From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Activity in European Steel Market: Shifts in Production and Plant Performance

Recent developments in the European steel market reveal a neutral sentiment shaped by production declines in key countries. Specifically, France reduced steel production by 13.6% m/m in November, primarily due to a fire at ArcelorMittal’s Fos-sur-Mer facility, which significantly affected output. Simultaneously, Italy’s steel production returns to decline in November after four months of growth, while German crude steel output down 9.3% in Jan-Nov 2025 indicates challenges in maintaining sustainable production levels. These developments have led to observable variations in satellite-monitored activity among several steel plants throughout Europe.

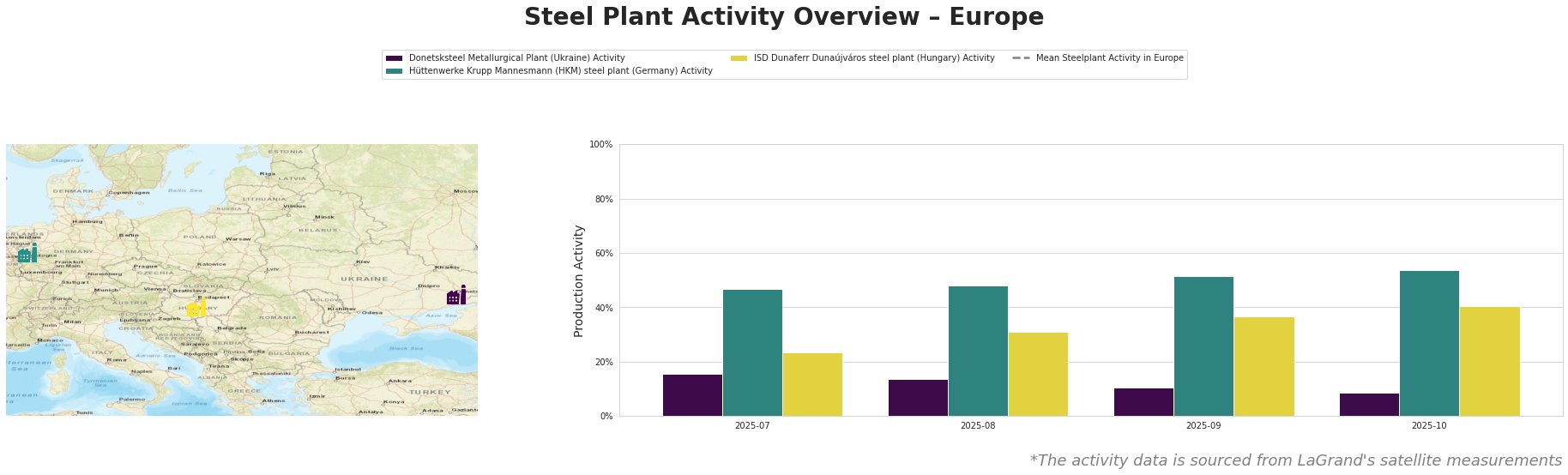

The overall observed activity across the region has seen a downward trend. The Donetsksteel Metallurgical Plant in Ukraine has experienced a notable decline, with activity dropping from 16% in July to merely 9% by October, reflecting ongoing regional instability and operational challenges. In contrast, the Hüttenwerke Krupp Mannesmann (HKM) steel plant maintained some consistency despite high import pressure and logistical issues, reported at 54% in October—a significant rise from the preceding months. However, the ISD Dunaferr Dunaújváros steel plant displayed a more stable performance with activity levels increasing from 23% in July to 40% by October.

Despite these internal fluctuations, there isn’t a direct connection between the satellite data and the recent news regarding production declines in France and Germany. No explicit relationships were noted linking the performance drops in individual plants to the disruptions reported in the articles.

The decline in French production emphasizes potential supply disruptions, particularly given that France’s production capacity stands at 12.09 million tons, which could lead to increased demand for steel from alternative suppliers. Steel buyers should closely monitor the Hüttenwerke Krupp Mannesmann (HKM) which shows resilience amid the emerging supply issues, while also considering the ISD Dunaferr plant as a stable supplier option. Strengthening relationships with these plants can mitigate risks associated with supply shortages originating from the French and German markets.

Given the situation, steel procurement strategies should be adjusted to focus on flexible sourcing options that take into account regional disruptions, especially prioritizing suppliers with a proven track record of maintaining production during volatile periods.