From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Update: Negative Outlook Amid Political Turmoil and Falling Activity Levels

Recent developments in South America indicate a negative sentiment in the steel market, primarily influenced by political instability and declining activity levels at key steel plants. The article titled “Venezuela defies US call to end support for Cuba“ highlights Venezuela’s ongoing commitment to its alliance with Cuba despite U.S. pressures, while “Trump to meet next week with Venezuela’s Machado“ foreshadows potential shifts in governance that could impact production decisions and market dynamics. Satellite observations reveal significant drops in activity levels across several facilities, suggesting a correlation between these political events and operational performance, although direct relationships with every facility were not established.

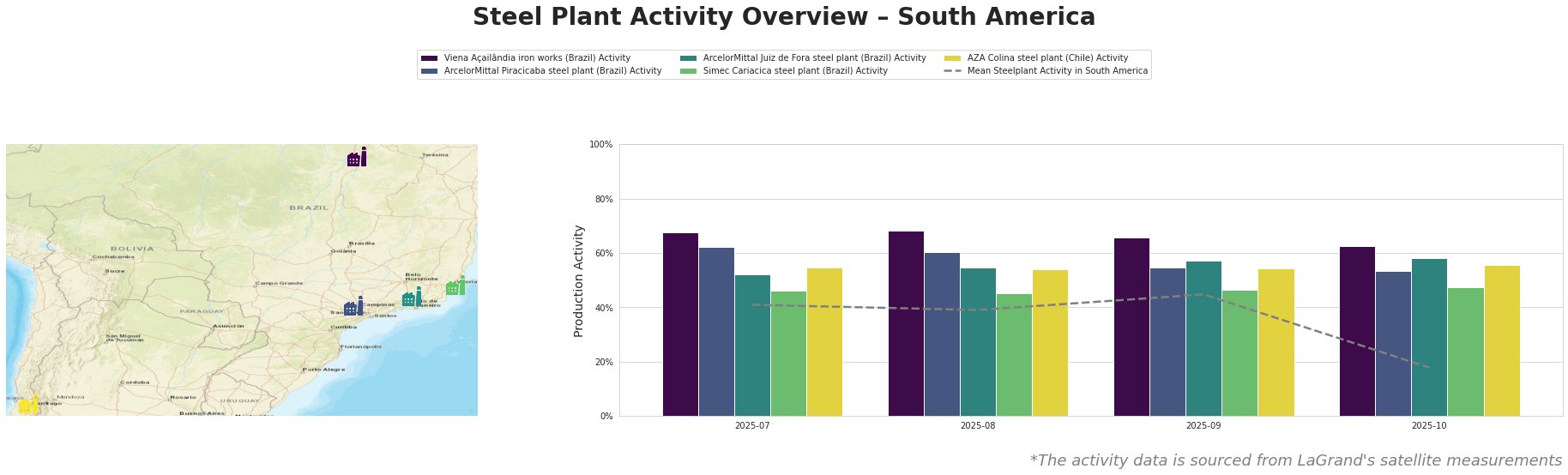

Activity levels across the observed steel plants have seen a substantial decline, with the mean activity dropping from 45.0% in September to just 18.0% in October 2025. Notably, while the Viena Açailândia Iron Works maintained a relatively high activity level (68.0% in July and August), the overall sentiment suggests a downward trend across nearly all facilities, aligning with the political uncertainty highlighted in the recent articles.

The ArcelorMittal Piracicaba steel plant, showcasing decreasing activity from 62.0% in July to just 53.0% in October, serves as a pertinent example. The plant’s operations could be substantially affected by the political climate surrounding Venezuela’s ongoing support for Cuba, given that its leadership has ties that could influence regional production positively or negatively. The Juiz de Fora plant experienced a decrease, but it remained strong relative to others, with activity levels above 50%.

The Simec Cariacica and AZA Colina plants also exhibited minor fluctuations (down from 48.0% to 45.0% and stable respectively) but are considerably below the mean activity amid broader slowdowns. However, no direct link to the cited news could be established for these plants.

Given these observed trends and the political landscape’s influence, several potential supply disruptions are on the horizon. Steel buyers are advised to:

- Consider alternative sourcing strategies, especially from plants the political scenarios may affect, particularly the operations tied to Venezuelan dynamics.

- Accelerate procurement efforts in the immediate future to mitigate risks associated with declining operational stability across facilities in regions prone to political upheaval.

- Maintain vigilance on political developments, especially concerning U.S.-Venezuelan relations and the potential reopening of the U.S. embassy in Caracas, as any shifts may directly impact future supply capabilities.

The ongoing political fluctuations and shrinking activity levels call for proactive engagement strategies and more diversified sourcing to navigate this tumultuous market effectively.