From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Trends in Asia: Opportunities for Buyers Amid Recovery Signals

The Asian steel market is witnessing a positive shift, particularly driven by recent developments in India, as highlighted in “India increased steel exports by 31% y/y in April-November“ and “The Indian government will increase its focus on steel industry and raw material security.” This optimism coincides with satellite-observed data indicating significant fluctuations in plant activities, notably a drop in Shandong Taishan Steel Group Co., Ltd., suggesting localized adjustments in production.

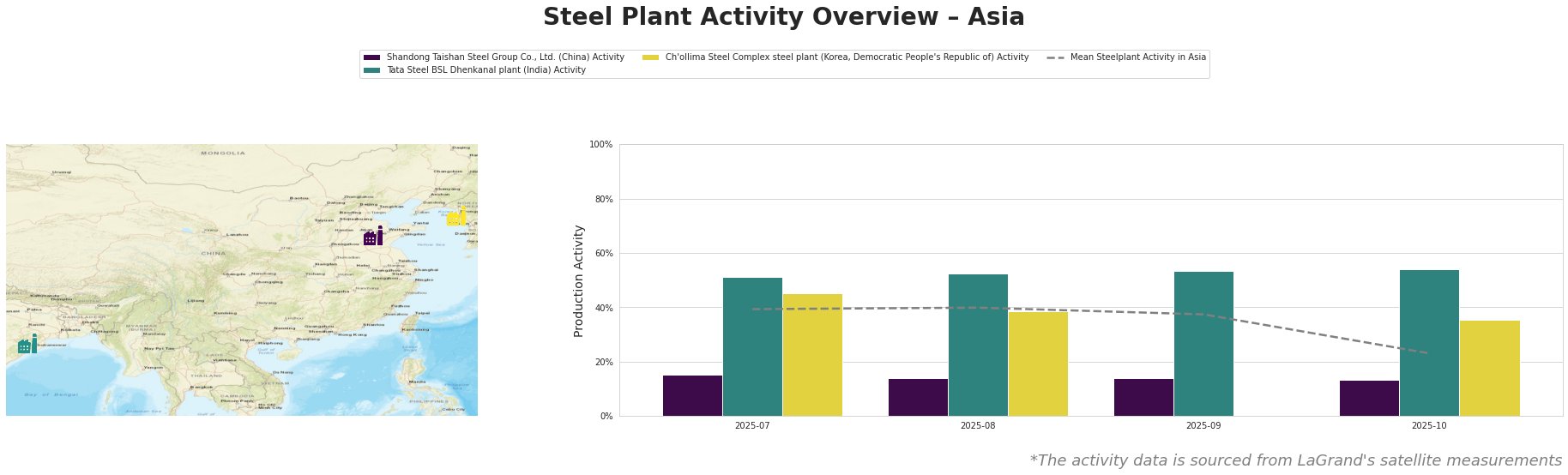

In July 2025, the mean activity level across observed plants was at 39.0%, with Shandong Taishan Steel Group Co., Ltd. showing the lowest activity at 15.0%. By October 2025, this figure plummeted to 23.0% for mean activity, indicating a concerning trend. In contrast, Tata Steel BSL Dhenkanal maintained a relatively higher activity, peaking at 54.0%. These observations appear linked to the forecast by Fitch Ratings expects global steel market to recover in 2026, highlighting a planned moderation in production from China’s steel sector due to government regulations.

Shandong Taishan Steel Group Co., Ltd.

This plant in Shandong, producing finished rolled products primarily through integrated processes, observed a notable decline in activity from 15.0% in July to 13.0% by October. The decrease correlates with forecasts of reduced steel consumption in China, as emphasized in “Rolled steel consumption in China will fall by 5.4% y/y in 2025 – forecast.” As China navigates significant construction sector challenges, the low activity levels at Shandong may signal a strategic response to lower demand.

Tata Steel BSL Dhenkanal plant

In contrast, Tata Steel BSL in Odisha reported activity levels growing from 51.0% in July to 54.0% in October, registering resilience amid broader market challenges. This uptick points to effective strategic alignment with Indian government initiatives aiming to bolster steel production capacity and secure raw material sources, as highlighted in “The Indian government will increase its focus on steel industry and raw material security.” Increased domestic demand and a push toward exports could suggest opportunities for buyers focusing on Indian-generated steel products.

Ch’ollima Steel Complex

The activity levels at the Ch’ollima Steel Complex displayed fluctuations with no established patterns from reports. Its activity was markedly lower at 39.0% in August but regained momentum to 35.0% in October. Observations indicate the necessity for careful procurement strategies in North Korea amidst unprecedented geopolitical and economic fluctuations with no direct correspondence to recent major developments affecting overall Asian steel market dynamics.

Evaluated Market Implications

Steel buyers should proactively consider sourcing from Tata Steel BSL Dhenkanal, with its strong activity levels indicative of reliable supply amidst the forecasted demand increases and government support in India. Simultaneously, buyers should exercise caution when engaging with Shandong Taishan methodologies given the forecasted reductions in consumption amidst China’s stringent regulations and industry-wide overcapacity issues. The inconsistencies observed in North Korea suggest a more speculative environment, requiring a tailored consultation approach before procurement commitments.

By leveraging targeted procurement strategies based on these insights, steel buyers can better navigate the evolving landscape and align purchases with anticipated demand shifts in the Asian steel market.