From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market: Activity Rises Amid Stable Demand Conditions

In Asia, recent satellite data indicates a positive shift in steel plant activities, driven by promising market dynamics. Reports such as “Viewpoint: Policy delays refocus US SAF industry“ and an increasing production rate suggest a favorable environment for steel manufacturers and buyers alike. Notably, the satellite observations reveal enhanced operational levels at key plants, aligning well with the optimistic sentiment reflected in policy discussions.

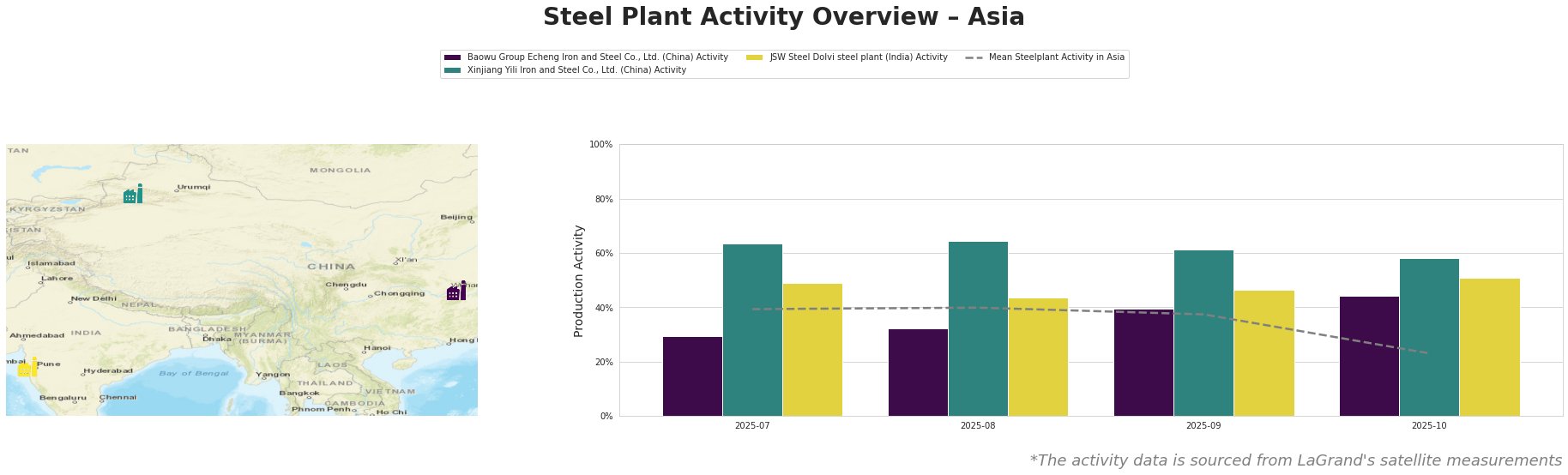

All observed plants exhibited variability in activity levels, with Baowu Group Echeng Iron and Steel Co., Ltd. showing the most significant recent increase to 44% activity in October, up from 29% in July. In contrast, the mean activity level dropped to 23% in October, spotlighting the fluctuations in the market. Xinjiang Yili Iron and Steel Co., Ltd., hovering around 58% activity, continues to be a significant contributor to the regional steel output. Meanwhile, JSW Steel Dolvi has stabilized activity around the mid-40s percent range, suggesting consistent demand.

Baowu Group’s rise in activity is notable, with operations climbing from 32% to 44% in September and October. However, no direct connection to recent news articles could be established for this increase.

Xinjiang Yili Iron and Steel Co., Ltd. operates at a commendable 58% activity level, benefiting from steady domestic demand as seen in the positive implications of the “Viewpoint: Tax credits will shape US ethanol market“. While direct linkages are not explicitly stated, shifts in policy may influence regional market conditions indirectly.

JSW Steel Dolvi, with operations reflecting 51% activity, may also experience favorable procurement terms, especially as stabilization in the steel price trend is suggested by potential increases in federal mandates influencing supply chains, as heedfully noted in “Viewpoint: Policy delays refocus US SAF industry.”

As activity levels stabilize, buyers should consider locking in current pricing with Baowu and JSW, as both plants are indicative of an optimistic supply outlook. The current upward trajectory in plant activity suggests that procurement professionals should proactively secure orders to avoid potential supply disruptions stemming from fluctuations in activity or changes in market policies.

In conclusion, the ongoing positive sentiment in Asia’s steel market, backed by notable operational shifts and supportive news articles, presents an encouraging landscape for buyers to act decisively.