From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOptimism in Ukraine’s Steel Market: Production Stays Steady Amid Challenges

Steel production in Ukraine continues to show resilience despite facing significant market pressures, as evidenced by recent trends reported in Ukraine’s 2026 steel output may match 2025: GMK and The volume of steel production in Ukraine in 2026 may correspond to the level of 2025: GMK. Satellite observations indicate fluctuations in plant activity but project a production stabilization at around 7.2 million tonnes for 2026, capitalizing on domestic demand from defense projects and reconstruction efforts. Recent government measures like setting zero quotas for scrap exports in The government has set zero quotas for scrap exports from Ukraine for 2026 may present opportunities for local steel production to thrive.

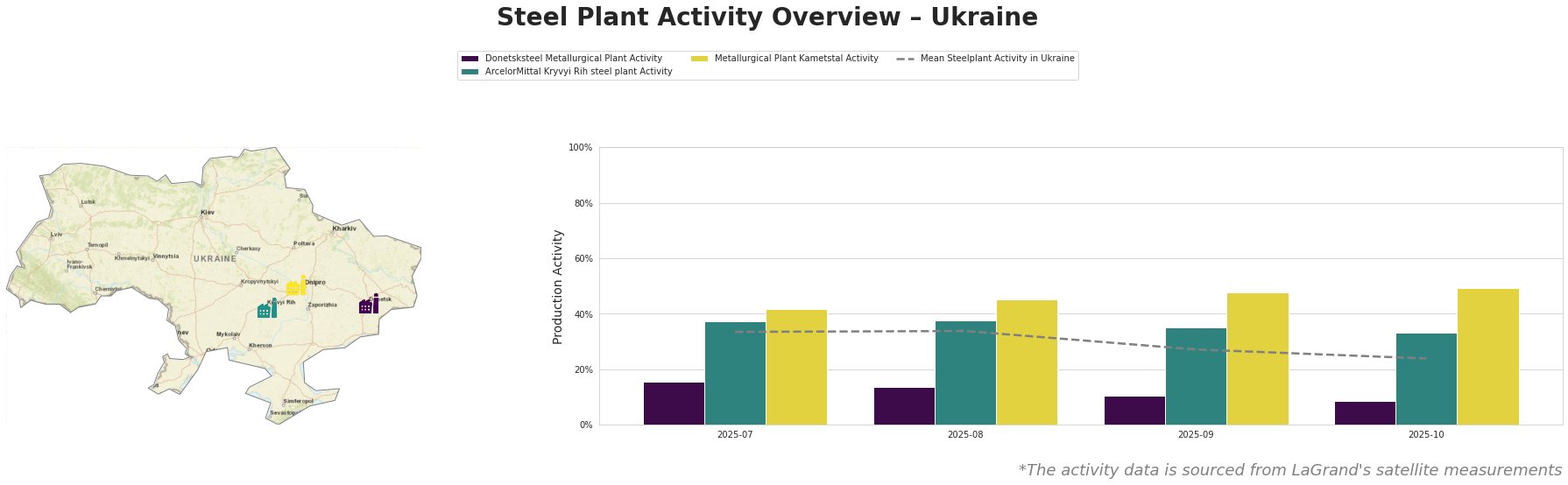

The ArcelorMittal Kryvyi Rih steel plant showed a measured peak activity of 38.0% in August, aligning with positive sentiments around potential domestic market boosts. However, the activity dipped to 33.0% by October amidst broader market issues, including risks from EU carbon regulations. Notably, Metallurgical Plant Kametstal exhibited robust performance, peaking at 49.0%, signaling effective operational resilience. In contrast, Donetsksteel faced consistent low activity, dropping to 9.0%, indicating operational challenges that may not have a direct correlation with the recent news developments.

ArcelorMittal Kryvyi Rih, with a robust production capacity of 8 million tonnes, likely benefits from heightened domestic demand for semi-finished goods in response to the government’s planned infrastructure investments, as articulated in the linked news articles. The plant’s production activity remains pertinent for supply chain stability as Ukraine navigates external pressures.

In response to potential supply disruptions from decreased activities at Donetsksteel and regulatory challenges, steel buyers should consider securing agreements and establishing local sourcing initiatives with high-activity plants like ArcelorMittal Kryvyi Rih and Kametstal. These plants are well-positioned to meet increased demand from domestic reconstruction projects while mitigating risk associated with EU market constraints highlighted in Ukraine’s 2026 steel output may match 2025: GMK.