and infrastructural challenges. Conversely, Hüttenwerke Krupp Mannesmann (HKM) and AG der Dillinger Hüttenwerke have demonstrated gradual improvements, peaking at 59% in December for Dillinger, indicating increased resilience and capacity adjustments likely influenced by rising demand. These trends align with the reported 15.1% increase in production at Zaporizhstal amid environmental challenges.

Hüttenwerke Krupp Mannesmann, with a robust capacity of 6,000 tons, continues to cater to various sectors with a range of rolled product offerings. In the latest data, activity peaked at 53% in November, indicating consistent production throughput likely linked to positive market sentiments.

Meanwhile, AG der Dillinger Hüttenwerke, despite reported peaks at 59%, must navigate competition and operational costs while maintaining focus on quality steel delivery, leveraging its diversified product range designed for critical end-user sectors such as automotive and infrastructure.

Market dynamics indicate potential supply disruptions from Donetsksteel, which continues to lag far below operational norms due to instability in the region. Steel buyers should strategize procurement to capitalize on enhanced production from Zaporizhstal and ArcelorMittal Kryvyi Rih, leveraging their noted output increases for favorable pricing scenarios.

Recommendations for steel procurement professionals include:

– Increase sourcing from Ukrainian mills, specifically from Zaporizhstal and ArcelorMittal Kryvyi Rih, taking advantage of their increased production capabilities and potential competitive pricing.

– Monitor activity levels at Donetsksteel closely, due to its insufficient operational capacity and heightened risk of supply fluctuations, altering procurement schedules accordingly.

– Engage with regional suppliers to align on long-term contracts, stabilizing supply against the backdrop of fluctuating market conditions.

The current landscape suggests a cautiously optimistic outlook for buyers focusing on prioritizing supply from active, production-capable plants while hedging against risks associated with less stable operations.