From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineArgentina Steel Market Report: Activity Surge Indicates Strong Outlook Amid Agricultural Growth

Argentina’s steel market shows a Very Positive sentiment, reinforced by recent agricultural advancements, particularly in wheat. Notably, the articles “Viewpoint: Argentina wheat crop to roil 2026 markets” and “Argentina wheat harvest almost complete, forecast rises” highlight the significant increase in wheat production, which indirectly relates to improving economic contexts, influencing steel demand and market optimism.

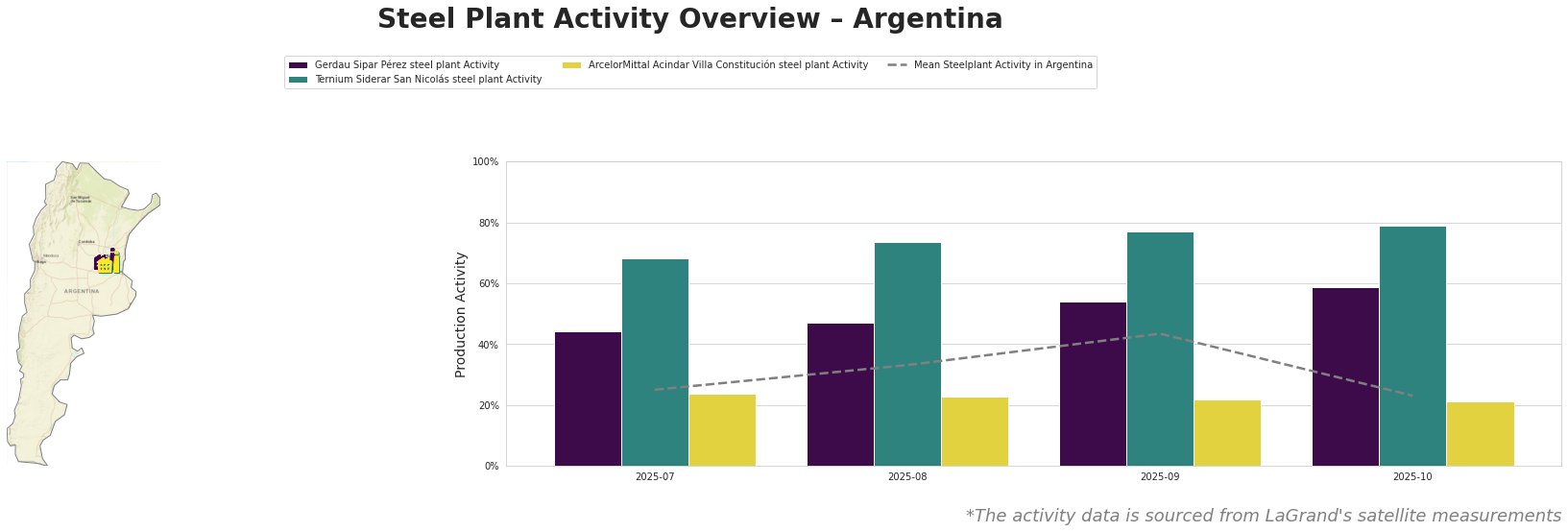

Measured Activity Overview

Recent satellite data indicates that the activity at Ternium Siderar San Nicolás has been consistently high, peaking at 79.0% in October, aligning with the broader positive market sentiment, although dropping from higher early fall levels. Gerdau Sipar Pérez showed a notable increase to 59.0% in October, indicating robust operations that support anticipated increases in steel demand due to the flourishing agriculture sector, as emphasized in the news articles. However, ArcelorMittal Acindar Villa Constitución exhibited a decline, with activity levels decreasing to 21.0% in October, which may indicate operational adjustments rather than reduced demand.

Steel Plant Activity Analysis

At the Gerdau Sipar Pérez steel plant in Santa Fe, the recent activity rise from 47.0% in August to 59.0% in October underscores a positive response to market conditions. Its electric arc furnace technology supports efficient production in the construction and automotive sectors, where demand is likely to grow due to agricultural expansions highlighted by the “Argentina wheat harvest almost complete, forecast rises” article, indicating increased economic activity.

Ternium Siderar San Nicolás, based in Buenos Aires, reflects a solid operational foundation with an extensive production capacity of 3,200 kt and has maintained a high activity level, ending at 79.0% in October. This stability suggests enhanced productivity that aligns well with agricultural outputs, likely supporting sustained demand across construction and infrastructure sectors as mentioned. It also positions the plant favorably amid the growing market optimism.

In contrast, ArcelorMittal Acindar Villa Constitución faced a reduction in activity from 23.0% in August to 21.0% in October, despite its significant production capabilities of 1,750 kt. This decline may not connect directly to the agricultural narrative, indicating possible operational challenges that steel buyers should monitor closely.

Evaluated Market Implications

Given the increased wheat production and rising off-farm stocks as reported in “Argentina off-farm stocks rise in December on wheat,” there is strong potential for demand growth in related sectors, urging steel buyers to explore procurement from plants showing high activity levels, particularly Gerdau Sipar Pérez and Ternium Siderar.

Steel buyers should prioritize sourcing from Ternium Siderar, given its high production trajectory and stability, as it may better serve rising demand aligned with agricultural growth. Potential supply disruptions could arise if operational challenges continue at ArcelorMittal Acindar. Consequently, diversifying supply sources to include higher-performing plants may reduce risks associated with procurement fluctuations in Argentina’s steel market.