From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook for Argentina: Demand Recovery Ahead with Production Gains

Argentina’s steel market is showing signs of improvement, buoyed by anticipated demand recovery as noted in the articles “Viewpoint: Steel demand in Argentina will recover“ and “Viewpoint: Argentina steel demand to rebound.” The former discusses the optimism surrounding a 13% projected increase in steel consumption in 2026, driven by significant government investments in infrastructure and energy projects, notably in the Vaca Muerta shale deposits. Meanwhile, recent satellite-observed activity highlights a 10.7% rise in steel production as per “Steel production in Argentina increased, cast iron decreased in November,” supporting this positive sentiment.

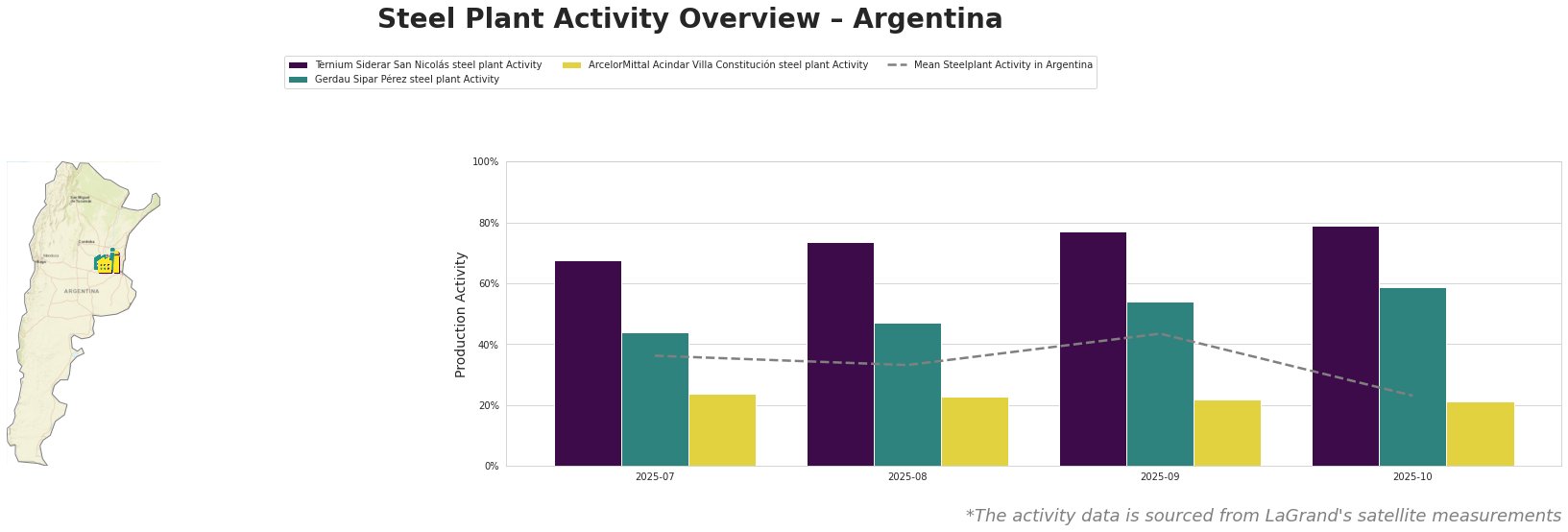

Recent activity levels indicate that Ternium Siderar San Nicolás maintains consistently high activity, peaking at 79% in October, well above the mean of 23% across all plants. This aligns with “Steel production in Argentina increased”, showcasing a robust production capability primarily aimed at supporting key sectors like automotive and construction. Gerdau Sipar Pérez demonstrated notable activity at 59% in October, benefiting from increased demand for rebar and finished products, though still influenced by economic conditions. ArcelorMittal Acindar Villa Constitución remains lower in activity, peaking at 22%, reflecting reduced demand and economic pressures primarily seen in the automotive sector, as discussed in “Argentina steel output up, iron down in Nov.”

Ternium Siderar’s production aligns well with the positive projections indicated by the articles, particularly “Viewpoint: Steel demand in Argentina will recover”. Gerdau Sipar’s activity gain can be correlated with its strategic positioning in infrastructure and construction markets, also backed by upcoming demand increases. Conversely, no direct relationship could be established for ArcelorMittal’s activity reductions, as the article highlights broader sectoral challenges.

Given the upcoming demand recovery anticipated in 2026, procurement professionals should consider tightening supply chains by securing contracts with Ternium Siderar, where production stability seems assured. Monitor Gerdau Sipar’s output closely as production aligns well with increased construction activity, making it a critical player. Conversely, caution is advised when dealing with ArcelorMittal, whose reduced activity reflects greater exposure to economic downturns and might limit supply availability. The anticipated increase in steel imports could disrupt local supply chains, necessitating proactive engagement with trusted local suppliers to mitigate risks.