From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Surge in Asia’s Steel Market: India’s Iron Ore Exports Spike Amid Demand Recovery

Recent reports highlight robust growth in the Asian steel market, especially driven by India’s iron ore export increases. The article “India: Iron ore and pellet exports jump 27 percent m-o-m in November 2025” outlines a significant 27.2% rise in exports due to heightened demand from China and favorable pricing. This surge aligns with observed satellite data indicating elevated activity at key steel plants, reflecting a solid market sentiment across the region.

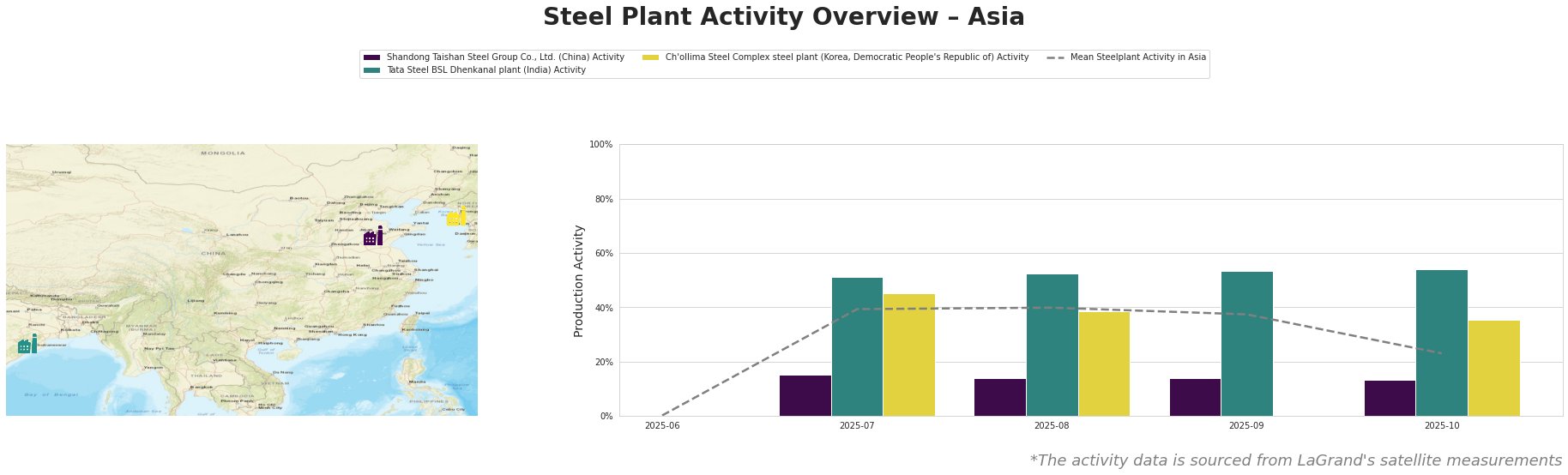

In comparing steel plant activity with the mean level in Asia, Tata Steel’s Dhenkanal plant demonstrated stronger performance, consistently above 50%. Interestingly, Shandong Taishan Steel exhibited lower activity, peaking at 15%, contrasting with Tata’s performance. The increase in Tata’s activity corresponds with the rising iron ore exports as detailed in “Iron ore exports from India rose by 27% m/m in November,” suggesting a pivotal response to international demand stimulation.

The Ch’ollima Steel Complex showed a decline in activity and does not relate to any notable current news, indicating potential internal challenges.

Shandong Taishan Steel’s activity, averaging only 14%, may imply supply chain issues or competitive pressures not linked to recent export trends. This lack of connection to the Indian export scenario indicates challenges in capitalizing on the broader market upswing.

Given the clear correlation between India’s exports and enhanced operations at Tata Steel BSL, procurement teams targeting Indian steel should consider leveraging this surge while prices remain competitive, especially as indicated by “India increased steel exports by 31% y/y in April-November.” Additionally, analysts should monitor Shandong Taishan’s performance for potential supply disruptions impacting the region.

In summary, the strategy for steel buyers includes focusing on procurement from Indian suppliers, especially Tata Steel, while also staying alert to the fluctuating dynamics of the Chinese market, where Shandong’s lower throughput may signal strategic buying opportunities or risks.