From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope’s Steel Market Sentiment Turns Very Positive Amidst Key Developments: EAF Projects and Resumed Operations

Recent advancements in Europe’s steel industry signal a very positive market sentiment, particularly following the news articles “ArcelorMittal to start Belval’s new EAF hot commissioning” and “Production resumes at ArcelorMittal Fos-sur-Mer”. Enhanced production capacity through new electric arc furnaces (EAF) and the restart of operations at critical plants are driving optimism, corroborated by satellite data showing increased activity levels at several facilities.

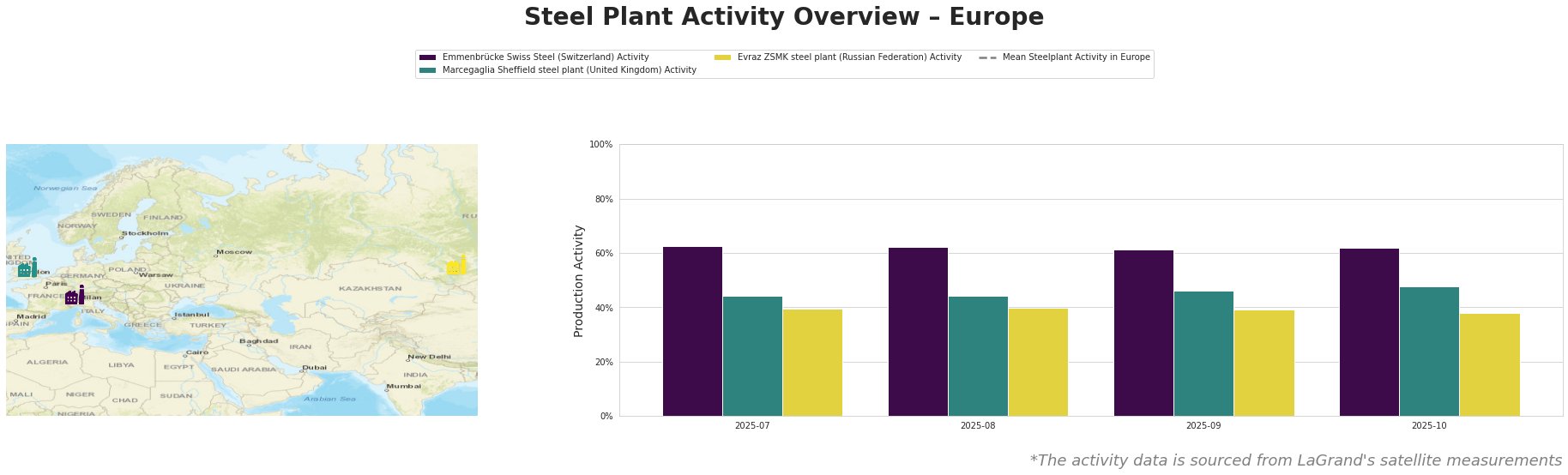

The average activity level across European steel plants has fluctuated between 61% and 63%, signaling a generally stable market. Notably, Emmenbrücke Swiss Steel has consistently maintained an activity level of 63% throughout this period, while the Marcegaglia Sheffield plant demonstrated a slight increase to 48% in October, potentially reflecting improved market conditions or operational adjustments following ongoing projects. Meanwhile, Evraz ZSMK’s activity remained lower but stable, showing no substantial deviations that could be connected to recent news.

Emmenbrücke Swiss Steel harnesses electric arc technology to produce high-quality steel, albeit lacking comprehensive operational updates that would link changes in activity to recent project news. Marcegaglia Sheffield, with a capacity of 500,000 tonnes and a focus on EAF operations, showcased a gradual increase to 48% activity coinciding with rising demand, but specific direct connections to the articles cannot be established. In contrast, Evraz ZSMK, a more traditional integrated steel producer, has seen consistent activity at lower levels, which also doesn’t correlate explicitly with the listed developments.

The resumption of operations at ArcelorMittal Fos-sur-Mer following their pre-emptive shutdown due to a fire illustrates resilience in the supply chain and an immediate boost to production levels within the region. This reinitiated capacity supports ongoing projects and customer commitments, reinforcing procurement strategies that favor responsive suppliers.

Given the significant developments, steel buyers should consider securing contracts with ArcelorMittal, especially in the aftermath of the new EAF commissioning at Belval which is expected to enhance capacity and reduce energy consumption dramatically. Additionally, firms may look to establish connections with operational plants like Marcegaglia Sheffield, which, despite recent improvements, could be candidates for increased production amidst shifting market dynamics.

In conclusion, while the overall market outlook remains very positive, procurement strategies should remain flexible to account for localized supply changes and operational upgrades, as evidenced by recent news and satellite data trends.