From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Asia’s Steel Market: Sanctions Ignite Domestic Production Growth

Recent developments in Asia’s steel market indicate a positive shift, particularly driven by protective measures in India and Turkey. The article India Imposes Duties on Steel Imports from China details India’s implementation of safeguard duties between 11% and 12% on Chinese steel imports. Correspondingly, Turkey has introduced anti-dumping measures against imports of cold-rolled stainless steel from China, reinforcing domestic production amidst intensified global competition. These policy changes correlate with observable increases in satellite-measured activity at various steel plants.

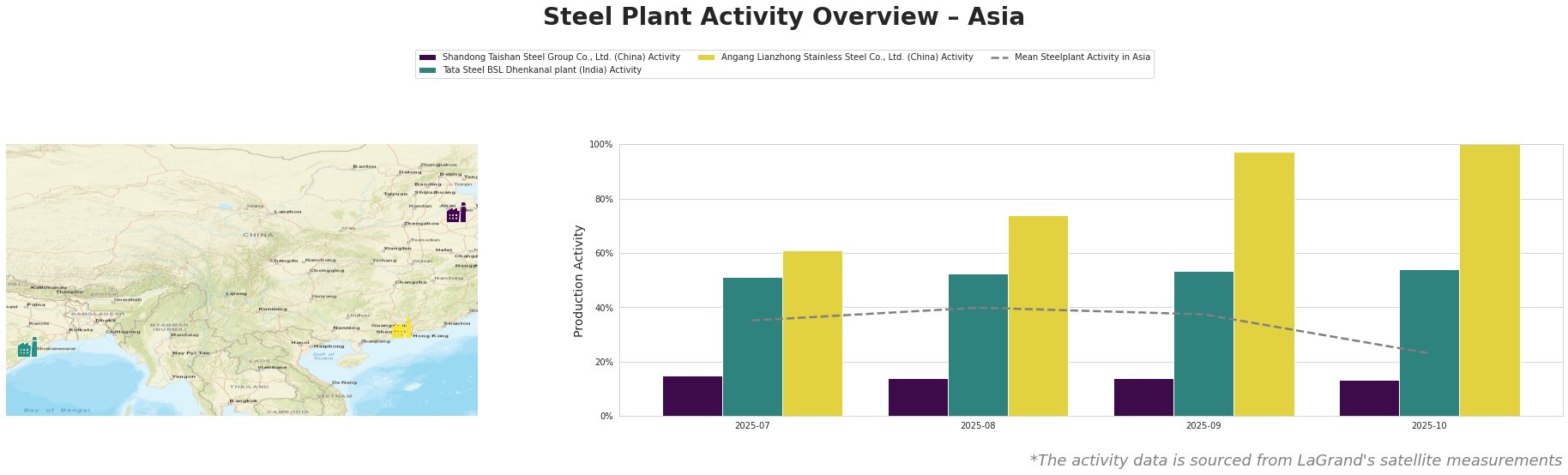

The plant activity data reveals a decline in overall mean activity to 23.0% by October 2025. Notably, Angang Lianzhong Stainless Steel Co., Ltd. in Guangdong significantly peaked at 100.0%, garnering attention for robust performance against the backdrop of sanctions affecting steel trade dynamics. However, both Shandong Taishan Steel Group Co., Ltd. and Tata Steel BSL Dhenkanal plant exhibit less stability and lower activity, with the former dropping to 13.0% in October, correlating with the increasing safeguard measures that may constrict their competitiveness.

The Tata Steel BSL Dhenkanal plant, with a crude steel capacity of 5.6 million tonnes, operates on an integrated system that combines blast furnaces (BF) and direct reduced iron (DRI). Recent activity remained relatively stable around 54.0% in October, underlining a possible responsiveness to India’s safeguard duties aimed at bolstering domestic production. The 12% tariff reported in India Imposes 12% Safeguard Tariff on Steel Imports from China and Others to Protect Domestic Producers is expected to sustain upward pressure on local prices, aiding Tata’s positioning as imports decrease.

Conversely, Shandong Taishan Steel Group Co., Ltd., operating mainly as an integrated BF plant, displayed a worrying trend, with a drop to 13.0% by October, suggesting difficulty in capitalizing on these protective policies. This reduction aligns with India extends import duties on flat steel to 3 years, which may inadvertently impact the demand for their products.

In light of these insights, steel buyers should consider the following procurement strategies:

– Shift purchasing focus to local suppliers, particularly within India, where imported tariffs are driving domestic production growth and may enhance availability and cost-effectiveness.

– Monitor Angang Lianzhong’s performance closely, as its peak may present a lucrative sourcing opportunity for stainless steel products amidst changing trade dynamics.

– Assess the competitive landscape regularly, adjusting procurement plans to anticipate fluctuations in supply from lower-performing plants like Shandong Taishan.

In summary, significant market implications from recent policy changes necessitate tailored procurement strategies that leverage local market gains while adapting to shifts in international trade flows.