From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Analysis – Neutral Sentiment Amidst Price Volatility and Export Adjustments

Steel prices in Asia are observing a neutral market sentiment as recent developments in India indicate a decline in hot-rolled coil (HRC) prices. The articles titled “Oversupply, rains drag Indian HRC prices lower in 2025“ and “Oversupply and rains will lead to lower prices for HRC in India in 2025“ highlight how excessive production and the impact of monsoon rains have drastically reduced prices from 51,630 rupees per ton in May to 45,775 rupees by December. This reflects increased domestic output and insufficient demand, leading to high inventories and aggressive export strategies.

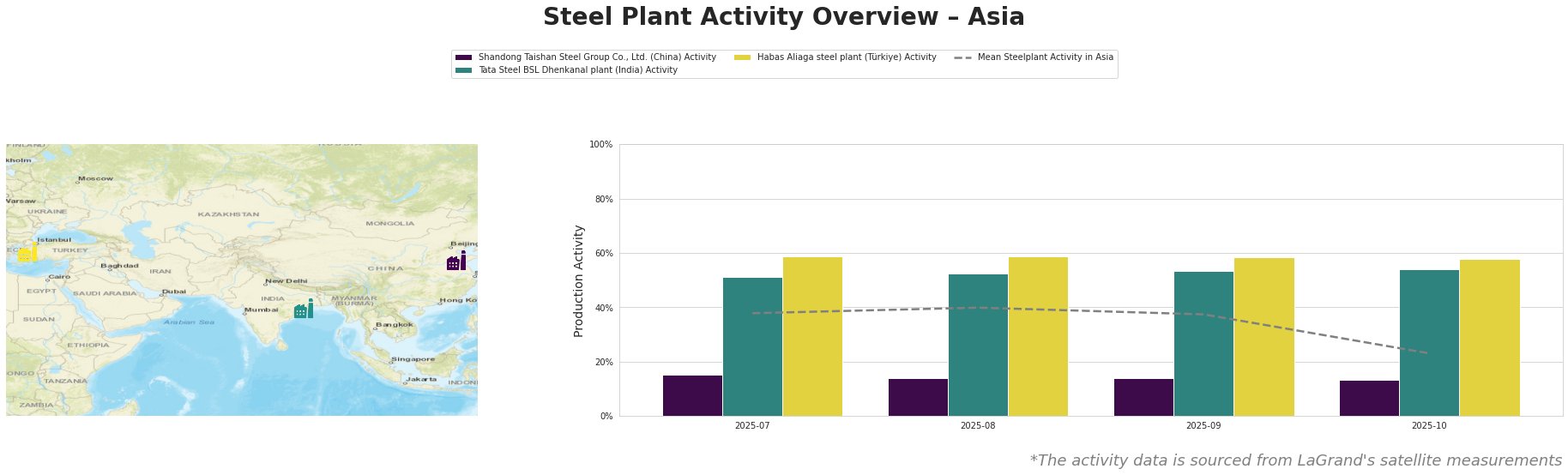

The satellite observations indicate that overall activity in Asian steel plants is declining, with the mean activity dropping from 38.0% in July to 23.0% in October. Notably, Shandong Taishan Steel Group experienced a significant drop from 15.0% to 13.0%, correlating with the downturn in HRC prices and excess supply as mentioned in “India increased steel exports by 31% y/y in April-November“. Despite this decline, Tata Steel’s Dhenkanal plant has maintained relatively stable operations around 53%, reflecting its strategic positioning amidst Indian producers’ search for international opportunities.

The Habas Aliaga steel plant has consistently shown high activity levels, remaining near 59.0%, suggesting robust production capabilities despite a challenging market influenced by rising competitive pressures from imports, particularly from India and China.

Disruption risks remain, especially for producers like Shandong Taishan Steel, given its declining activity and dependency on domestic demand dynamics influenced by excessive supply. Steel buyers are recommended to closely monitor export trends and pricing in India, leveraging potential lower costs under the current inventory pressures while being aware of the competitive landscape cluttered with aggressive pricing strategies.

Procurement strategies should incorporate hedging against further price volatility while exploring diversified sourcing options, particularly from India, as they adjust to external market pressures and regulatory developments stemming from the anticipated Carbon Border Adjustment Mechanism (CBAM) in 2026.