From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil’s Steel Market: Positive Outlook with Rising Activity Levels Amid Supply Adjustments

Brazil’s steel market is witnessing a very positive sentiment as recent satellite data indicate increasing activity levels at key plants. Following the article Viewpoint: Brazil poised for record soy output, exports published on December 22, 2025, notable changes in plant operations align with a strengthening demand outlook.

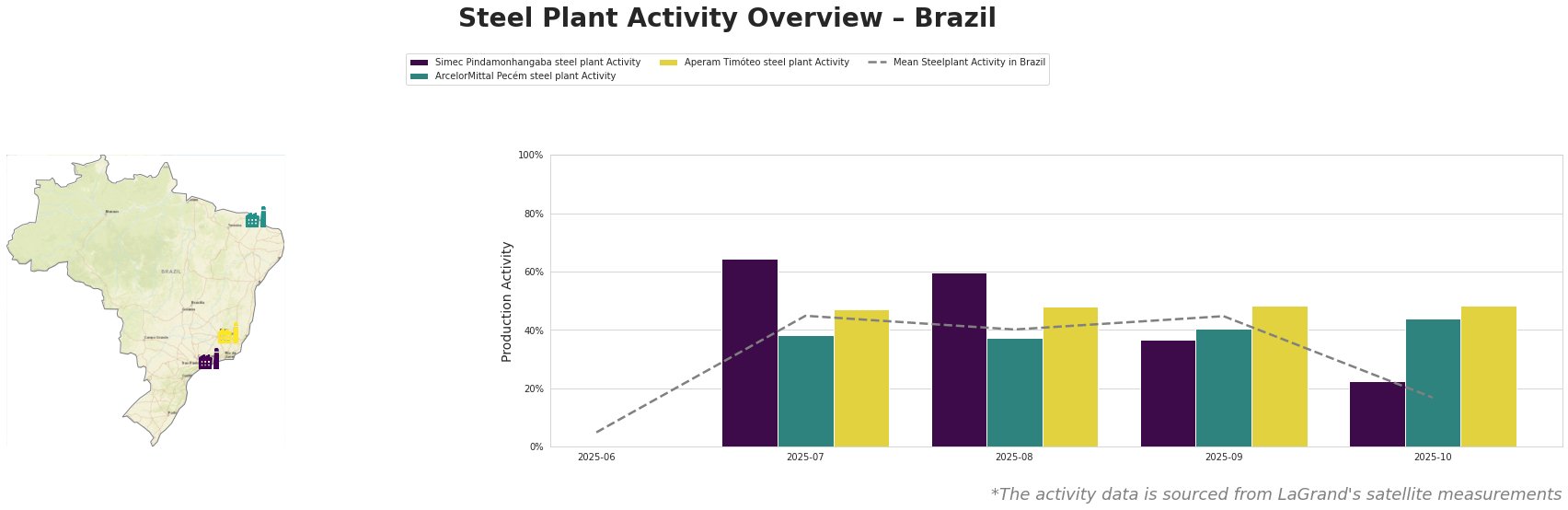

The satellite-observed activity data (see table) indicates that while activity dropped in October 2025, the overall monthly trends for the steel plants have been incremental, with significant peaks noted in July and August. This upward trend correlates with Brazil’s anticipated rise in soybean exports, which could lead to increased demand for steel in agricultural machinery and infrastructure projects.

Simec Pindamonhangaba’s activity peaked at 64% in July, leveraging its electric EAF process for finished rolled products, crucial for infrastructure development, directly correlated with the increasing soybean output requiring machinery. However, it faced a decline to 23% in October, with no explicit links to recent news affecting this drop.

ArcelorMittal Pecém operates on a more integrated basis with a capacity of 3,000 tonnes and showed fluctuations, peaking at a 44% activity level in October. The plant’s primary products serve diverse sectors such as automotive and energy, aligning well with overall market demands, although specific connections to the Viewpoint: Brazil ethanol imports may double in Dec-Mar were not evident.

Aperam Timóteo reported stability, maintaining high operational metrics, indicating resilience amid potential supply disruptions linked to fluctuating demand dynamics in energy and automotive sectors, guided by market shifts highlighted in the previously discussed articles.

To navigate these dynamics, steel buyers should consider:

- Early Procurement: Given the peaks observed at Simec and Aperam during earlier months, buyers should stock up on critical steel grades before contracts are affected by potential import dynamics as forecasted in Viewpoint: Brazil ethanol imports may double in Dec-Mar.

- Monitoring Crop Outputs: Engagement with Brazil’s agricultural forecasts, particularly in soybean production, can provide insight into the future demand for steel in related sectors, especially in machinery production.

- Supplier Diversification: For regions with active facilities like Ceará or São Paulo, diversifying suppliers could mitigate risks of localized disruptions, especially as plant activity fluctuates.

Buyers and market analysts should remain vigilant to ongoing agricultural production trends that can directly affect steel demand and procurement strategies in Brazil’s evolving market landscape.