From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineVery Positive Trends in the Asian Steel Market: Insights Driven by Plant Activities and Recent Developments

Recent developments indicate a very positive sentiment in the Asian steel market, particularly owing to significant shifts in plant activities and global trade dynamics. Citing the article “India: Iron ore and pellet exports jump 27 percent m-o-m in November 2025,” there has been a noteworthy rise in Indian iron ore and pellet exports, contributing to robust demand from Asian buyers. This aligns with increased satellite-observed activity at prominent steel manufacturers, indicating a vibrant operational landscape fueled by international economic stimuli.

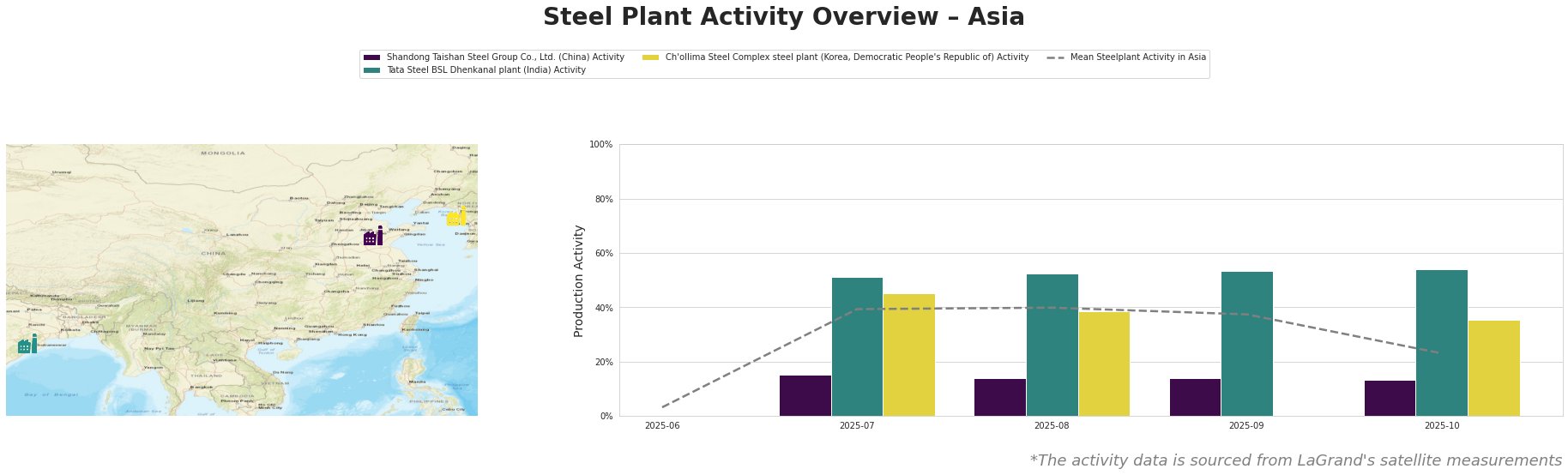

Shandong Taishan Steel Group has shown increasing but still low activity levels, fluctuating between 13% and 15% in recent months, characterized by challenges yet unlinked directly to market news. Tata Steel BSL experienced higher operational levels, notably peaking at 54% in October, highly responsive to demand uptick echoed in the “India increased steel exports by 31% y/y in April-November“ article, indicating robust export strategies amid tighter domestic supply chains. In contrast, Ch’ollima Steel Complex activity trends show less stability, correlating less directly with the available news.

The Shandong Taishan Steel Group, utilizing integrated BF processing technologies and producing finished rolled steel, remains significantly underperforming with just 15% activity in July. This stagnation has no direct correlation identified within the current news context.

Conversely, Tata Steel BSL’s state-of-the-art operation in Odisha, with a capacity of 5,600 tonnes, has allowed for a vibrant export profile amidst rising demand. Notably, the article “Oversupply, rains drag Indian HRC prices lower in 2025“ indicates that decreasing Indian HRC prices may lead to aggressive pricing strategies, potentially maintaining export momentum.

For procurement professionals in the steel industry, it is advisable to strategically focus on sourcing from suppliers capable of reacting swiftly to shifts in demand, specifically from Tata Steel BSL, given their substantial production capacity and the recent positive export trends aligning with the global demand driven by the upcoming CBAM regulations expected to favor localized producers over imports. Monitoring supply changes will be critical, especially in light of Indian market dynamics that may influence regional supply availability.

In summary, prioritized procurement from active sectors within India, while maintaining flexibility to adapt to sudden market shifts driven by regulatory changes, presents an actionable strategy for informed buyers navigating the positive steel industry landscape in Asia.