From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook in Oceania Driven by Increased Domestic Activity & Regulatory Changes

The steel market in Oceania is experiencing a positive sentiment, bolstered by recent regulatory shifts and increased activity at local steel manufacturers. The implementation of the EU’s Carbon Border Adjustment Mechanism (CBAM) has prompted changes that might affect import dynamics, as noted in the articles “European domestic HRC market still mostly quiet but mood remains positive” and “Domestic steel sheet prices in Europe are rising after the end-of-year holidays.” The satellite data supporting the heightened activity reflects ongoing adjustments in plant outputs, with observable increases in production levels.

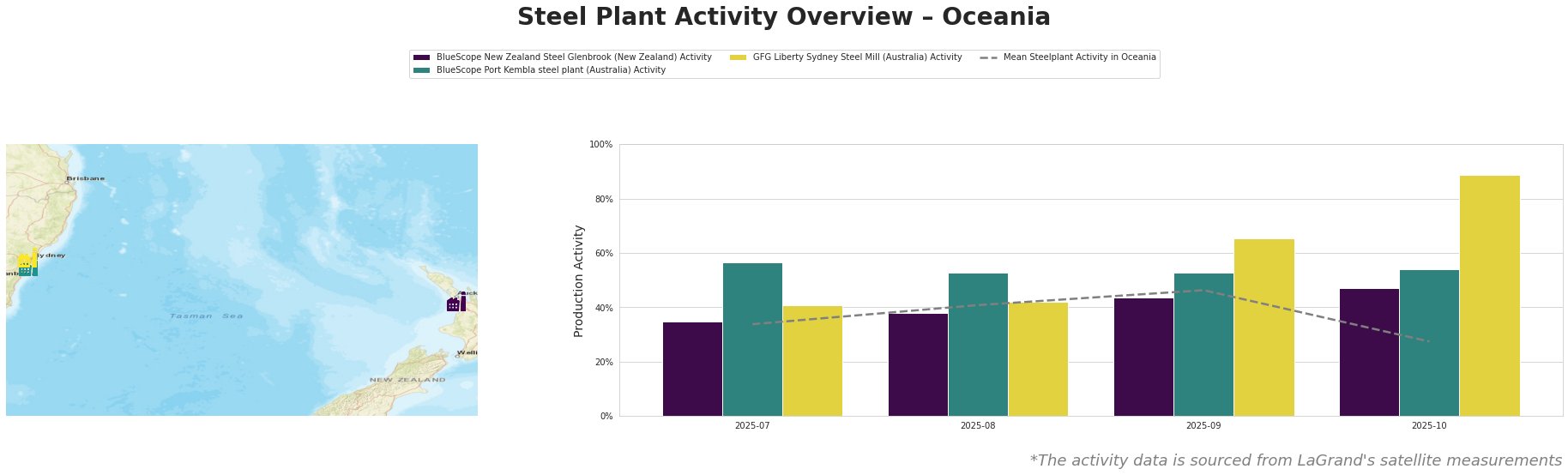

Recent activity trends reveal that BlueScope New Zealand shows variable performance, peaking at 44% in September but dropping to 35% by the end of July. BlueScope Port Kembla has shown a steady level between 53% and 57% over the observed months, while GFG Liberty has exhibited notable volatility, peaking at 89% in October, aligning with escalating local demand in the building infrastructure sector amidst regulatory changes that may impact imports.

BlueScope New Zealand Steel Glenbrook, which utilizes an integrated DRI process and has a crude steel capacity of 650kt, reported activity peaking at 47% in October. This aligns with an industry uptick in domestic demand amidst tightening import costs. However, by the end of October, activity decreased sharply to 35%, with no direct linkage to observed news developments.

BlueScope Port Kembla, with a higher capacity of 3200kt, maintains a more stable operation model. Its activity hovered between 53% and 57% throughout the observed period, reflecting resilient demand for flat-rolled products within local markets. No significant correlation with recent news suggests uncertainty in future import levels due to regulatory changes.

GFG Liberty Sydney Steel Mill recorded significant activity at 89% in October. This sharp rise correlates with the heightened anticipation of domestic price increases from expected supply constraints outlined in the report “HRC futures in the Northern part of the EU strengthen on CME.”

Considering these insights, it is critical for procurement professionals to focus on the stability observed in BlueScope Port Kembla, as it may present a reliable source for high-capacity needs. Additionally, engaging with GFG Liberty might yield potential opportunities for long products as they capitalize on the recent increase in construction activities. However, caution is advised due to the observed volatility in BlueScope New Zealand, which may suggest supply inconsistencies. Firms should strategically position purchases to navigate potential disruptions stemming from increased costs due to the CBAM, ensuring comprehensive supplier negotiations that emphasize cost management upstream.