From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook in the Asian Steel Market: Emerging Opportunities Amid Regulatory Changes

Recent developments in the Asian steel market indicate a positive sentiment, particularly influenced by regulatory changes in the EU. The article “EU quotas for metal-coated sheet products are rapidly declining“ highlights how Turkey’s and Vietnam’s exhaustions of import quotas are shaping market dynamics, correlating with satellite-observed activity changes at various steel plants across the region. Notably, the strong demand for certain steel products has pushed activity levels at these plants to notable highs amid the backdrop of tightening EU regulations, specifically targeted by the “EU steel imports hit early 2026 bottleneck” article, which delves into the rapid utilization of import quotas and the resultant bullish trend domestically.

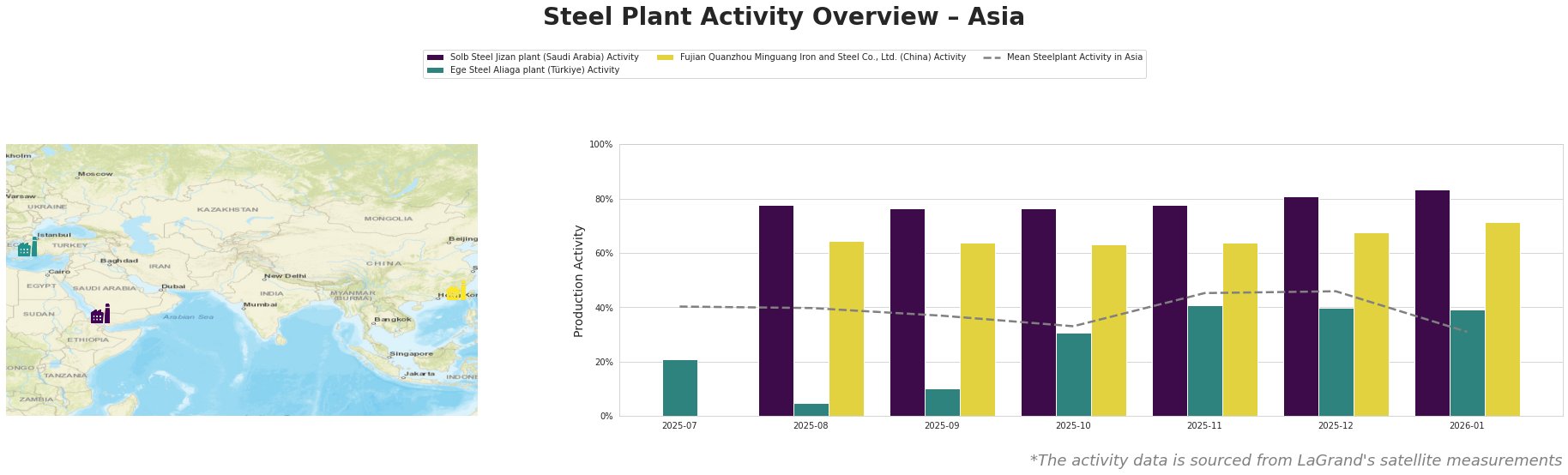

The data reveals significant fluctuations in activity levels. For the Solb Steel Jizan plant, activity rose sharply from 78% in August to 83% by the end of January 2026, suggesting it has effectively capitalized on heightened demand amid evolving regulations, which aligns with the insights derived from “EU steel import quotas for some steel products have been reached full capacity“. Meanwhile, the Ege Steel Aliaga plant showed volatility, peaking at 41% in November before leveling off at around 39%-40%, indicating stable but cautious operations, potentially influenced by the tightening import situation discussed in both “EU metallic-coated sheet quotas draw down rapidly“ and “EU steel imports to the EU in early 2026 became a bottleneck”.

Fujian Quanzhou Minguang Iron and Steel Co. has maintained relatively stable outputs, with activity hovering around 64% to 72%. However, lack of a clear connection to regulatory news suggests their operational stability may be less influenced by the current EU quota dynamics.

In response to these findings, it is advisable for steel buyers to prioritize procurement from the Solb Steel Jizan plant given its upward trend in activity and capacity readiness. Additionally, buyers should be aware of potential supply disruptions arising from restricted quotas, particularly in Turkey and Vietnam, which may affect product availability. Strategic initiatives to reassess supplier reliance in the EU context would benefit steel analysts and buyers as they navigate these emerging challenges.