From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Market Trends in Asia’s Steel Industry: Insights from Recent Activity and News

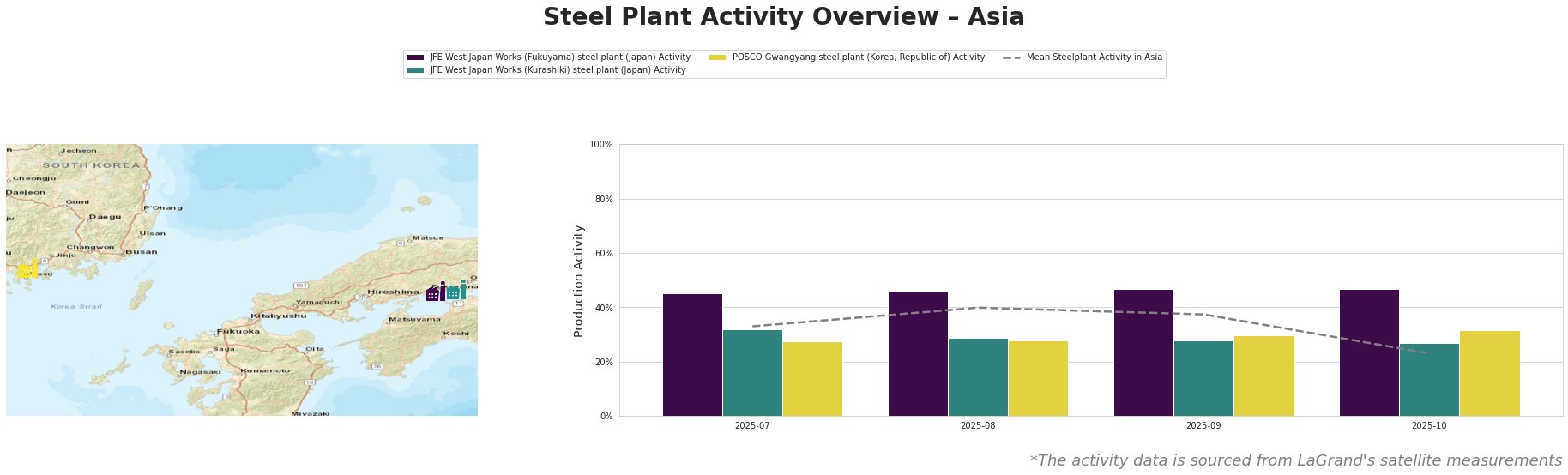

Recent developments in Asia’s steel market reveal optimistic trends, driven significantly by satellite-observed activity data and pertinent industry news. Satellite activity data for July to October 2025 indicate a rising trend with the mean steel plant activity in Asia fluctuating but maintaining a positive outlook amidst challenges facing other sectors, as underscored in “India defers upstream hopes into 2026“. The satellite data reflects steady operational rates, with notable activity spikes at Japanese plants JFE West Japan Works (Fukuyama) and (Kurashiki), indicating a gradual recovery in production post previous year lows.

JFE West Japan Works (Fukuyama) has shown remarkable stability, with activity levels reaching 47.0% in September 2025, paralleling the industry’s positive sentiment. The plant utilizes Blast Furnace (BF) and Basic Oxygen Furnace (BOF) technologies, primarily producing finished rolled products for diverse sectors. The observed consistency aligns well with the strategic adjustments referenced in “India defers upstream hopes into 2026,” reinforcing the effectiveness of Japan’s production capacity in the face of regional uncertainties.

Conversely, JFE West Japan Works (Kurashiki) has experienced minor fluctuations, peaking at 32.0% in September but showing resilience, maintaining an alignment with the overall market positivity amid fluctuating global demand. This suggests that while the Kurashiki plant is stable, it faces competition from its Fukuyama counterpart.

POSCO Gwangyang also highlights the broader market positivity, achieving a peak of 32.0% in October, which reflects a gradual resurgence in demand for finished rolled products like hot rolled and galvanized steel. This resurgence is particularly relevant as it positions the plant strategically amidst global supply shifts, particularly after examining assertions in “Point of view: The US is using delays against the ‘green’ policy,” which may impact international trade dynamics and steel demand forecasts in the future.

In summary, while the overall mean activity indicates a slight dip in October to 23.0%, the fluctuation has not diminished the overall positive sentiment. The regional activity trends suggest strong procurement considerations:

- Actionable Insight for Buyers: Align procurement strategies with the observed peaks at JFE plants, particularly around September, to secure advantageous pricing before potential increases in demand.

- Long-term Contracts: Given the uncertainty in regulatory impacts as seen in the news, consider establishing long-term contracts with reliable producers like JFE and POSCO, capitalizing on their stable activity levels to hedge against potential future supply disruptions.

In conclusion, Asia’s steel market reflects positive trends amidst approaching challenges. By focusing procurement on trends revealed by satellite data and aligning strategies with the current production landscape, steel buyers and analysts can navigate potential disruptions and capitalize on growth opportunities.