From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in India’s Steel Market: Thyssenkrupp-Jindal Negotiations Boost Activity

India’s steel market is currently exhibiting a positive sentiment, fueled by significant developments in the acquisition of Thyssenkrupp Steel Europe (TKSE) by Jindal Steel International. Notably, the article “Thyssenkrupp considers phased sale of steel unit to India’s Jindal“ highlights Jindal’s interest in acquiring a 60% stake in TKSE, a move that reflects confidence in the European steel sector and could enhance Jindal’s operational capacity. This is closely tied to observed increases in operational activity at major Indian steel plants.

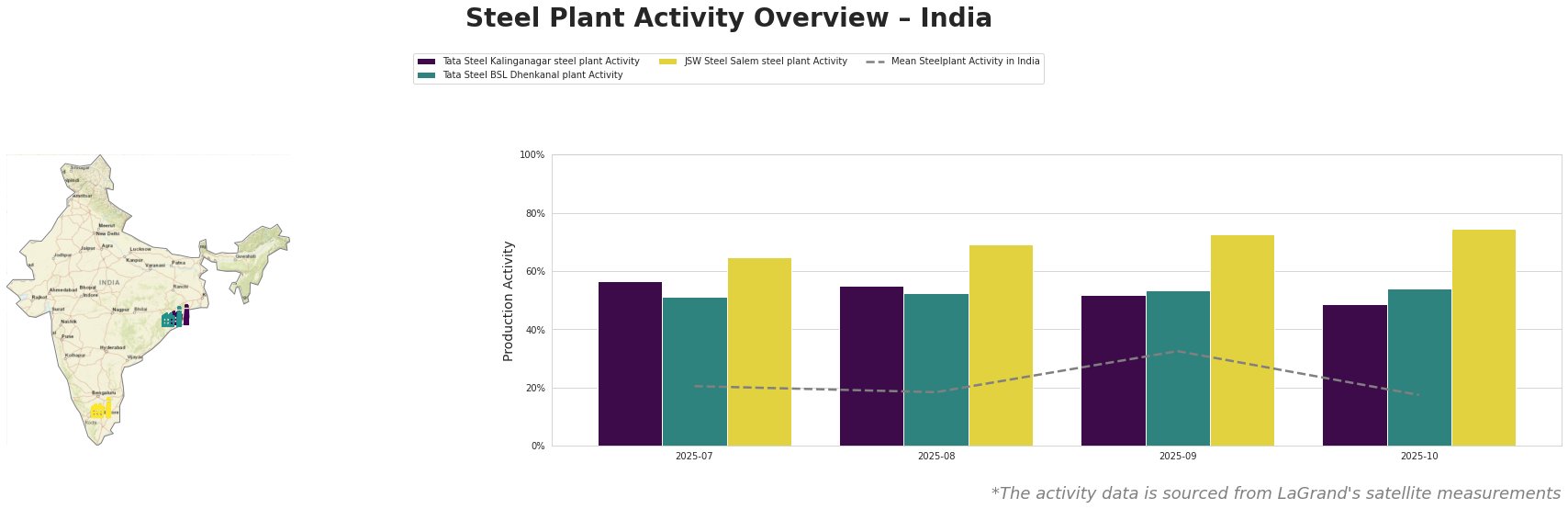

Tata Steel Kalinganagar, with a crude steel capacity of 3,000 MT, saw a decline in activity from 56.0% in July to 49.0% by October 2025. This drop was not directly linked to the ongoing negotiations with Thyssenkrupp, suggesting other operational factors might be at play. The plant, focused on integrated production, primarily serves the automotive sector.

In comparison, Tata Steel BSL Dhenkanal exhibited stable performance with only slight fluctuations, peaking at 54.0% activity in October. The plant, known for its blended BF and DRI processes, supports a diverse product range including hot rolled coils, positioning it strategically amidst changing market demands.

JSW Steel Salem displayed the strongest activity levels, increasing from 65.0% to 75.0% during the same period. The facility’s focus on semi-finished and finished rolled products caters to critical sectors like energy and infrastructure, driving robust demand.

The on-going discussions regarding the “Thyssenkrupp continues talks on the sale of its steel unit TKSE to Jindal Steel“ and the strategic implications highlighted in “Merz discusses thyssenkrupp sale during India visit: reports“ reinforce the positive outlook for the Indian steel sector. These developments suggest a tightening supply market for high-quality European steel, leading to a potential uplift in domestic pricing.

For steel buyers and market analysts, the recent activity trends indicate a recommendation for proactive procurement strategies. Increased operational activity at JSW Steel Salem suggests a reliable sourcing opportunity for semi-finished and finished rolled products. Conversely, fluctuations at Tata Steel Kalinganagar warrant close monitoring, as inconsistency could imply potential supply disruptions.

In summary, the interplay between international acquisitions and local activity levels offers actionable insights for procurement professionals aiming to navigate the evolving landscape of India’s steel market.