From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market: Navigating Early 2026 Trade Dynamics Amid EU Quota Constraints

Recent developments in India’s steel market indicate a Neutral sentiment, heavily influenced by EU’s new steel import quota period makes strong start and EU steel imports hit early 2026 bottleneck with some Q1 TRQs exhausted within days. Early 2026 has seen Indian suppliers, particularly for hot-rolled coils (HRC), face rapid quota exhaustion — India’s HRC allocations were utilized within just nine days — reflecting heightened demand in the EU and tighter trade regulations under the CBAM.

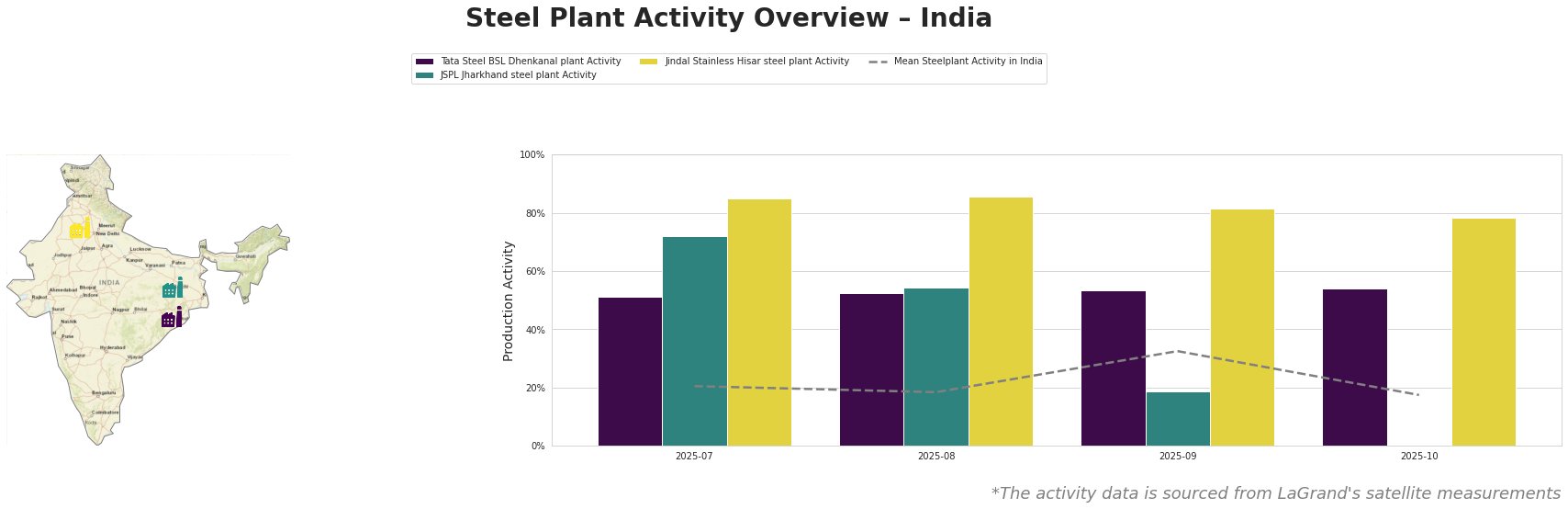

Plant activity has shown fluctuations: Tata Steel BSL Dhenkanal maintained stability with a peak at 54% in October, while JSPL Jharkhand experienced a notable drop to 19% by September. Jindal Stainless Hisar, on the other hand, fluctuated but remained high, indicating robust production for value-added products. Notably, fluctuations in activity levels appear disconnected from recent news trends, indicating independent operating conditions.

Tata Steel BSL Dhenkanal, operating an integrated process with a capacity of 5,600 tonnes of crude steel, reported an activity rise to 54% in October. This stability may reflect preparedness for higher demand from the EU, particularly for fit-for-purpose products as quotas tighten, despite no direct link to the rapid quota uptake for HRC. JSPL Jharkhand, while it dropped to 19% in September, could be facing internal logistical issues, with no explicit connection to EU demand highlighted in the news articles. Meanwhile, Jindal Stainless Hisar likely benefits from the market dynamics due to its diverse product lineup, remaining active and relevant.

The observed elevations in domestic activity from Tata and Jindal support a strategic pivot towards local procurement, echoed in the EU’s tightening regulations. Steel buyers should prioritize engagements with Tata Steel BSL and Jindal Stainless Hisar, given their operational stability and product readiness amid international bottlenecks. Concurrently, JSPL Jharkhand’s recent activity downturn prompts caution; procurement considerations should monitor its recovery trajectory closely.

In summary, potential supply disruptions could arise from JSPL Jharkhand’s inconsistent activity levels, while Tata and Jindal Stainless present reliable options for mitigating risks associated with volatile EU import regulations. Steel buyers are advised to secure contracts early and maintain flexibility in sourcing plans to adapt to the rapidly changing import landscape.