From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Market Sentiment in Oceania’s Steel Sector Amid Regulatory Changes and Activity Fluctuations

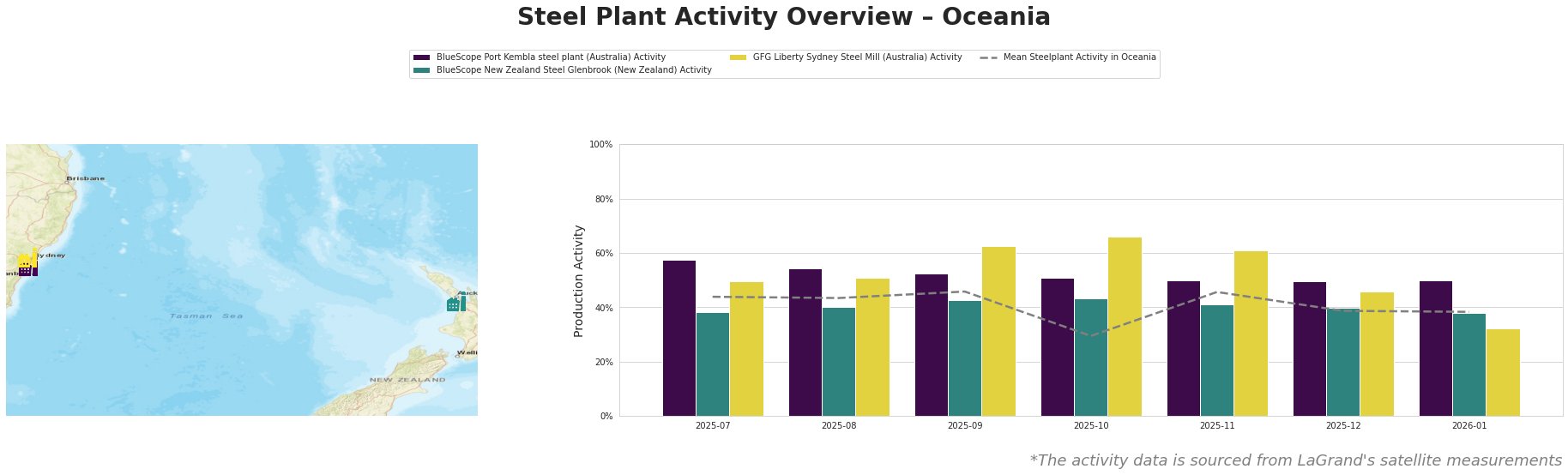

Oceania’s steel market remains neutral as recent satellite-observed activity at major steel plants has shown no significant improvement, aligning with caution from buyers following new regulations. Notably, the title European domestic steel plate prices rise after year-end holidays correlates with observed fluctuations, although no direct causality can be established between this news and local activity. Conversely, reports from European CRC and HDG prices have increased slightly, the market is still slowing down after the holidays reflect the broader effects of increasing import costs due to the EU’s latest carbon regulations, which echo in local sentiments about steel procurement.

BlueScope Port Kembla, which primarily utilizes a BOF process with an annual capacity of 3.2 million tonnes, displayed stable activity at 50% in January, reflecting no sharp declines. Despite steady production, the broader sentiment is shaped by the European domestic prices for HRC steel which are assessed amid low demand, possibly echoing supply hesitance stemming from regulatory concerns.

In contrast, BlueScope New Zealand Steel Glenbrook, operating using DRI and with a capacity of 0.65 million tonnes, reported a decrease to 38%, potentially aligning with the subdued demand observed in European markets, indicative from the European HRC prices steady, with CBAM confusion limiting imports article. These trends suggest local producers are adjusting supply levels in anticipation of international regulatory impacts.

GFG Liberty Sydney, employing electric arc furnaces with the total capacity of 0.75 million tonnes, fell dramatically to 32%, marking a meaningful drop that does not directly align with current news, suggesting internal operational challenges or a retraction in output in reaction to reduced local demand.

Evaluated market conditions indicate potential supply disruptions predominantly in New Zealand, while Australian producers maintain moderate outputs. Steel buyers should closely monitor supply levels, considering the cautious stance warranted by the regulatory landscape. Furthermore, anticipating price stability urged by CBAM, procurement strategies should favor securing contracts with local producers like BlueScope to mitigate risks associated with fluctuating import prices.