From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trend in Ukraine’s Steel Market: Prompted by Increased Exports and Plant Activity

Recent analyses indicate a rejuvenation in Ukraine’s steel market, particularly in long product exports, highlighted by the news title “Ukraine increased exports of long products by 43% y/y in January-November.” This increase correlates with observed satellite data suggesting heightened activity at various steel plants, notably in November 2025, where production rose by 18.5% year-on-year yet experienced a slight monthly decline.

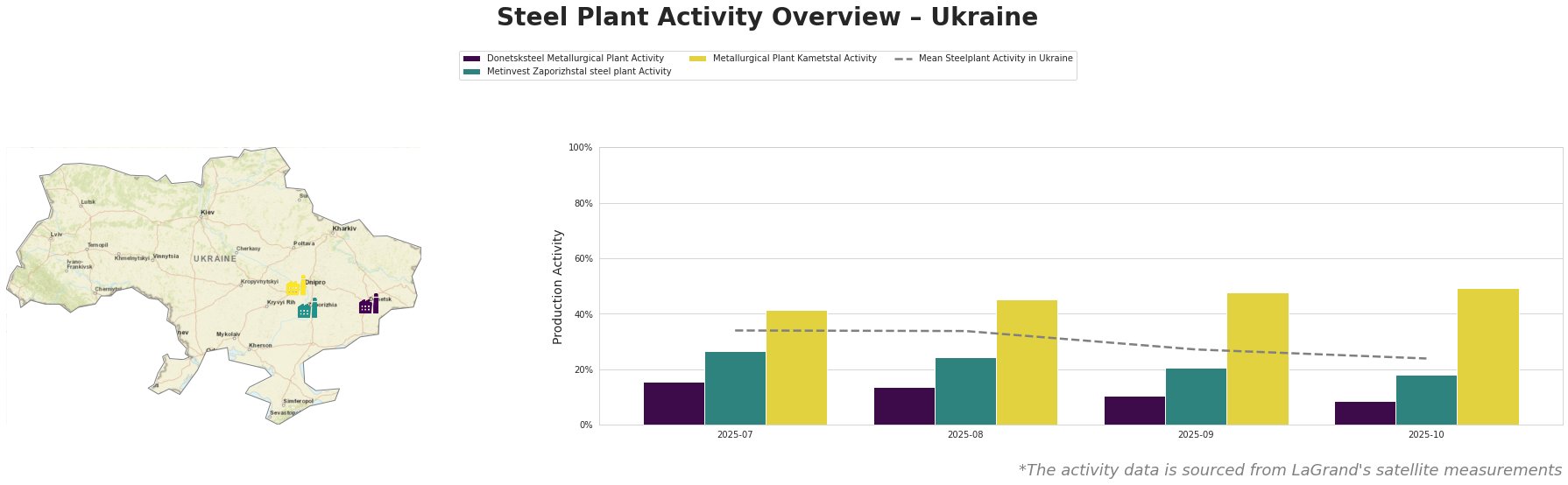

Measured activity across selected steel plants showcases a notable decrease in the Donetsksteel Metallurgical Plant, which recorded a peak activity level of only 16% in July 2025, dropping to a mere 9% by October 2025. In contrast, the Metallurgical Plant Kametstal showed resilience, fluctuating between 41% and 49% during the same timeframe. This aligns with the growing export figures, affirming an optimistic projection for the plant’s capacity utilization in the upcoming months. Metinvest Zaporizhstal, despite a drastic production fall in recent months, remains foundationally stable, critical for fulfilling domestic demands as mentioned in the article “Steel production in 2026 may remain at 7.2 million tons – GMK Center forecast.”

At Donetsksteel, the inactivity correlates with a lack of recent investment or repairs, indicated by the cessation of operations in significant machinery. The factory has shifted to a minimal output of pig iron. Meanwhile, Metinvest Zaporizhstal, with potential shifts to domestic construction projects, could benefit from a stable workforce and diversified product lines. Kametstal’s sustained activity amidst global production downturns reflects its adaptive mechanisms to retain output levels.

Considering the developing trends, steel buyers should focus on procuring long products, harnessing the anticipated increase in demand driven by rising exports, particularly to the EU, as stated in “Ukraine increased imports of long rolled products by 51% y/y in January-November.” Additionally, the potential introduction of tougher regulations such as the CBAM could significantly affect import levels, urging buyers to secure supplies before full regulation impacts become evident.

In conclusion, stakeholders are advised to monitor production metrics closely and engage with active suppliers like Kametstal while preparing procurement strategies that accommodate fluctuating domestic and international market demands. Understanding the intricacies of plant activity will be critical in navigating potential supply disruptions.