From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Insights: Positive Trends Amid Regulatory Strains

The European steel market is showing signs of positivity, with notable price increases in domestic hot-rolled coil (HRC) and cold-rolled coil (CRC) prices as reported in European HRC markets restart slowly; mills push prices up as CBAM creates structural strain on imports and European CRC and HDG prices rise marginally, market still slow after holidays. During this period, satellite observations reveal a clear recovery in plant activity, particularly influenced by the ongoing impacts of the Carbon Border Adjustment Mechanism (CBAM).

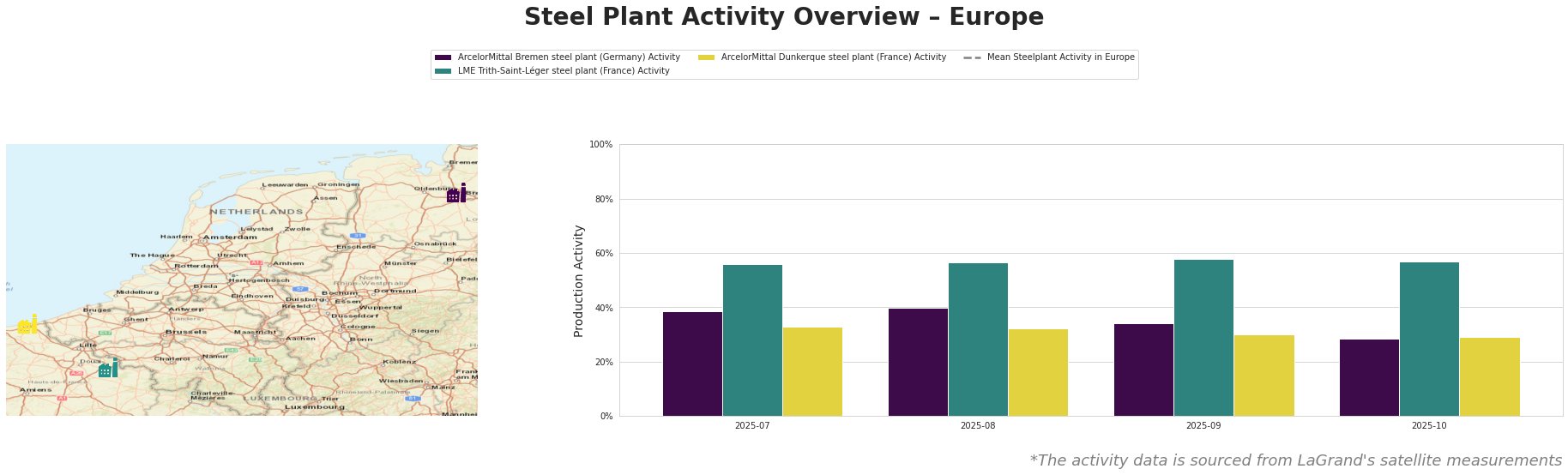

From July to October 2025, the average activity of steel plants in Europe experienced fluctuations, peaking in August but declining toward the end of the quarter. The ArcelorMittal Bremen plant stood steady at around 39-40%, aligning with the expectation for rising domestic prices as noted in the aforementioned news articles. In contrast, the LME Trith-Saint-Léger plant exhibited more significant fluctuations, notably peaking at 58% in September, suggesting a responsiveness to market demands despite the broader market hesitance.

At the ArcelorMittal Bremen plant, where integrated steelmaking is the primary process, activity stabilized during this period; holding steady around 39% amid rising market prices and demand pressures primarily driven by the implications of CBAM. The plant produces key products like hot-rolled coils and cold-rolled coils aimed at end-user sectors such as automotive and construction, which will likely benefit from the expected price increase as outlined in European HRC markets restart slowly.

Conversely, the LME Trith-Saint-Léger plant, known for its electric arc furnace operations, maintained a relatively higher activity peak in September but showed a subsequent decline, suggesting that its responsiveness to the higher domestic prices is more elastic than those of traditional integrated plants. This aligns with observations in European CRC and HDG prices rise marginally where domestic mills push for prices despite slow import activities.

ArcelorMittal Dunkerque’s integrated production capabilities and certifications enable it to adapt to the tightening regulatory environment driven by CBAM, which is affecting cost structures and import dynamics as highlighted in the European HRC markets are recovering slowly article. Activity at Dunkerque fell to 29% by October, indicative of potential supply challenges stemming from both domestic and international market conditions.

To mitigate potential supply disruptions, procurement professionals should prioritize sourcing from integrated mills like ArcelorMittal Bremen and Dunkerque for consistency amidst regulatory turbulence. Consider leveraging the upward price momentum by strategically purchasing HRC and CRC materials ahead of anticipated further price hikes, ensuring alignment with buying trends indicating a preference for local production amid rising import costs attributed to CBAM. Additionally, maintaining flexibility in procurement strategies could be advantageous as the market sentiment remains positive despite current challenges.