From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America’s Steel Market Outlook: High Activity Amid Strong Demand Drivers

Steel activity across South America displays a very positive market sentiment, primarily influenced by recent developments in Brazil’s biodiesel and asphalt sectors, as noted in the articles “Viewpoint: Brazil likely to delay biodiesel blend hike” and “Viewpoint: Brazil’s asphalt demand to grow in 2026.” These reports indicate major adjustments in production and demand forecasts, which correlate with observed activity shifts in regional steel plants.

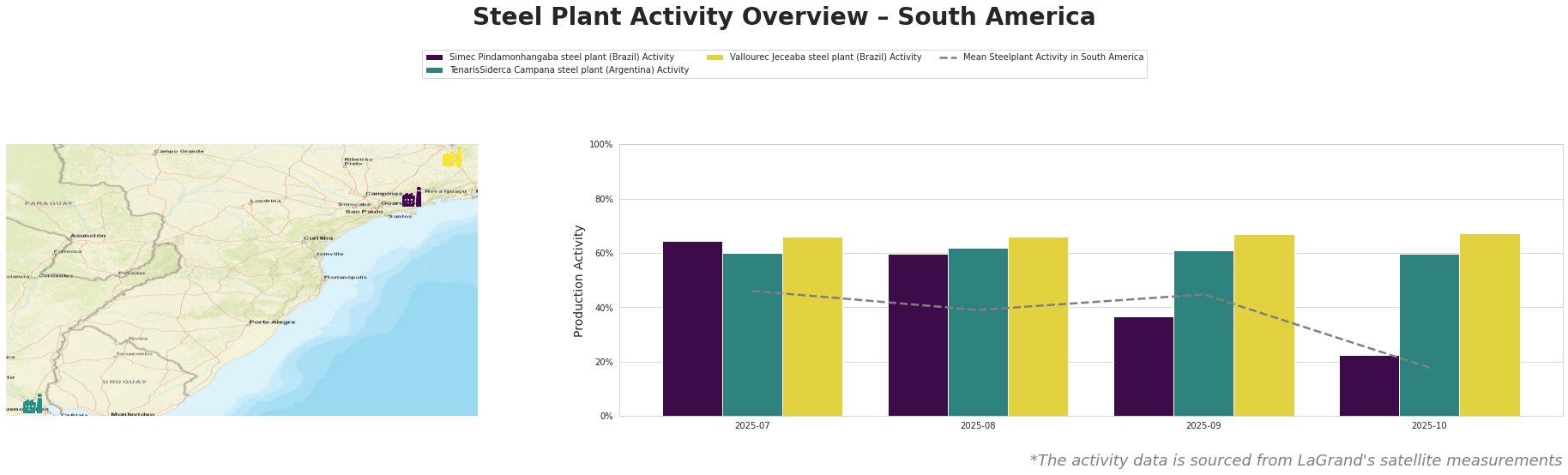

Recent satellite data highlights fluctuating activity levels:

The data reveals that while the mean steelplant activity experienced a significant drop to 18% in October, Simec Pindamonhangaba’s and Vallourec Jeceaba’s activities declined steeply to 23% and 67%, respectively. This contrast signals that while Vallourec maintains steady operational levels, Simec Pindamonhangaba faced notable setbacks.

Simec Pindamonhangaba, located in São Paulo, operates a significant EAF-focused plant with a crude steel capacity of 500,000 tons. Activity peaked at 65% in July, aligning with bullish sentiment in market conditions; however, it fell sharply post-September, with no clear linkage to recent news arising around biodiesel or asphalt demand forecasts. This drop, thus, remains isolated.

TenarisSiderca Campana saw stable production levels characterized by a responsive operation focused on seamless pipes critical for the energy sector. Activity levels hovered between 60% and 62% until October when it held at 60%, suggesting resilience amidst the overall decline in the market. The increase in asphalt demand tied to infrastructure spending may indirectly bolster future orders for construction-grade steel products, particularly relevant in upcoming election cycles.

Vallourec Jeceaba, with a crude steel capacity of 1 million tons, consistently performed at around 66% in recent months, demonstrating strong adaptability to market fluctuations influenced by energy sector demands. The continuity of high activity levels suggests a robust operational framework, potentially opening procurement avenues to mitigate any shortfalls in other plants.

As the demand for asphalt is projected to grow influenced by government expenditure (as noted in “Viewpoint: Brazil’s asphalt demand to grow in 2026”), buyers should specifically increase procurement from Vallourec and TenarisSiderca, which indicate market resilience and maintain output capabilities amidst logistical challenges.

Given the anticipated rises in freight costs and logistical challenges highlighted in “Viewpoint: Brazil freight rates rise on record soy crop,” it is prudent for buyers to secure steel purchases ahead of these rising rates to maintain profit margins and ensure supply stability against potential bottlenecks.