From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Update: Scrap Export Surge and Stable Production Outlook Amid Activity Fluctuations

Recent trends in Ukraine’s steel market have been influenced by critical developments in both scrap exports and steel production levels. The articles titled “Scrap exports from Ukraine increased by 45% y/y over 11 months“ and “Ukraine’s Scrap Exports Rise by 45% In January–November 2025“ indicate a significant year-on-year increase in scrap exports, which may affect local supply chains and production capacities negatively. However, steel production is projected to stabilize at approximately 7.2 million tons in 2026, as reported in “The volume of steel production in Ukraine in 2026 may correspond to the level of 2025: GMK.”

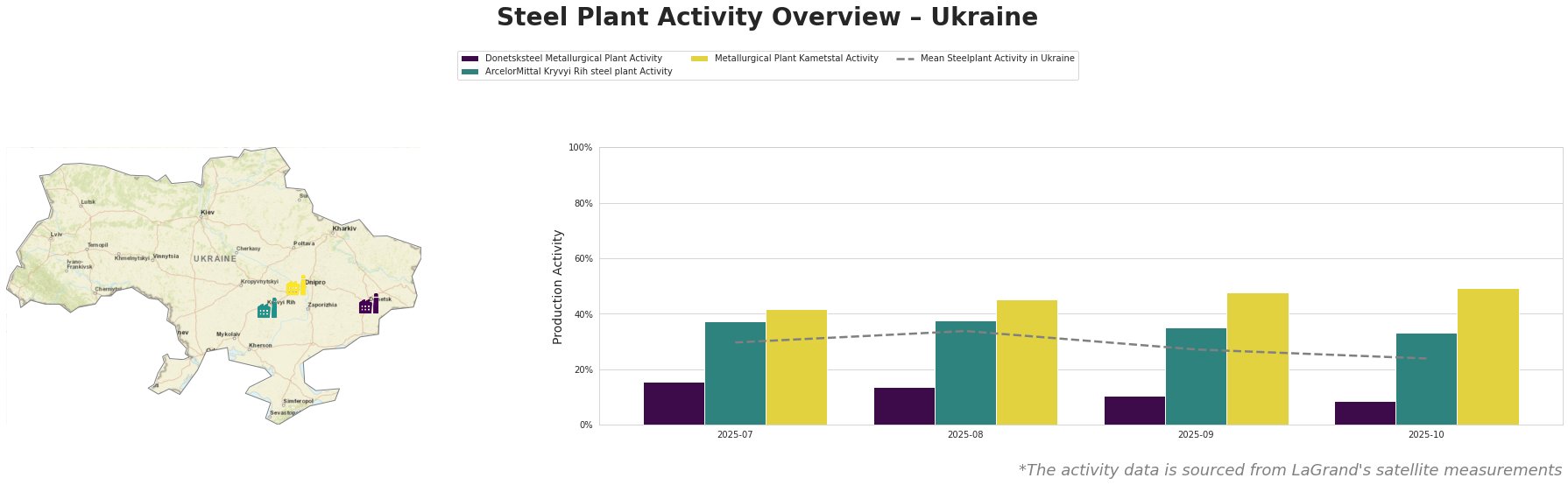

Satellite observations show that the activity levels of major steel plants in Ukraine have experienced notable fluctuations. The general activity remains at a mean of 24.0% to 34.0% during the last four months of 2025.

Donetsksteel Metallurgical Plant has been struggling, exhibiting declining activity, from 16.0% in July to 9.0% in October, correlating with challenges in raw material supply and a reduced workforce. The connection to rising scrap exports could exacerbate local shortages. ArcelorMittal Kryvyi Rih’s activity also shows a downward trend, from 37.0% to 33.0%, aligning with the challenges highlighted in the news, particularly concerning operational constraints tied to maritime logistics and European market restrictions. Kametstal has sustained higher activity levels, peaking at 49.0%, rationalized by increased domestic demand and a stable operational framework.

The increase in scrap exports suggests potential supply disruptions for local steel production due to diminishing domestic scrap availability, impacting production outputs at Donetsksteel and possibly influencing overall market prices. Therefore, steel buyers and market analysts should consider the following recommendations:

- Monitor incoming policy changes related to scrap exports beginning in 2026, as licensing and quotas could restrict access to essential raw materials.

- Diversify scrap supply sources, especially given the current upward trend in exports; procurement strategies should factor in rising competition and potential raw material shortages.

- Engage with producers like Kametstal, which maintain operational efficiency, to secure contracts that may leverage their strong production metrics amidst a potentially tightening market.

The interconnectedness of market conditions and plant activity underscores the necessity for proactive procurement strategies in a neutral but shifting environment.