From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Demand Drives Positive Steel Market Outlook in China: Activity and Supply Insights

Recent satellite observations indicate a warming steel market in China, evidenced by significant activity at major steel plants. The article China’s Silver Export Curbs Trigger Global Supply Fears As Prices Surge (published December 29, 2025) outlines how the tightening supply of silver due to China’s export policies has heightened industrial demand, directly linking to increased operational levels in steel production facilities. Despite this, no explicit connections were found regarding changes in activity levels in all observed plants from the news articles.

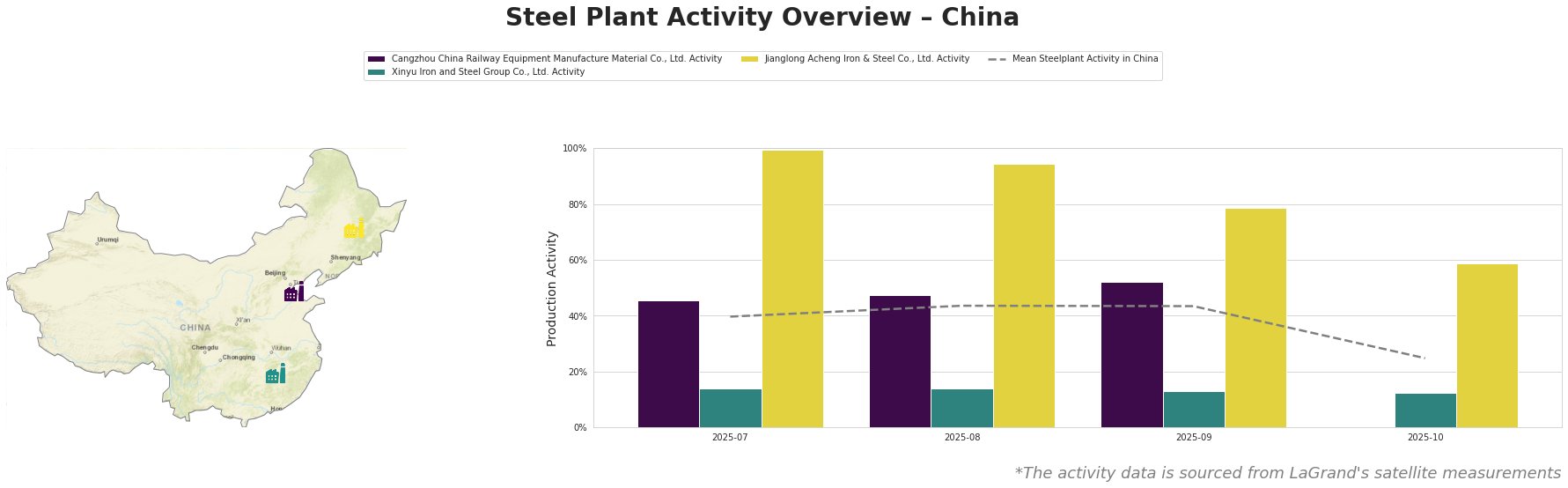

Cangzhou China Railway Equipment Manufacture Material Co., Ltd. shows a modest activity increase from 45.0% in July to 48.0% in August, ultimately peaking at 52.0% in September. This reflects a stable production environment possibly enhancing their capacity to meet rising demands highlighted in Musk warns on record silver prices amid China supply fears (December 29, 2025), which suggests a tighter market for essential materials including silver used in steel production.

Xinyu Iron and Steel Group Co., Ltd. has been less stable, decreasing to 12.0% activity by October, down from January levels, potentially signaling falling market confidence or operational challenges. This decline reflects concerns raised in Silver Pulls Back From Record After Historic Rally Above $80 (December 29, 2025), where high material costs affect production viability. Jianglong Acheng Iron & Steel Co., Ltd. shows a consistent high at 100.0% in July, marking it as pivotal for production flows despite a subsequent drop to 59.0% in October, aligning with observed demand inconsistencies linked to the recent silver market volatility.

Given these developments, steel buyers should anticipate potential supply disruptions particularly from Xinyu, where production levels are alarmingly low. It would be prudent for procurers to strategize and lock in orders with Cangzhou, whose rising activity suggests capacity to fulfill orders amidst anticipated spikes in demand linked to industrial sectors reliant on high-quality steel products. Conversely, monitoring Jianglong for fluctuations is advised, ensuring that supply chains remain agile to adapt to ongoing market conditions influenced by the upstream silver prices and policy changes.