From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Upsurge in European Steel Production Reflects Positive Market Dynamics in 2025

Europe’s steel market is exhibiting a very positive outlook, largely driven by significant production increases at pivotal plants. Notable developments include Zaporizhstal increased its rolled steel production by 15.1% y/y in 2025 and ArcelorMittal Kryvyi Rih produced 1.69 million tons of steel in 2025, reflecting a resilient adaptation to challenging conditions. This boost in production aligns with satellite-observed increases, especially during December 2025, where observed activity data indicated a strong performance despite operational hurdles.

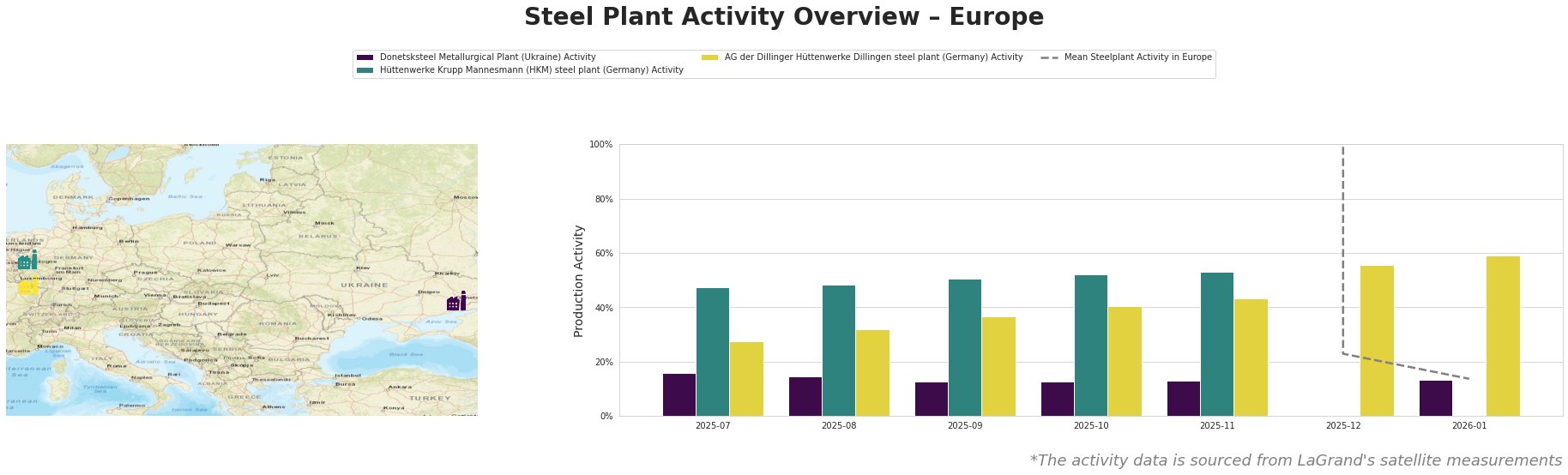

The Hüttenwerke Krupp Mannesmann (HKM) steel plant showed a consistent upward trend, reaching a peak activity of 53.0% in November 2025, coinciding with the strong demand outlined in Ukraine’s trade turnover in 2025 amounted to $125.1 billion, suggesting a robust steel market environment. Conversely, the Donetsksteel Metallurgical Plant displayed lower activity levels, remaining consistently around 13.0%, indicating potential disruptions yet marking stability amidst turbulent conditions.

AG der Dillinger Hüttenwerke Dillingen managed to achieve impressive activity levels, peaking at 56.0% in December 2025, reflective of successful adjustments to supply chain challenges noted in Ukraine reduced iron ore exports by 8% y/y in 2025, highlighting effective navigation through import and export dynamics.

The observed production enhancements in Zaporizhstal and ArcelorMittal Kryvyi Rih underline an overall positive sentiment within the market, enhancing buyers’ confidence amidst a slightly unstable backdrop.

Specific procurement strategies are recommended:

– Prioritize sourcing from plants with observable increases in activity such as Hüttenwerke Krupp Mannesmann and AG der Dillinger Hüttenwerke, aligning with reported production escalations in the news articles.

– Monitor developments at Donetsksteel for timely adjustments in procurement strategies, given its current lower capacity utilization.

– Consider hedging against potential supply disruptions arising from geopolitical tensions impacting plants like the Donetsksteel, thus ensuring continuous supply flow remains intact amidst fluctuating export/import scenarios highlighted in the recent reports.