From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Outlook: Stable Activity Yet Uncertainty Amid Economic Pressures

Recent reports indicate a slowdown in the Asian steel market, particularly impacting Japan and regional dynamics in the face of economic challenges. Notably, “Japan’s Steel Exports Down 3.8% In January–November 2025“ and the “Viewpoint: Southeast Asia to support Asian scrap market“ highlight these troubling trends accompanied by changes in observed activity levels at steel plants across the region.

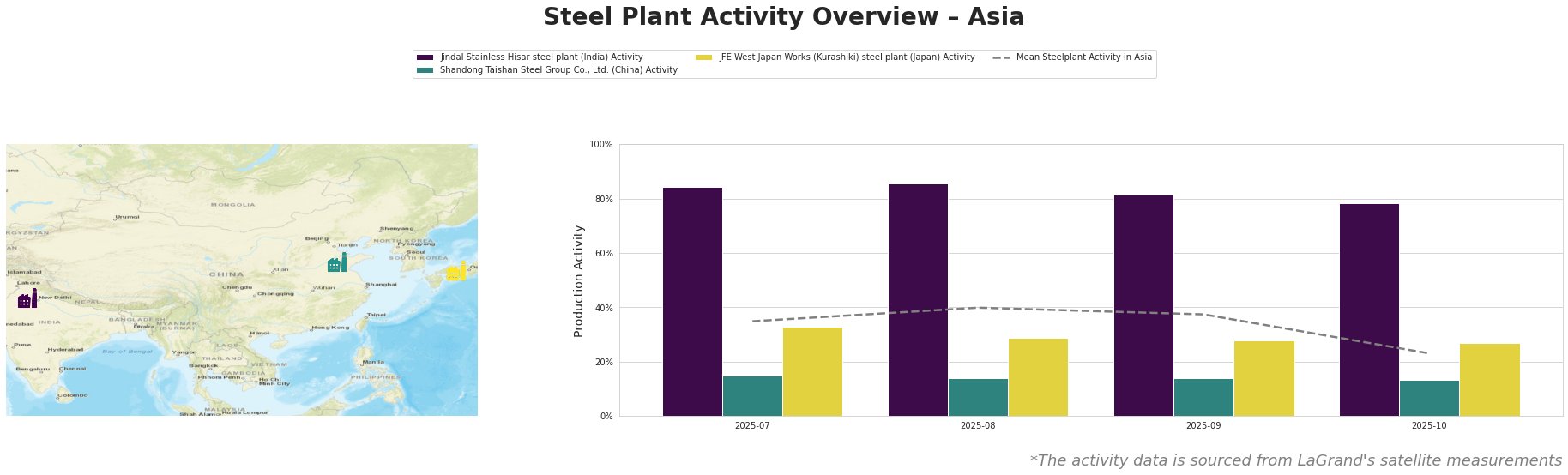

As Japan’s exports fell significantly—down 3.8% with a notable decrease in scrap demand from markets like Vietnam—the satellite-observed activity levels of key plants have been affected. For instance, the activity at the JFE West Japan Works plant displayed a progressive decline from 33% in July to just 27% by October 2025, aligning with the drop in export volume and reinforcing concerns about a sluggish domestic market.

The Shandong Taishan Steel Group in China has also shown diminished activity, hitting a low of just 14% throughout this period, which corresponds with increased competition from both local and international players. This low demand scenario has been exacerbated by the fallout from high tariffs in North America detailed in “Viewpoint: US steel tariffs cause scrap supply glut“, although no direct link could be made regarding its impact on Asian plant activity levels.

Conversely, the Jindal Stainless Hisar plant in India maintained a relatively better performance, showing consistent activity levels upwards of 78% in October, reflecting potential resilience amid regional declines. This resilience could be attributed to domestic demand stemming from infrastructure projects, as noted in “Viewpoint: Southeast Asia to support Asian scrap market.”

The observed trends at these key plants suggest potential supply disruptions, especially from Japan and Shandong, where recent performance drops could impact delivery timelines and pricing structures. For procurement professionals, it is recommended to consider ramping up orders from Indian sources like Jindal Stainless, as their high operational activity indicates readiness to meet local demand. Additionally, monitoring shifts in the Southeast Asian market—particularly from Vietnam and Indonesia—may open alternative supply avenues amidst the operational strains in Japan and China.

In conclusion, while the sentiment remains neutral across the broader Asian market, active steel procurement strategies need to pivot towards regions showing resilience and potential growth, specifically targeting Jindal Stainless and closely following developments in Southeast Asia to mitigate risks associated with stalled production and exports.