From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for European Steel Market Amidst Ukrainian Supply Fluctuations

Recent developments in the European steel market indicate a positive sentiment driven by increasing steel exports from Ukraine and stable production forecasts. Key articles such as “Ukraine increased exports of long products by 43% y/y in January-November” highlight a significant rise in Ukrainian long rolled product exports to the EU, while “Steel production in 2026 may remain at 7.2 million tons – GMK Center forecast” suggests stable production levels despite potential challenges from European market regulations.

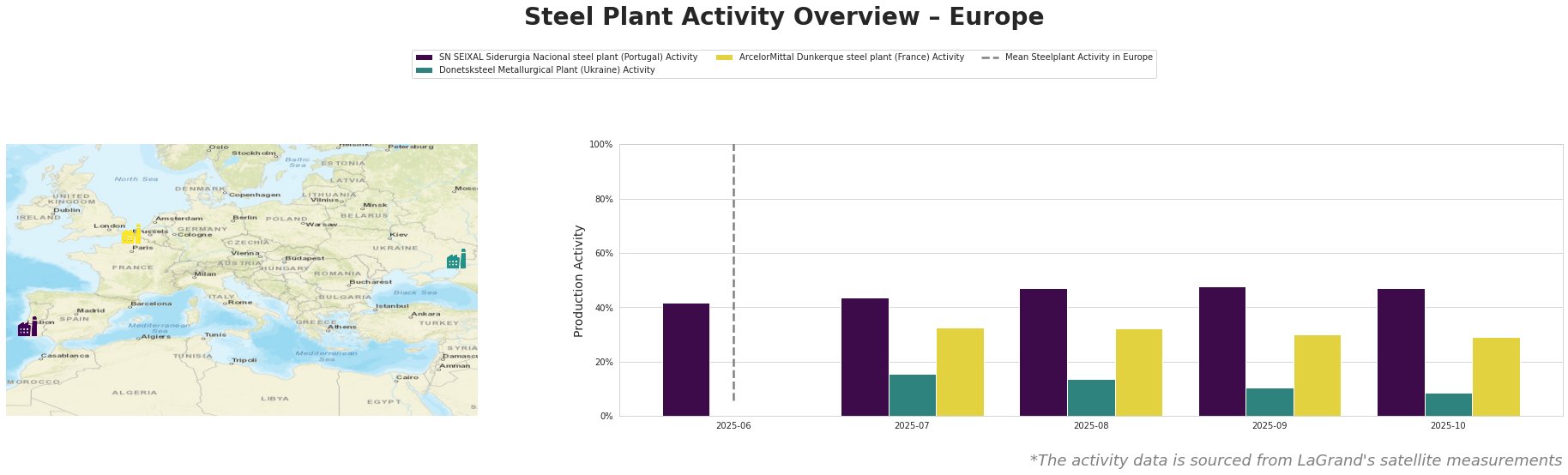

As satellite-observed data shows, Ukrainian plant activity has fluctuated, with Donetsksteel Metallurgical Plant experiencing a notable production drop of 50% in October compared to September, correlating with a period of increased export activity. Meanwhile, the ArcelorMittal Dunkerque steel plant has maintained relative stability, aligning its operations with growing EU demand.

The SN SEIXAL Siderurgia Nacional plant in Portugal reported a steady production activity of 47% in October, supporting the EU’s integration of Ukrainian products. Contrastingly, the Donetsksteel Metallurgical Plant showed a significant downturn, hitting an activity low of 10% in September. This decline may reflect the broader geopolitical issues that challenge consistent production. However, the rise in Ukrainian long product exports (as noted in “Ukraine increased exports of long products by 43% y/y in January-November”) indicates there are still viable markets, despite operational limitations.

The ArcelorMittal Dunkerque plant, with a robust capacity of 6,750 tons, has been effectively aligning its production processes with prevailing market demand for semi-finished and finished goods. This plant maintains its rate to cater to increasing exports and stable local demands.

Recommendations for steel buyers should focus on securing contracts now given the anticipated supply constraints stemming from potential blockades and the CBAM carbon regulation impact on Ukrainian steel exports, which could reduce imports by up to 50%. Buyers should also consider diversification of sourcing, especially given the 51.3% increase in Ukrainian imports, which could indicate a strategic opportunity to leverage competitive pricing during this window before potential disruptions.

In conclusion, while Ukrainian production faces challenges, the overall European steel market appears resilient, presenting actionable opportunities for savvy procurement professionals.