From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine’s Steel Industry Shows Resilience with 43% Export Surge and Steady Production Amid Global Decline

Ukrainian steel manufacturing has demonstrated remarkable resilience, as “Ukraine increased exports of long products by 43% y/y in January-November“, signaling a robust recovery. This is further underpinned by activity data indicating varying trends across key steel plants, particularly as “Steel production in 2026 may remain at 7.2 million tons – GMK Center forecast“ illustrates nearing production capacity limits amidst European market uncertainties.

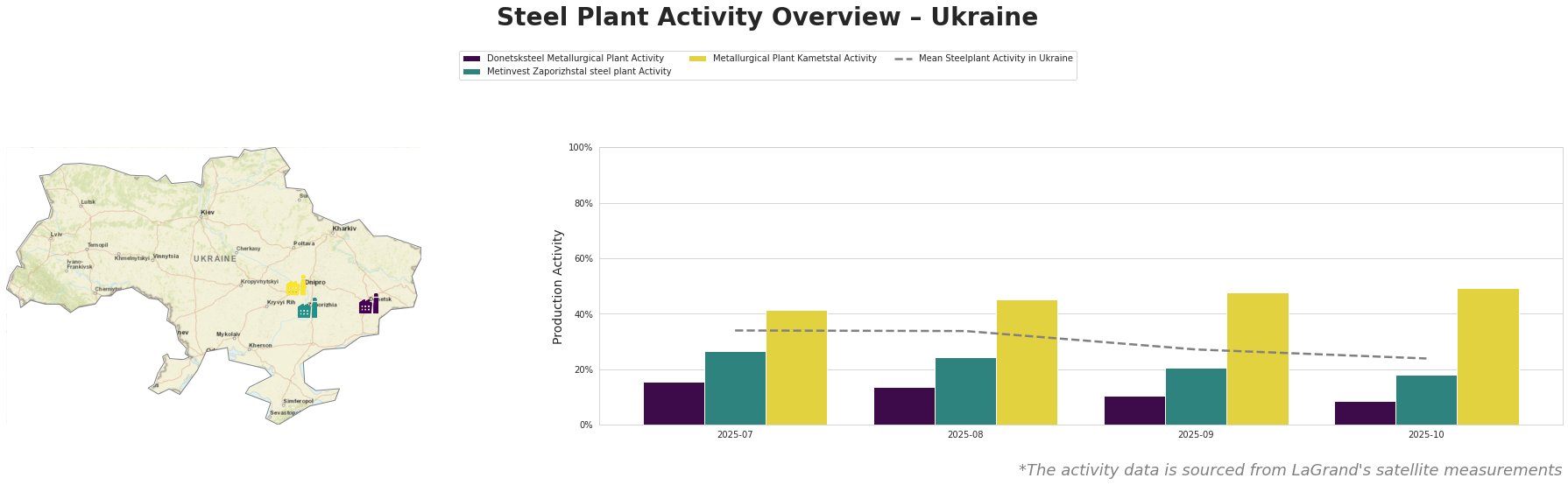

Activity levels in Ukrainian steel plants reflect significant differences, particularly with Kametstal, which peaked at 49% in late October, significantly above the mean of 24%. Conversely, Donetsksteel has consistently shown low activity, with a 14% drop observed from July to October, potentially highlighting operational challenges that may not directly link to market conditions. The overall drop in the mean activity level towards October aligns with concerns raised in “Steel production in 2026 may remain at 7.2 million tons – GMK Center forecast”, where limited capacity and production forecasts suggest potential struggles.

At Donetsksteel, activity remains low, with the plant barely operating amidst operational constraints and shutdowns of key facilities. Notably, it recorded a steep decline in activity to 9% by October, reflecting significant operational challenges. These drops could impact its capacity to contribute to rising export figures, such as the 43% increase in long product exports.

Metinvest Zaporizhstal shows a more positive trend with stable outputs but still falls below optimal levels, as evidenced by its low October activity at 18%. Despite these setbacks, the plant remains a key player in the country’s export landscape, serving critical sectors.

Kametstal’s strong performance, peaking at 49%, signals its capability of meeting rising domestic and export demand for semi-finished and finished products, aligning with the notable increase of 32.7% in earnings reported in the long-term product export sector.

Ukrainian steel buyers should closely monitor these plants, emphasizing Kametstal for procurement due to its optimal operational performance and product range suited for both domestic needs and export opportunities. However, procurement strategies must account for potential disruptions caused by erratic activity levels at Donetsksteel and the underlying challenges in securing reliable sourcing from the domestic market as highlighted by “Ukraine’s Scrap Exports Rise by 45% In January–November 2025“.

Strategically, buyers are advised to diversify sourcing options while prioritizing procurement from plants with stable production capabilities like Kametstal, ensuring minimal exposure to the potential volatility in Donetsksteel’s output.