From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for China’s Steel Market Amid Structural Adjustments

China’s steel industry is experiencing notable shifts, driven by regulatory changes and varying demand across sectors. Recent news articles such as “China will maintain control over steel production and exports in 2026-2030“ and “Rolled steel consumption in China will fall by 5.4% y/y in 2025 – forecast“ indicate that the government is enacting stricter control over production to manage excess capacity. This regulatory stance appears to correlate with observed declines in activity levels at key plants, as highlighted by satellite data.

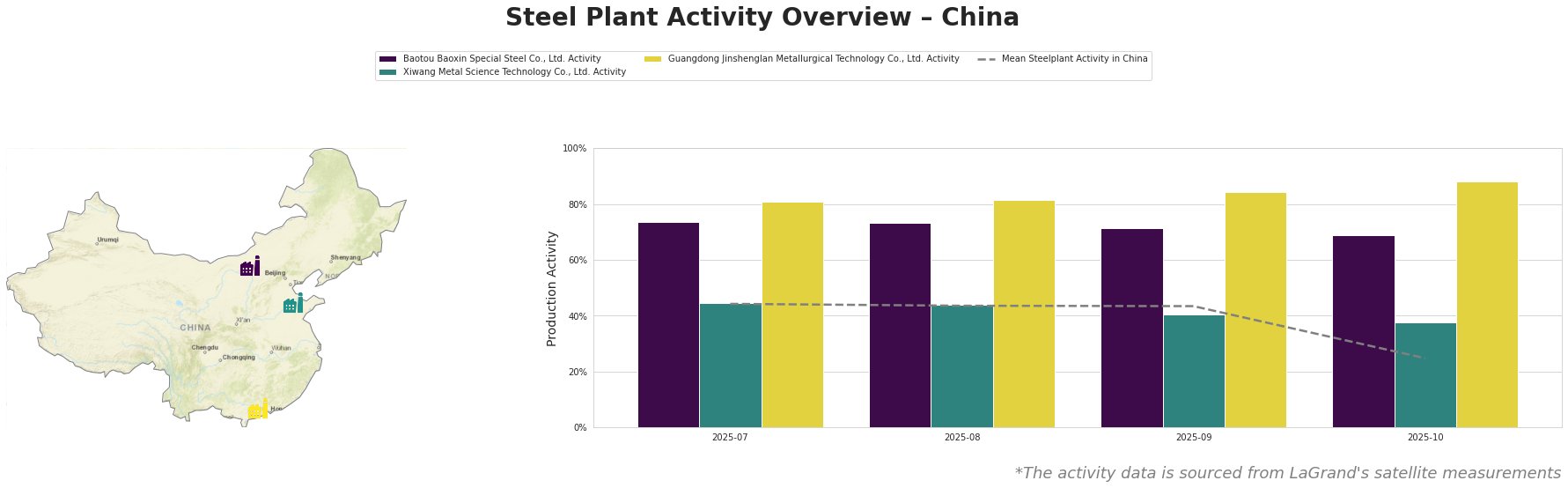

In September 2025, the mean activity level of steel plants decreased to 43%, falling to just 25% in October. Baotou Baoxin Special Steel Co., Ltd. demonstrated a consistent decline, dropping to 69% activity in October from a peak of 74% in July. In contrast, Guangdong Jinshenglan Metallurgical Technology Co., Ltd. maintained higher activity levels, ending October at 88%. Despite the general downturn in production, the specific plant activities suggest localized resilience in certain areas.

Baotou Baoxin Special Steel Co., Ltd., located in Inner Mongolia, operates primarily with integrated production using blast furnaces (BF) and basic oxygen furnaces (BOF). The decline in its activity to 69% in October aligns with forecasts of reduced rolled steel consumption, as suggested by “Rolled steel consumption in China will fall by 5.4% y/y in 2025 – forecast.” Despite these challenges, Baotou has a ResponsibleSteel Certification, which may provide it an advantage by appealing to sustainable sourcing practices.

Xiwang Metal Science Technology Co., Ltd., based in Shandong, is noted for integrated production capabilities but experienced a more substantial drop to 38% in October, influenced by decreasing demand as indicated by the broader national trends. No direct connections to specific news articles can be established to explain this drop beyond the general forecasts of declining demand.

In contrast, Guangdong Jinshenglan Metallurgical Technology Co., Ltd. has shown remarkable resilience, maintaining an activity level of 88% by utilizing electric arc furnace technology, which enhances operational flexibility amidst the shifting market. This suggests that companies investing in modern, efficient technologies may mitigate the impacts of regulatory and market fluctuations.

The forecasted tightening of steel supply due to regulatory controls, as discussed in “China will maintain control over steel production and exports in 2026-2030,” likely points to potential procurement challenges for buyers in 2026. Buyers should consider focusing on establishing supplier relationships with resilient producers like Guangdong Jinshenglan, which can provide reliable supply chains despite economic contractions in other areas.

In conclusion, while the steel market in China faces headwinds such as reduced consumption and regulatory pressures, there remains potential for strategic procurement opportunities. Buyers should closely monitor individual plant performances, aligning procurement strategies with those demonstrating stability or growth amidst the broader market corrections.