From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for South American Steel Market: Key Insights from Recent Activities and Regulatory Changes

The South American steel market is exhibiting positive momentum, driven by recent developments in Brazil and Argentina. The articles Viewpoint: Brazil gasoline auctions set market tone and Viewpoint: Argentina edges toward fuel export status highlight regulatory shifts impacting local production dynamics and energy consumption, which in turn may influence steel production activities.

In Brazil, while gasoline imports surge as a result of a refinery shutdown, no direct correlation with steel plant activity is established. Conversely, Argentina’s transition towards fuel export status indicates a reshaping of its market, which could enhance regional steel demand as refineries move toward full capacity.

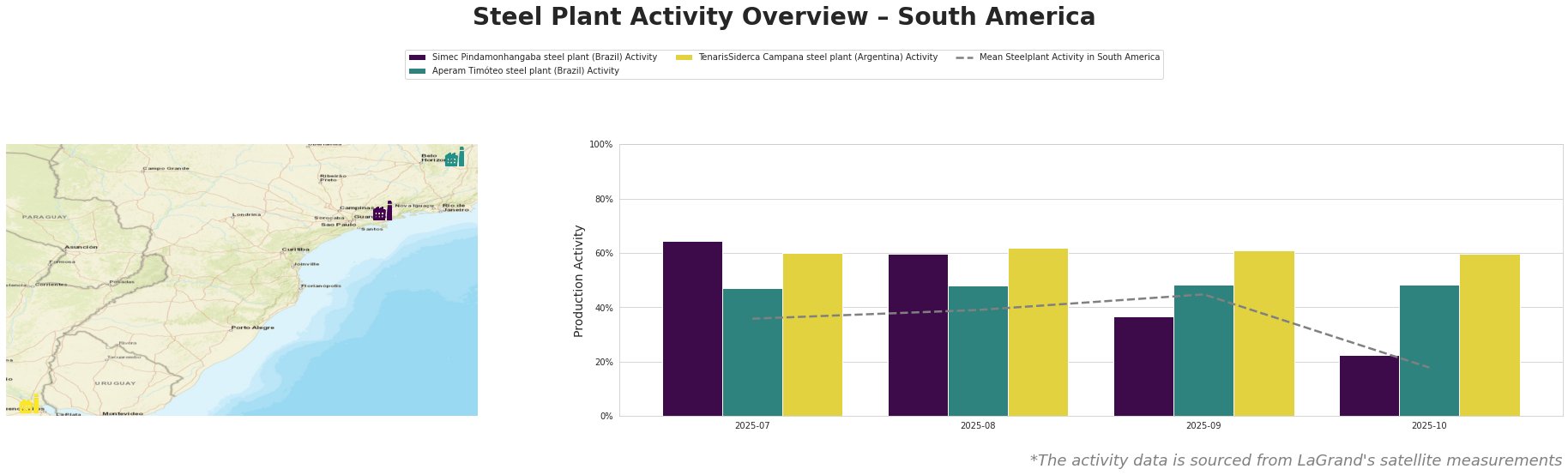

Simec Pindamonhangaba in Brazil displays notable activity fluctuations, peaking at 65.0% in July before a drastic drop to 23.0% by October. This drop may connect to changes in underlying fuel pricing mechanics due to regulatory effects noted in Viewpoint: Brazil gasoline auctions set market tone, although no direct linkage was substantiated. Aperam Timóteo’s activity remains relatively stable, peaking at 62.0% in October. TenarisSiderca Campana experienced a slight dip in October but maintained consistent activity levels, showcasing resilience amidst external pressures.

Simec Pindamonhangaba’s activity metrics reflect operational adjustments, coinciding with the regulatory shifts impacting fuel prices and, indirectly, steel production costs. Conversely, Aperam’s stable operations indicate that existing market conditions allow for consistent production without significant alterations in input costs. TenarisSiderca’s minor activity fluctuation reflects ongoing dedication to energy optimization with its integrated DRI and EAF processes.

In evaluating market implications, the positive trajectory in production capabilities across these selected plants suggests potential stability in steel supply, especially as Argentina’s energy policies promote increased refining output. Steel buyers should closely monitor Simec’s output volatility as it may represent strategic procurement opportunities. For procurement professionals, leveraging areas of stable output at Aperam and TenarisSiderca to secure contracts could mitigate risk amid fluctuating market conditions.

The observed regulatory shifts and production trends signal a favorable environment for steel buyers to anticipate a tightening market with potential upward pricing pressure, particularly if energy reforms lead to enhanced fuel availability and production efficiencies across the region. Engaging with suppliers to lock in favorable agreements in anticipation of improved demand levels is advised.