From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Insights: Positive Activity Driven by Enhanced Production Conditions

Brazil and Argentina are experiencing notable increases in steel production activity levels. Recent articles, including Viewpoint: Brazil seeks gas growth and price cuts and Viewpoint: Argentina wheat harvest almost complete, forecast rises, relate to favorable conditions supporting enhanced industrial output, aligning well with observed satellite data on plant activity.

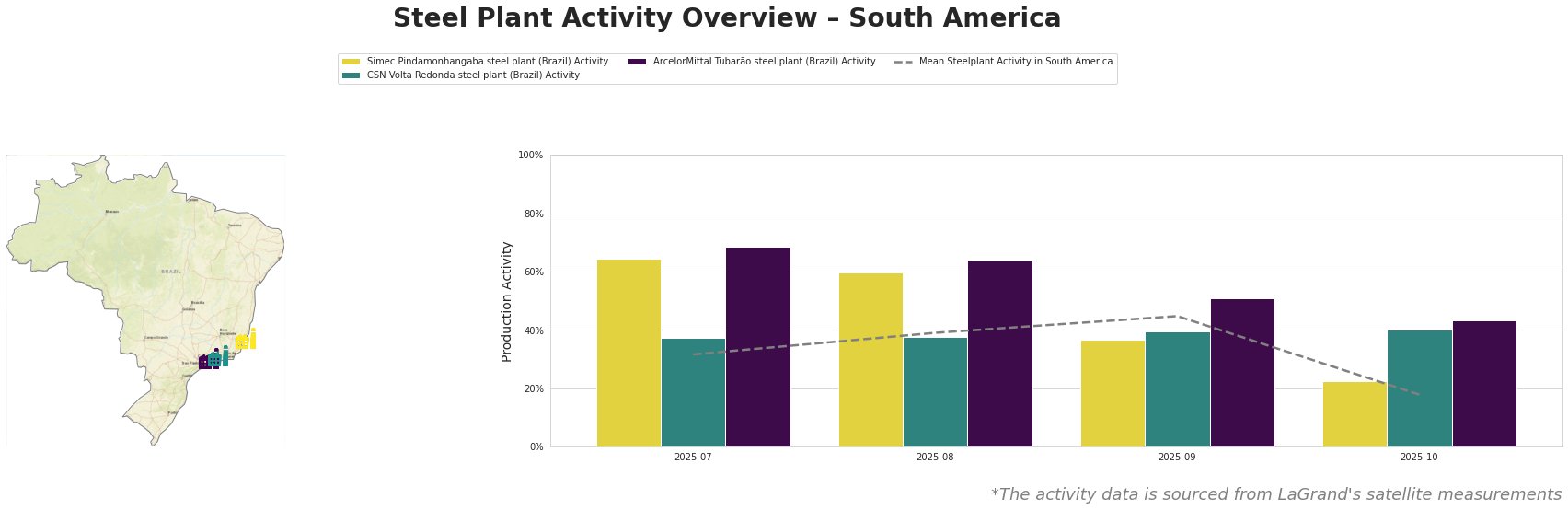

Recent activity levels across selected steel plants demonstrate a very positive trend. For instance, the CSN Volta Redonda plant recorded an average of 39% activity in August 2025, followed by a peak at 45% in September. Conversely, activity for the Simec Pindamonhangaba plant saw a decline to 37% in September, indicating variability within the sector. The overall mean activity level across all observed plants stood at 32%, with fluctuations noted certainly warranting close monitoring.

Simec Pindamonhangaba Steel Plant

The Simec Pindamonhangaba steel plant in São Paulo has demonstrated fluctuating activity levels, peaking at 65% in July 2025, before settling to 60% in August and dropping to 37% in September. This volatility may not directly align with recent news, as the Viewpoint: Brazil seeks gas growth and price cuts highlights shifting gas supply dynamics potentially stabilizing future production rates. The plant specializes in producing finished rolled products, primarily for the building and infrastructure sectors.

CSN Volta Redonda Steel Plant

CSN Volta Redonda, with a capacity of 6,250,000 tons, has shown stable activity levels fluctuating from 37% to 45% in the months ending August and September, respectively. The plant’s activity aligns well with its diverse production capabilities, including automotive-grade steel. The improvements can be partially attributed to the developments in Brazil’s gas market discussed in Viewpoint: Brazil seeks gas growth and price cuts which are expected to enhance industrial output demands.

ArcelorMittal Tubarão Steel Plant

ArcelorMittal Tubarão, an integrated steel production facility, reported its activity at 68% in July, slightly dipping to 51% by September. The robust energy production appears linked positively to improved operational efficiency, as its self-sufficient energy model allows greater adaptability to market changes. This plant’s activity can also be indirectly correlated with broader industrial growth mentioned in the updates on Argentina’s wheat harvest, enhancing overall demand for high-quality raw materials.

Evaluated together, the market sentiment persists as very positive. Procurement specialists should expedite sourcing from CSN Volta Redonda and ArcelorMittal Tubarão plants at current capacity levels to capitalize on increased production rates. Close attention to Simec should be maintained, given recent drops, while monitoring gas developments to predict upcoming operational trends. A strategic focus on leveraging Argentinian wheat growth could also advantage regional steel needs, provided quality outputs are ensured from local production dynamics.