From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market Driven by Southeast Asian Expansion and Strong Scrap Demand

Recent developments in Asia’s steel market indicate a positive trend, particularly highlighted in the articles “Southeast Asia Steel Expansion to Bolster Regional Scrap Demand Amid Chinese Export Pressures“ and “Viewpoint: Southeast Asia to support Asian scrap market.” These pieces reveal that increasing infrastructure projects and economic recovery in Southeast Asian nations like Vietnam and Indonesia are anticipated to enhance local scrap demand, counterbalancing declines in markets such as South Korea and Taiwan.

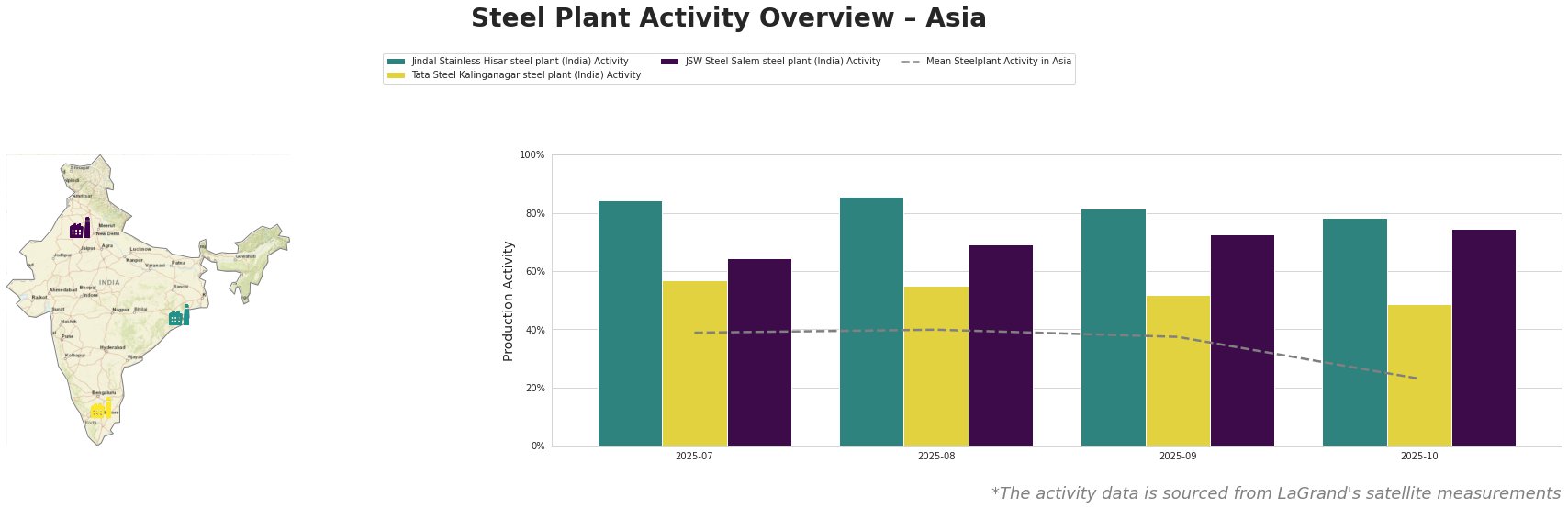

Satellite-observed activity data substantiate these insights. The mean steel plant activity across Asia decreased from 40% in August to 23% in October 2025, reflecting the fluctuating landscape. However, notable exceptions include the Jindal Stainless Hisar steel plant (India), which maintained a robust activity level of 78% in October and 86% in August, outperforming the regional mean significantly. This aligns with the positive sentiment outlined in the news articles regarding increased local production capabilities.

Jindal Stainless Hisar steel plant in Haryana, with an electric arc furnace (EAF) technology and a strong production portfolio ranging from semi-finished to finished products, reflected notable peaks in activity, aligning with increased demand for scrap (as noted in the articles).

Tata Steel Kalinganagar in Odisha displayed a decrease in activity to 49% in October from 55% in August; however, its integrated production capacity of 3,000 tons positions it strongly amidst the demand recovery in Southeast Asia, indirectly aligning with the articles’ forecast for regional growth.

JSW Steel Salem, utilizing blast furnace technology, also maintained comparatively stable activity metrics, suggesting resilience amid regional fluctuations as seen through its activity levels of 75% in October from 69% in August.

In terms of procurement recommendations, buyers should prioritize sourcing from Southeast Asian suppliers to leverage the expected scrap demand surge and avoid potential supply disruptions in markets heavily impacted by declines in production, particularly in South Korea and Taiwan. Furthermore, exploring partnerships with well-performing plants such as Jindal Stainless Hisar may lead to advantageous supply agreements, capitalizing on a matrix of growing local demand against the backdrop of international pressures, especially from China.

With the dynamic market sentiment and growth potential, actionable strategies must be rooted in these observations and aligned with industry movements to mitigate risks and capitalize on upcoming opportunities in the steel procurement landscape.